News

Manchester, United Kingdom — 22-25 September 2009WYSE Archives

![]()

July jubilee: Hostel recovery begins across Europe

Keep up-to-date with WYSE webinars >

Kelsey Fenerty, STR

Over the past several months, European hostels have struggled to find footing in an industry turned inside out by the COVID-19 pandemic, and performance suffered accordingly.

For much of the spring and summer, hostels temporarily shut their doors in record numbers, some by choice and others by mandate. For the few properties that remained open, demand all but disappeared and revenue per available bed moved into single digits.

Fortunately, it appears that over the past month the sector may have turned the corner: hostel occupancy skyrocketed in July, well above comparable hotel occupancy and significantly better than the past several months’ performance.

Occupancy on the rise

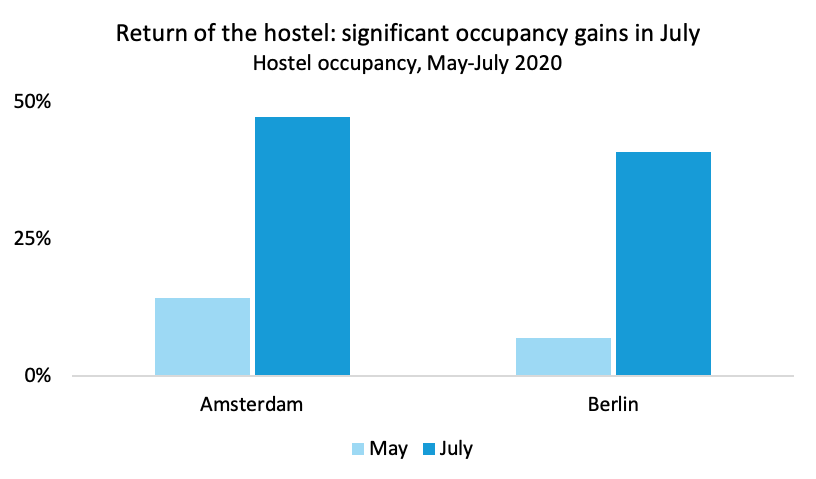

Hostel occupancy grew a staggering 33 points in Amsterdam and 34 points in Berlin between May and July 2020. Both markets re-opened properties in July and still ended the month with over 42% of beds filled.

This abrupt return of demand mirrors the equally swift demand decline hostels endured in March. Amsterdam hostel occupancy hovered between 12-14% from April to June, and while hostel closures in Berlin left the market insufficient in April and June, May occupancy in the German capital was 6.9%.

While relaxed restrictions and re-opened borders throughout Europe are a cause for increased demand, July performance also may have been impacted by shifts in how hostels operate. Hostels traditionally sell beds and not rooms, although in recent years many properties have shifted to a mixed model offering both dormitories and private rooms.

To comply with hygiene and physical distancing measures, some hostels have stopped selling dorm beds or reduced shared room capacity. Others are now shifting to a more room-based model, allowing or requiring guests to book an entire room, regardless of how many beds the party requires. This practice will necessarily inflate demand.

Taking on hotels

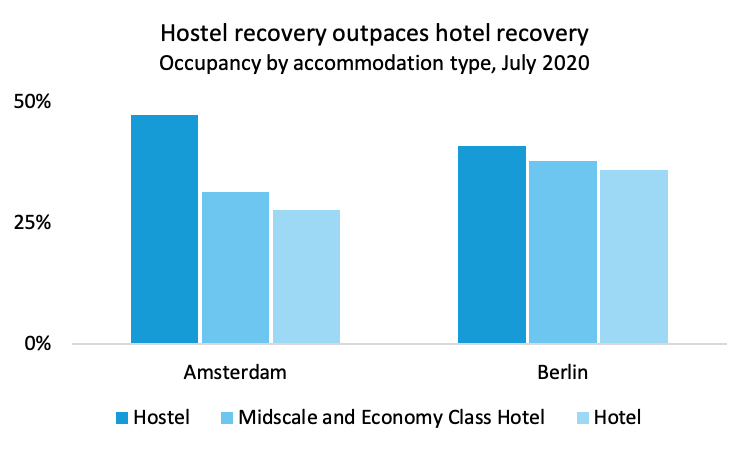

Hostels’ sharp improvement was not mirrored by hotels; in both markets, hotel occupancy reached its trough in April and rose slowly but steadily over the next three months. Even without the advantage of a steady recovery, hostel occupancy outpaced hotel occupancy in both Amsterdam and Berlin during July.

Average daily rate and guest segmentation may play a role in this hostel win. Over the past several months, budget-friendly Midscale and Economy class hotels have outperformed other hotel classes worldwide, so it follows that inexpensive hostel beds should sell quickly once travel resumes.

Hostels’ preponderance of leisure travelers also has been a boon. While in recent years some brands have marketed themselves as a cost-friendly accommodation option for business travelers and “digital nomads,” the sector’s reliance on leisure travelers has been a saving grace now that business travel has been paused; this is reflected in hostel occupancy in comparison to hotel occupancy.

What’s next?

Looking ahead into weekly August hotel data, a small plateau may be on the horizon. Midscale and Economy hotels in Berlin reached the vaunted 50% occupancy mark for the week ending 1 August but week-over-week occupancy fell for the following two weeks and Amsterdam hotel performance followed a similar pattern.

Cancelled or postponed events – notably Oktoberfest in Germany and Fringe Festival in Scotland – will lead to difficult comps in the fall months, and of course the threat of a second wave of COVID-19 infections casts a pall over the future. Hosteliers should take heart, however, because July performance data proved once again that hostels may be the most resilient accommodation sector.

Interested in More?

STR has created a dedicated landing page https://str.com/data-insights-blog/coronavirus-hotel-industry-data-news for all hotel performance analysis around COVID-19. For more information regarding the hostel industry, please contact Kelsey Fenerty at kfenerty@str.com.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for global hospitality sectors. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, and an international headquarters in London, England. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.

Join WYSE Travel Confederation

If you’d like to join WYSE Travel Confederation and benefit from new connections, free access to industry research, informative webinar sessions, discounts on industry events and brand exposure within the youth and student travel industry, click below to view our membership options and find out more.