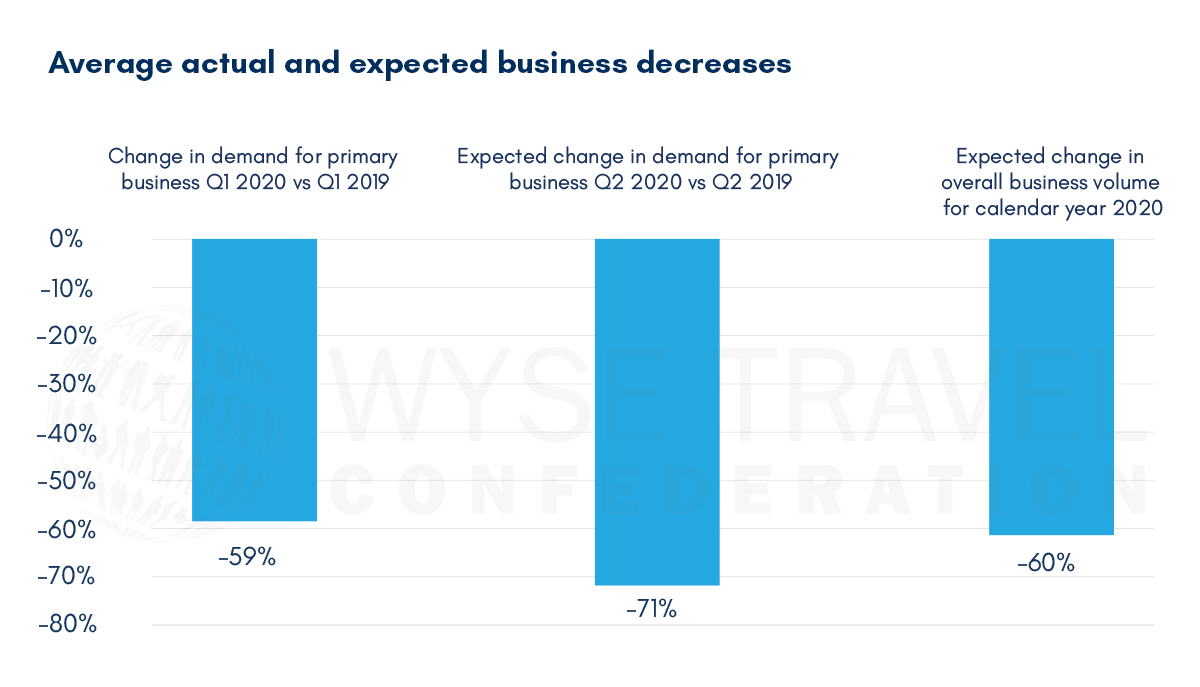

Findings from WYSE Travel Confederation’s second COVID-19 Travel Business Impact Survey[1] indicate that travel and tourism businesses experienced a 60% drop in business in Q1 2020 compared to the same period in 2019. Looking ahead to the rest of 2020, respondents expect things to remain the same, with an average 60% drop in business (year on year) anticipated for 2020 overall.

Launched in March 2020, the COVID-19 Travel Business Impact Survey series aims to monitor the impact of the COVID-19 pandemic on travel and tourism businesses that serve young travellers.[2] At the time of the first survey in March, significant travel restrictions had yet to be implemented in North, Central and South America. By the time of the second survey in April, UNWTO had estimated that 96% of worldwide destinations had implemented travel restrictions.[3]

Based on the survey’s most recent findings, the estimated decline in international tourism receipts for the youth travel industry would equate to 174 billion euros in 2020 – twice the 87 billion euro decline estimated in March 2020 when the survey was first launched and respondents were anticipating only a 30% drop in business for the whole of 2020.

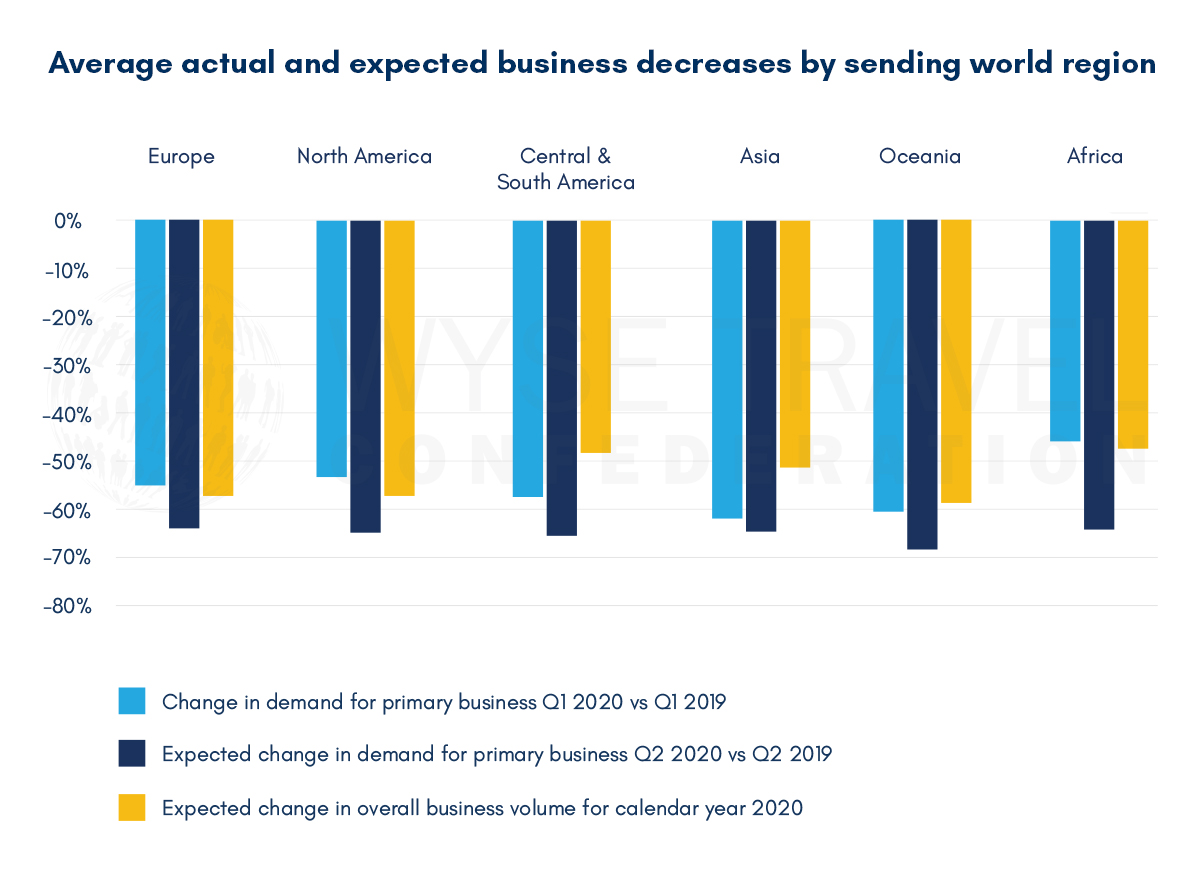

While optimism about business prospects for the rest of 2020 remains low across most types of youth travel product, survey findings show some differences between world regions and senders vs receivers of travellers. Senders from Africa, Latin America, and Asia are currently those anticipating slightly better outcomes for 2020.

Overall outlook and average decrease in business

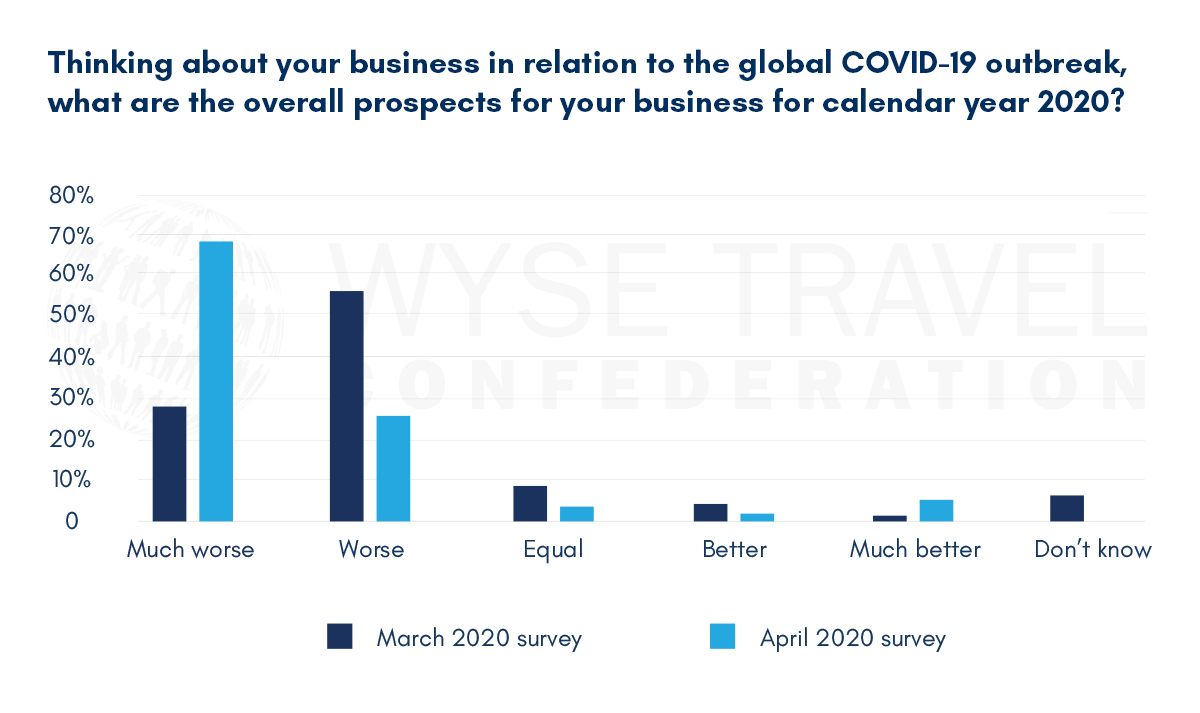

Not surprisingly, the business outlook has worsened between March and April. Sixty-seven percent of respondents now believe that their business prospects will be ‘much worse’ over the course of this year – a considerable increase from the 28% of businesses that had a ‘much worse’ outlook in March.

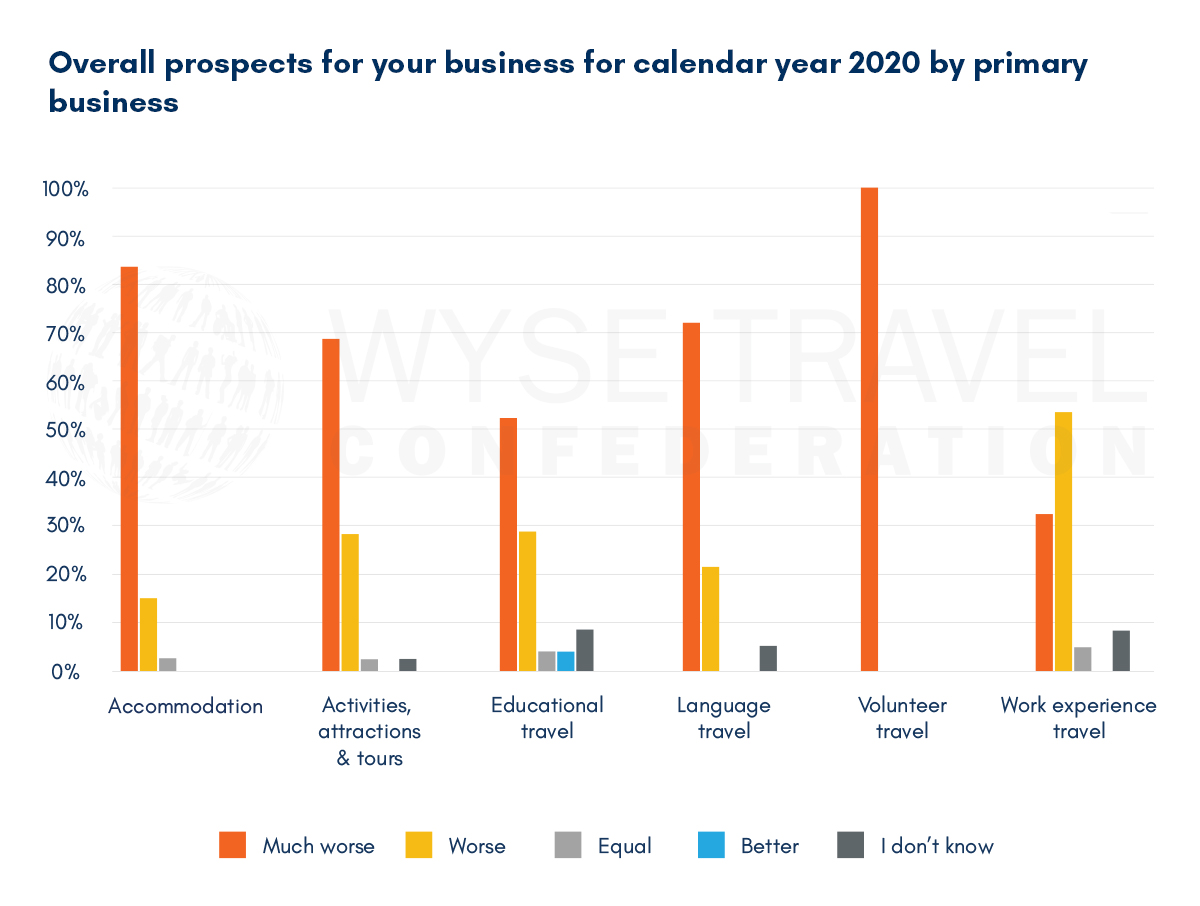

The outlook by type of business suggests that the majority of youth travel businesses expect their prospects to be worse or much worse for the rest of this year. Businesses specialised in volunteer travel are particularly pessimistic.

On average, respondents experienced a 59% drop in demand in Q1 2020 compared to the same period in 2019. Looking ahead to the rest of 2020, respondents anticipate things to remain similar- an average 60% drop in business volume (year on year) for 2020 overall. A slightly greater decline in demand (71%) is expected for Q2 2020.

There was no statistically significant difference between businesses specialised in youth travel[4] and other travel businesses in terms of business decreases reported and the outlook for the rest of the year.

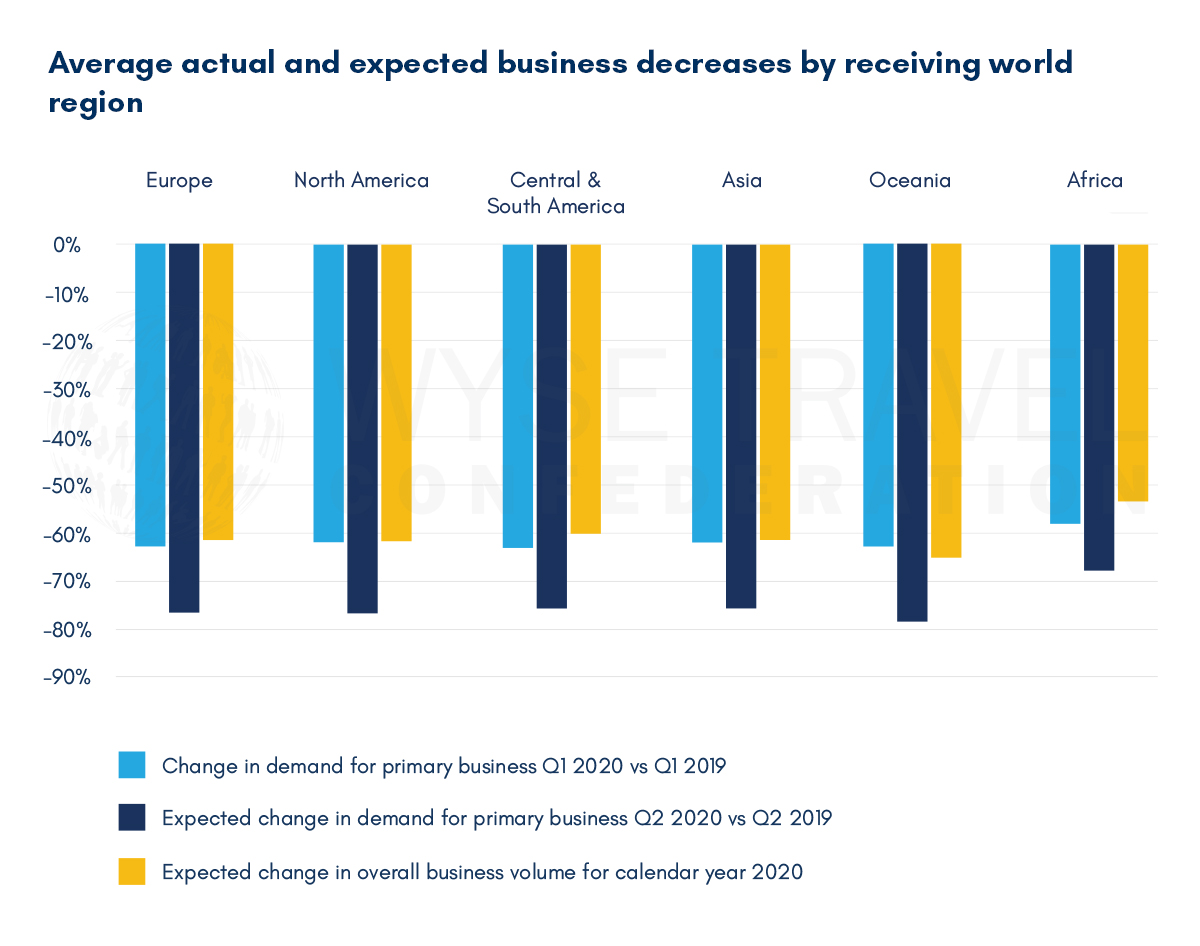

Actual and expected business decreases for Q1, Q2 and the whole of 2020 varied only slightly across world regions though there were some differences between senders and receivers. Senders and receivers in Africa experienced the lowest actual decreases in Q1 and also seem to be the least pessimistic when it comes to Q2 and the rest of 2020.

On the sending side, businesses sending travellers from Asia and Oceania reported the largest actual decreases for Q1 2020. The prospects for Q2 from Asia (-65%) and Oceania (-69%) are similarly cautious though the outlook for the whole of 2020 from Asia (-51%) is more positive than it is in Oceania (-59%). Senders from Central and South America (-48%) and Africa (-48%) are slightly more optimistic about 2020 than other world regions.

WYSE Travel Confederation and the COVID-19 Travel Business Impact Survey

If your business would benefit from unique business insights on the youth travel market, industry representation for common business interests, and hopefully soon, new trading opportunities with international partners, we invite you to discover the resources of the global trade association for businesses serving young travellers, WYSE Travel Confederation.

Next survey in the series

WYSE Travel Confederation will repeat the COVD-19 Travel Business Impact Series 1-11 May 2020. As with past travel business crises that we have monitored, it is important for the industry to come together and take its collective temperature, so to speak. Given that youth aged 15 to 29 represent 23% of international arrivals, all travel businesses, regardless of their focus on youth-tailored travel products, are welcome to participate in the survey.

April 2020 Travel Business Impact Survey:

Staff cuts, location closures and short survival periods

March 2020 Travel Business Impact Survey:

Youth travel anticipating 30% decrease in business for 2020

Business outlook by youth travel sector

Looking back in order to see ahead

[1]Data for this report were collected between 3-13 April 2020 by WYSE Travel Confederation, the global association for youth, student and educational travel organisations, via web-based questionnaire (in English). The survey was the second in a series titled COVID-19 Travel Business Impact Survey. The second iteration of the survey attracted 331 responses from 72 countries. Two-hundred and thirty-nine responses were retained for analysis. Respondents included organisations specialised in youth travel products as well as those representing mainstream travel products, members and non-members of the association. All respondents were asked about the impact that the COVID-19 (Coronavirus) pandemic has had on their business in travel. Questions related to change in demand, outlook for 2020, main concerns and actions taken in response to COVID-19 have been repeated across surveys. New questions related to staff reductions, financial risk and potential up-and-coming trends were added to this second iteration of the survey. The profile of respondents to the second survey in April 2020 was similar to that of respondents of the first survey in March 2020, though there were fewer responses from language and educational travel providers and more responses from providers of accommodation and activities, tours & attractions. When comparing the March and April survey respondents, there was very little change in the level of youth travel specialisation of respondents, with over two-thirds of respondents doing 50% or more of their business in youth travel.

[2]Young travellers, sometimes referred to as ‘youth travel’, includes travellers aged 15 to 29.”

[3]COVID-19 response: 96% of global destinations impose travel restrictions, 17 April 2020, UNWTO.

[4]Fifty percent or more of business is focussed on the youth travel segment. Youth travel is defined as travellers aged 15 to 29. Just over two-thirds of respondents are doing 50% or more of their business in youth travel.