Findings from WYSE Travel Confederation’s second COVID-19 Travel Business Impact Survey[1] indicate that travel businesses have moved quickly to streamline operations in the face of declining business by cutting staff and closing locations – particularly businesses offering accommodation and activities, tours & attractions. Even so, the average expected solvency period for travel businesses is currently just four months and a large proportion are seeking, or planning to seek, financial assistance. Nearly half of respondents indicated that they already have sought financial assistance or would do so immediately. Ten percent said there was (currently) no financial assistance available in their location. In Asia and Central and South America it was far less likely that financial assistance was available.

Staffing

Given the significant drops in business due to COVID-19-related travel restrictions and other measures, youth travel businesses have reduced staff, whether permanently or temporarily. The average numbers of staff employed by youth travel businesses fell significantly between the March and April 2020 surveys, with numbers of full- and part-time staff halved.

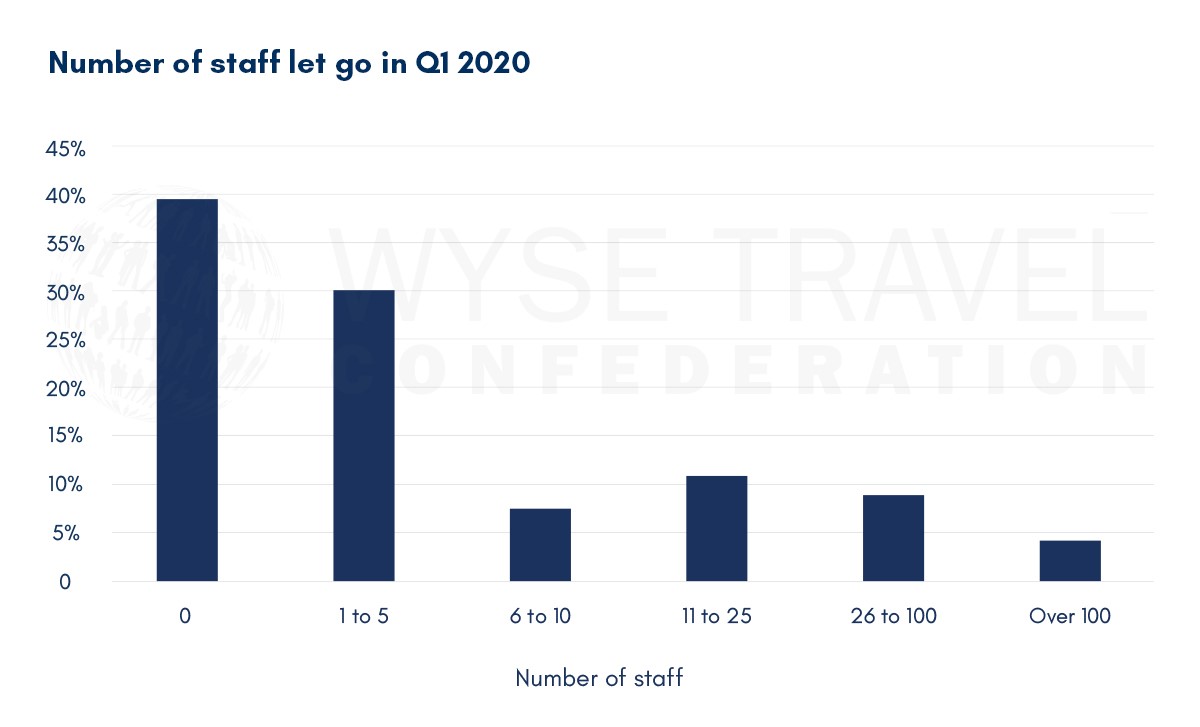

The vast majority of responding businesses are small. Around 70% of respondents indicated that they had laid off five or fewer staff in the first quarter of 2020.

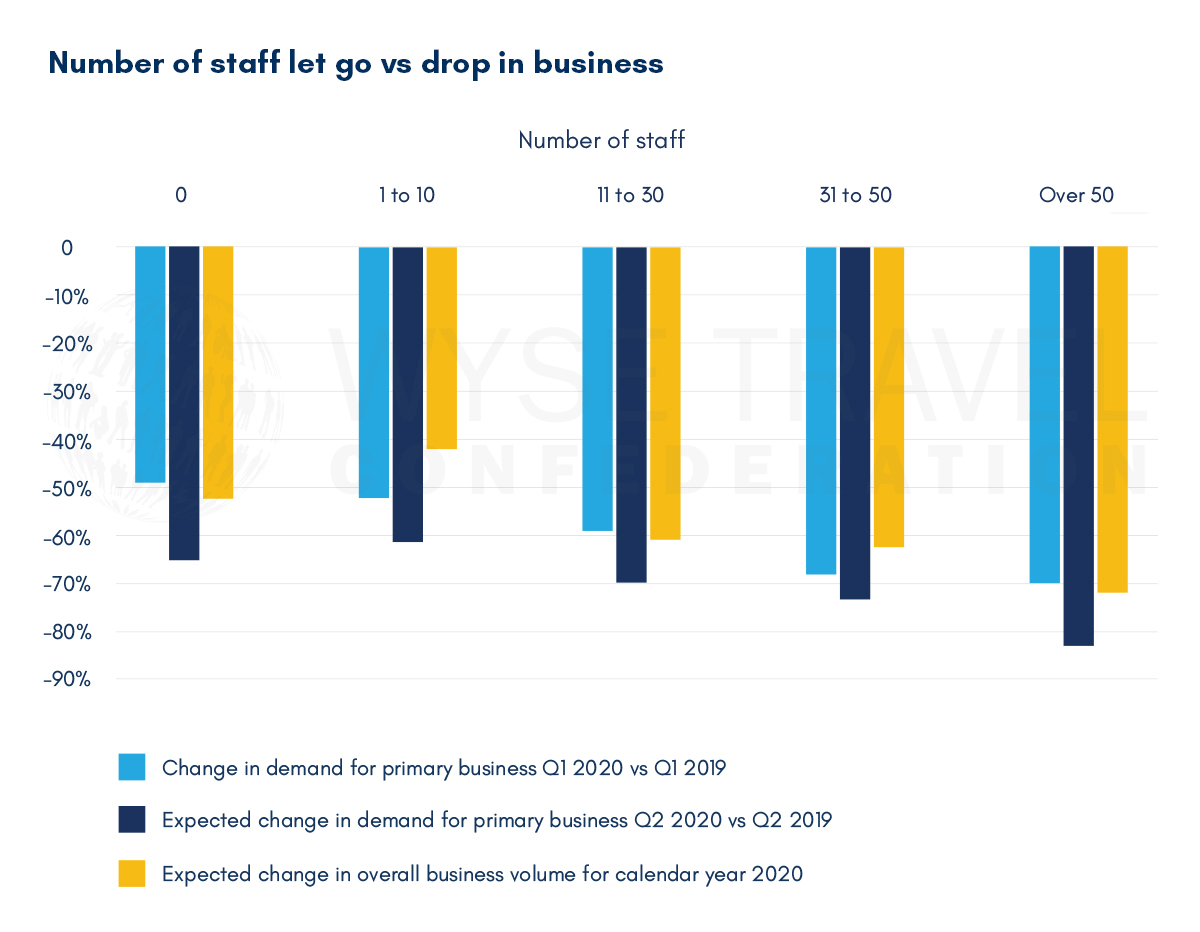

There was a significant relationship between the drop in business and number of staff laid off. The greater the decline in business, the more staff were let go in Q1 2020.

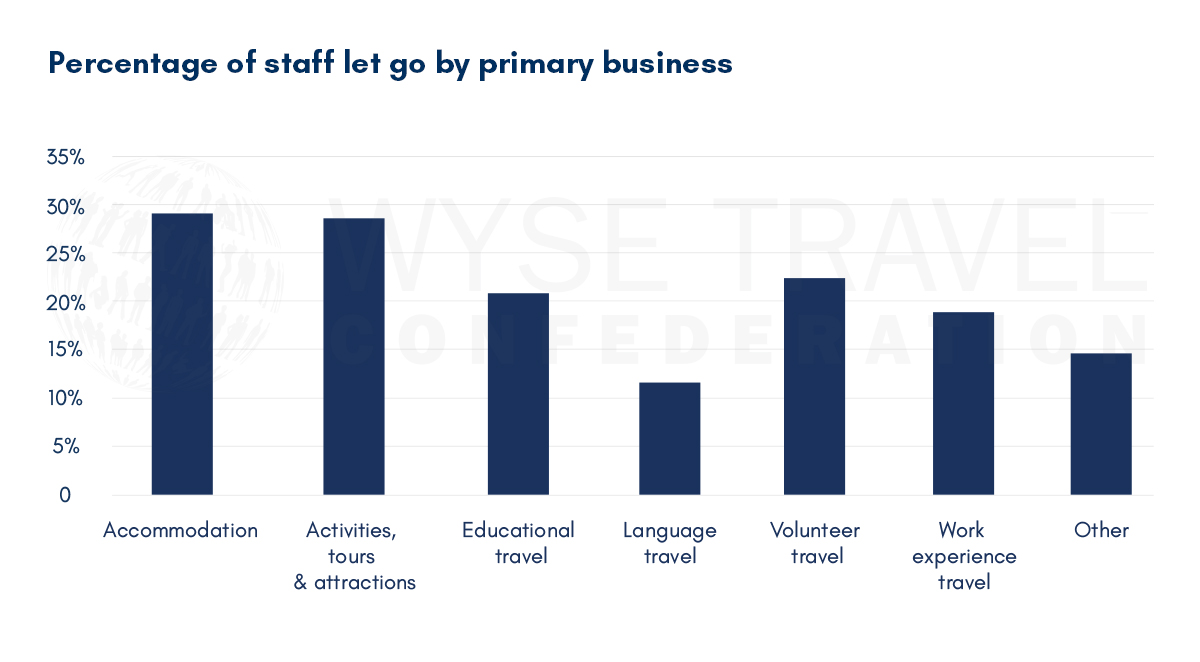

The percentage of staff laid off was greatest for activities, tours & attractions, followed by accommodation and volunteer travel.

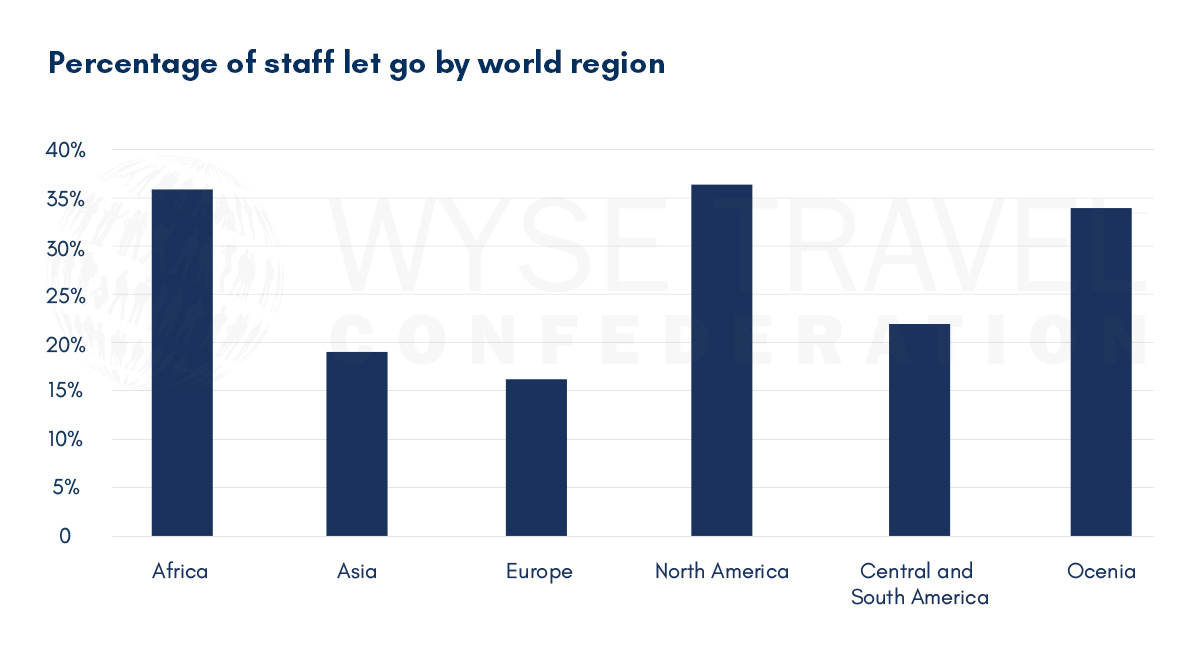

World regions reporting the highest proportions of staff let go were reported in North America, Africa and Oceania.

Closure of business locations

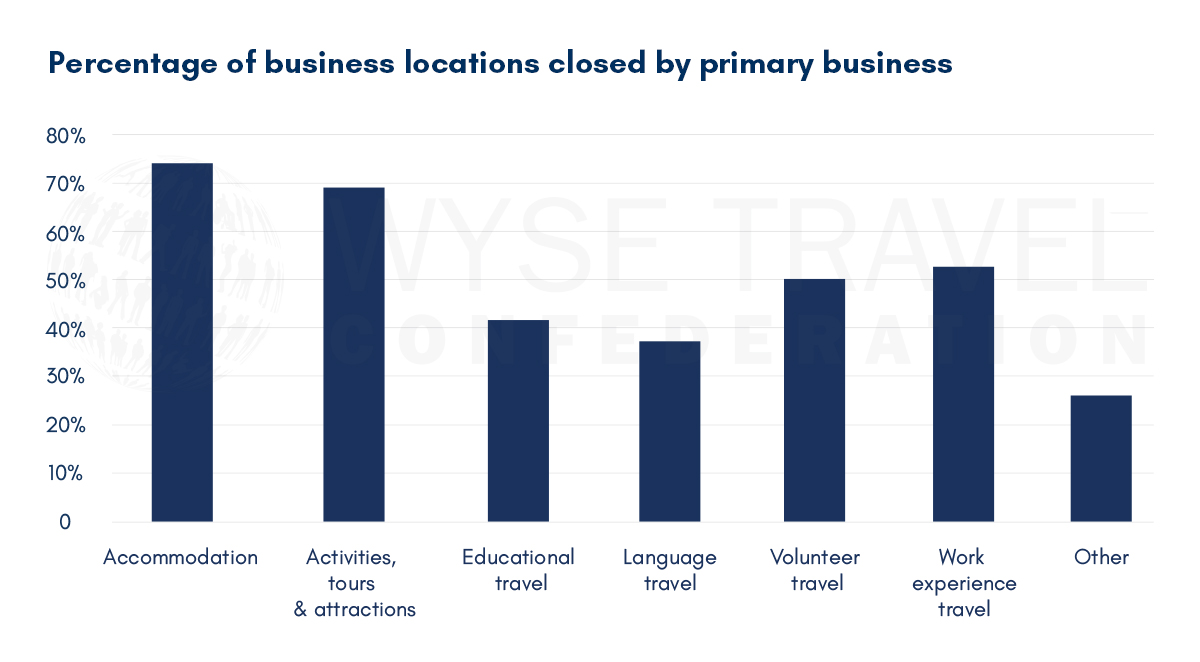

On average, respondents reported closing 56% of their business locations in Q1 of 2020. Closures were most prevalent for business in accommodation and activities, tours & attractions.

The highest level of location closures was in Africa, while Europe had the lowest level of business location closures.

Financial solvency

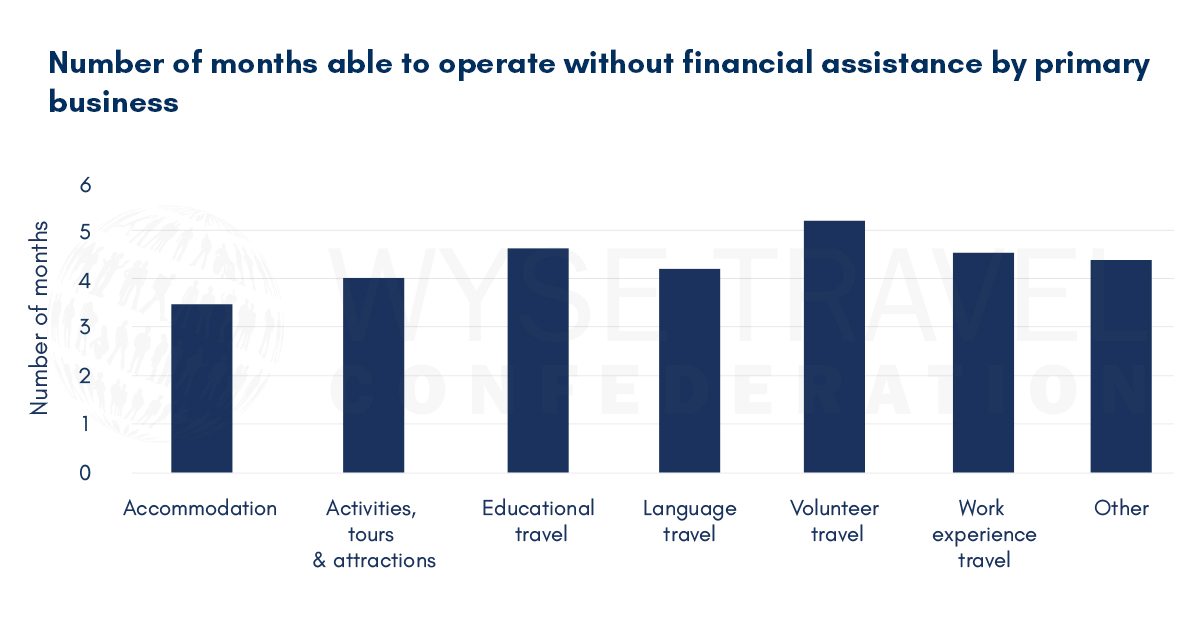

Respondents were asked how long their business would be able to operate without financial assistance of some kind. On average, respondents reported that they could continue operations for another four months, or until the end of the summer.

Those in the accommodation and activities, tours & attractions business reported the shortest expected survival period and those in volunteer travel the longest.

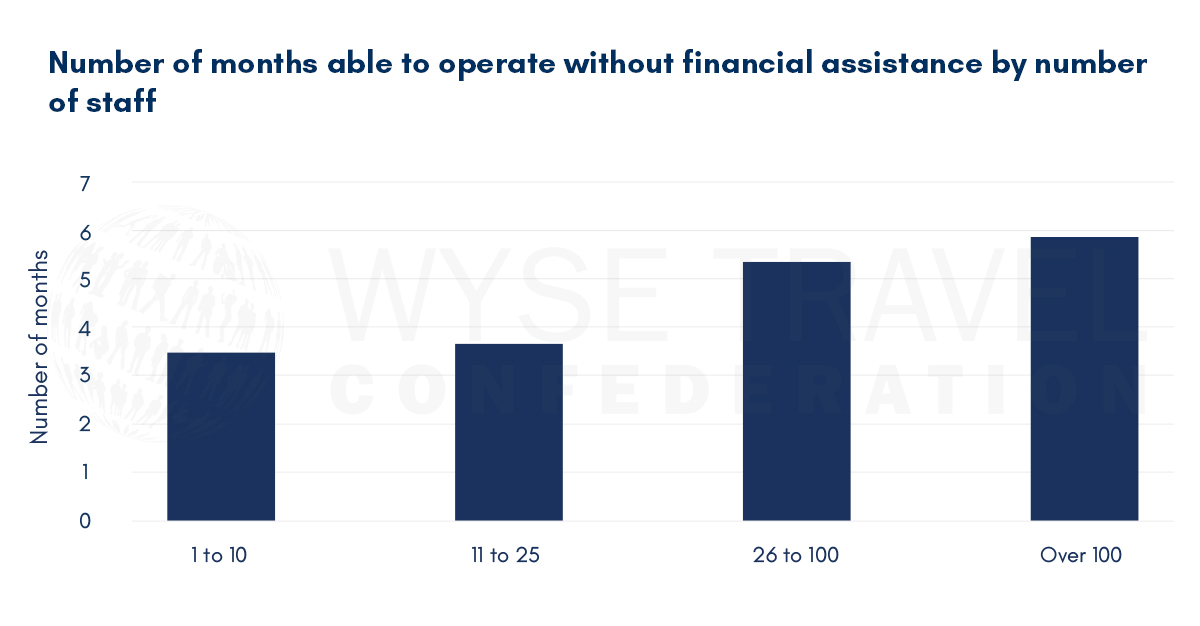

Larger companies are more likely to be able to operate longer.

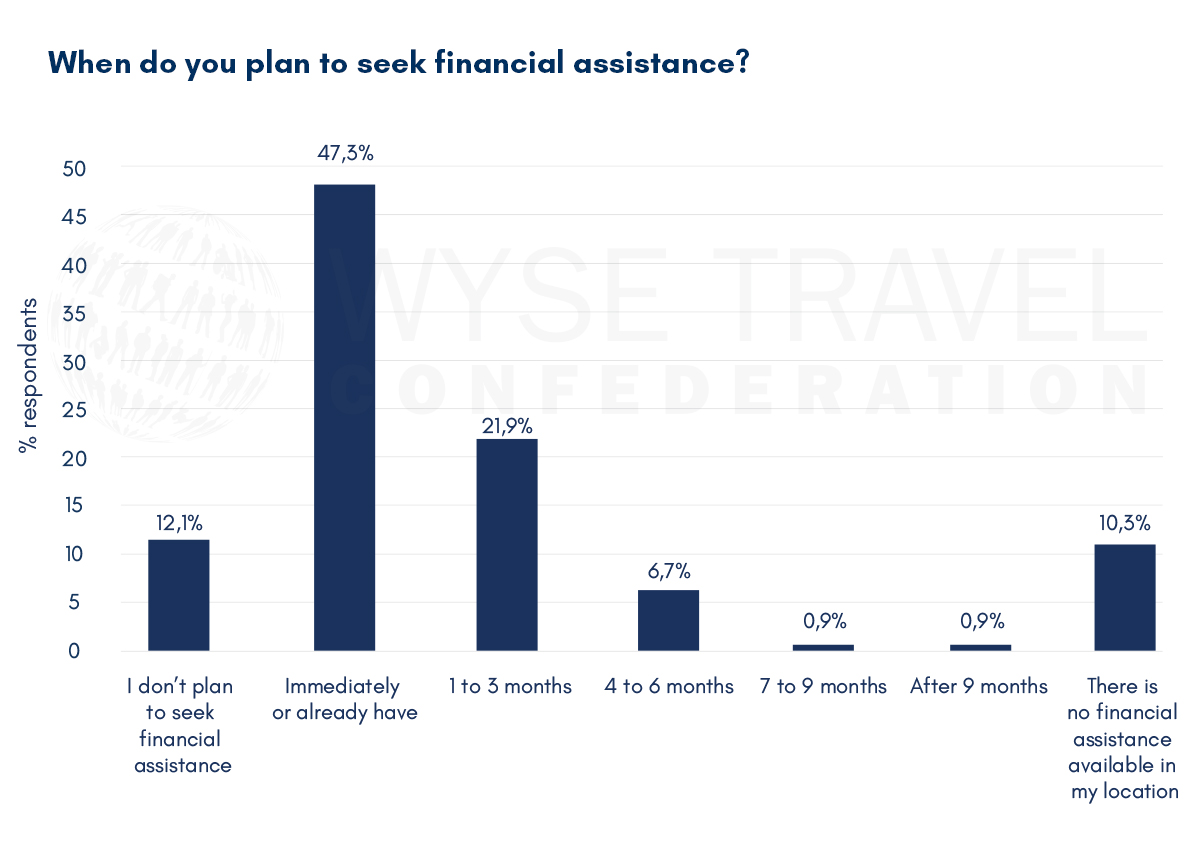

In view of the relatively short period of time that businesses expect to be able to operate, it is not surprising that a large proportion are seeking, or planning to seek, financial assistance. Almost half the respondents (47%) indicated that they have already done so or would do so immediately. About 12% said they did not plan to seek assistance, and a further 10% said there was (currently) no financial assistance available in their location.

There were significant differences across world regions in the timing for seeking financial assistance. Respondents in Oceania, North America, Europe and Africa were most likely to have sought help immediately. For respondents in Asia and Central and South America it was far less likely that help was available.

WYSE Travel Confederation and the COVID-19 Travel Business Impact Survey

If your business would benefit from unique business insights on the youth travel market, industry representation for common business interests, and hopefully soon, new trading opportunities with international partners, we invite you to discover the resources of the global trade association for businesses serving young travellers, WYSE Travel Confederation.

Next survey in the series

WYSE Travel Confederation will repeat the COVD-19 Travel Business Impact Series 1-11 May 2020. As with past travel business crises that we have monitored, it is important for the industry to come together and take its collective temperature, so to speak. Given that youth aged 15 to 29 represent 23% of international arrivals, all travel businesses, regardless of their focus on youth-tailored travel products, are welcome to participate in the survey.

April 2020 Travel Business Impact Survey:

Q2 worse across the globe, but some source markets expecting better for the whole of 2020

March 2020 Travel Business Impact Survey:

Youth travel anticipating 30% decrease in business for 2020

Business outlook by youth travel sector

Looking back in order to see ahead

[1]Data for this report were collected between 3-13 April 2020 by WYSE Travel Confederation, the global association for youth, student and educational travel organisations, via web-based questionnaire (in English). The survey was the second in a series titled COVID-19 Travel Business Impact Survey. The second iteration of the survey attracted 331 responses from 72 countries. Two-hundred and thirty-nine responses were retained for analysis. Respondents included organisations specialised in youth travel products as well as those representing mainstream travel products, members and non-members of the association. All respondents were asked about the impact that the COVID-19 (Coronavirus) pandemic has had on their business in travel. Questions related to change in demand, outlook for 2020, main concerns and actions taken in response to COVID-19 have been repeated across surveys. New questions related to staff reductions, financial risk and potential up-and-coming trends were added to this second iteration of the survey. The profile of respondents to the second survey in April 2020 was similar to that of respondents of the first survey in March 2020, though there were fewer responses from language and educational travel providers and more responses from providers of accommodation and activities, tours & attractions. When comparing the March and April survey respondents, there was very little change in the level of youth travel specialisation of respondents, with over two-thirds of respondents doing 50% or more of their business in youth travel.