The Brexit vote in 2016 to leave the European Union eventually led to the UK formally departing on 31 January 2020. Since then, there has been much speculation on the consequences of Brexit for many areas of economic and social life.

It took some time for the effects of Brexit to become visible. In 2019, research by StudentUniverse indicated that less than half of British youth travellers had delayed their travel plans due to Brexit uncertainties. There were some who were concerned about the loss of health cover in the EU, but almost half said it would not deter them from travelling there.

After the formal departure of the UK from the EU we can now begin to assess what actually happened. Although the Covid pandemic quickly obscured the immediate effects of Brexit, data from the post-Covid era is now beginning to emerge which provides a more realistic picture of the Brexit impact on travel.

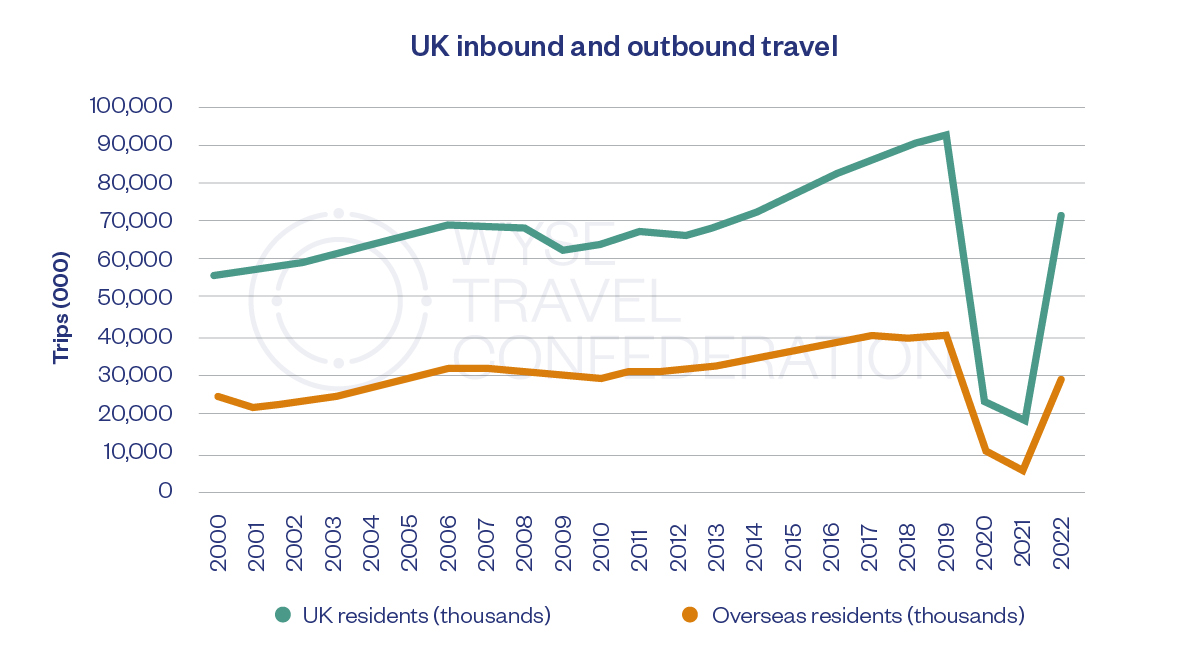

Data from the UK International Passenger Survey show that there was fairly steady growth in outbound travel from 2012 until 2019, just before the pandemic. Between 2021 and 2019, outbound trips rose by 39%. In contrast, inbound tourism grew by only 27%, largely due to a flattening off after the 2016 Brexit vote. In the period 2017 to 2019 outbound travel grew by 14%, over three times the rate of inbound travel. This indicates that UK travellers were largely not affected by Brexit before the actual departure of the UK in 2020, whereas inbound travel was significantly dampened.

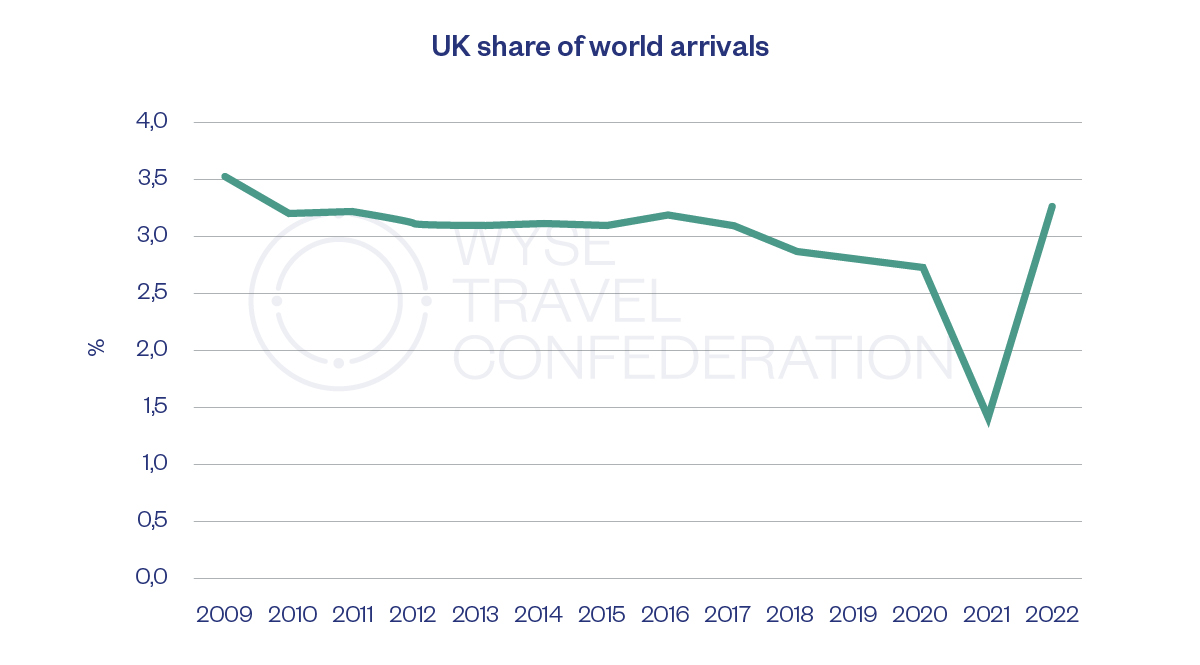

A comparison of UK international arrivals and global international arrivals shows that the UK was steadily losing market share up to the pandemic. During the pandemic there was a sharp relative fall in arrivals, but in 2022 the UK’s share rose to levels last seen before Brexit.

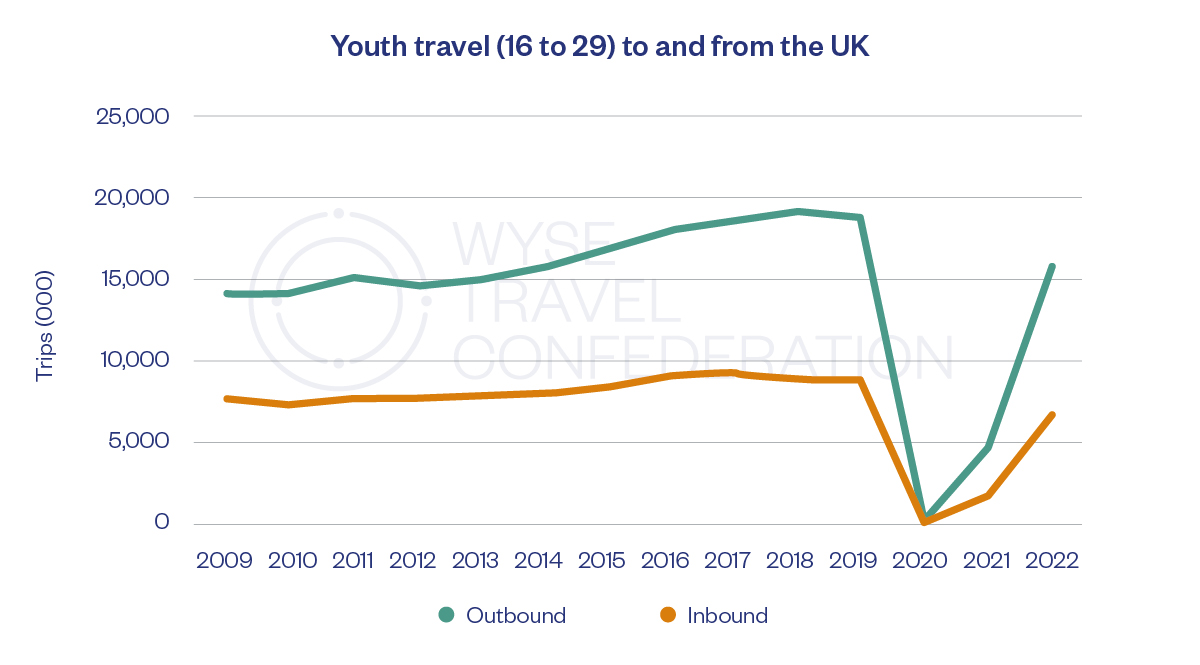

Looking at youth travel specifically, we see a more pronounced Brexit impact. Outbound youth travel grew by around 4% in the period 2017-2019, a significant decline compared with previous years. Inbound travel actually fell, with a fall of almost 4% youth arrivals in the period 2017-2019. Youth travel was also significantly impacted by the pandemic from early 2020 onwards, but proved itself more resilient than the travel market in general.

The recovery in outbound UK travel has been strong, with total 2022 trips reaching 77% of their 2019 levels, whereas inbound travel recovered to 73% of 2019 figures. For youth travel the recovery in outbound trips has been particularly strong, reaching 84% of 2019 levels by 2022. For inbound travel, however, the recovery has been slower, only attaining 77% of 2019 business. The youth market has therefore been more resilient than travel overall, but the major growth has come in outbound rather than inbound markets.

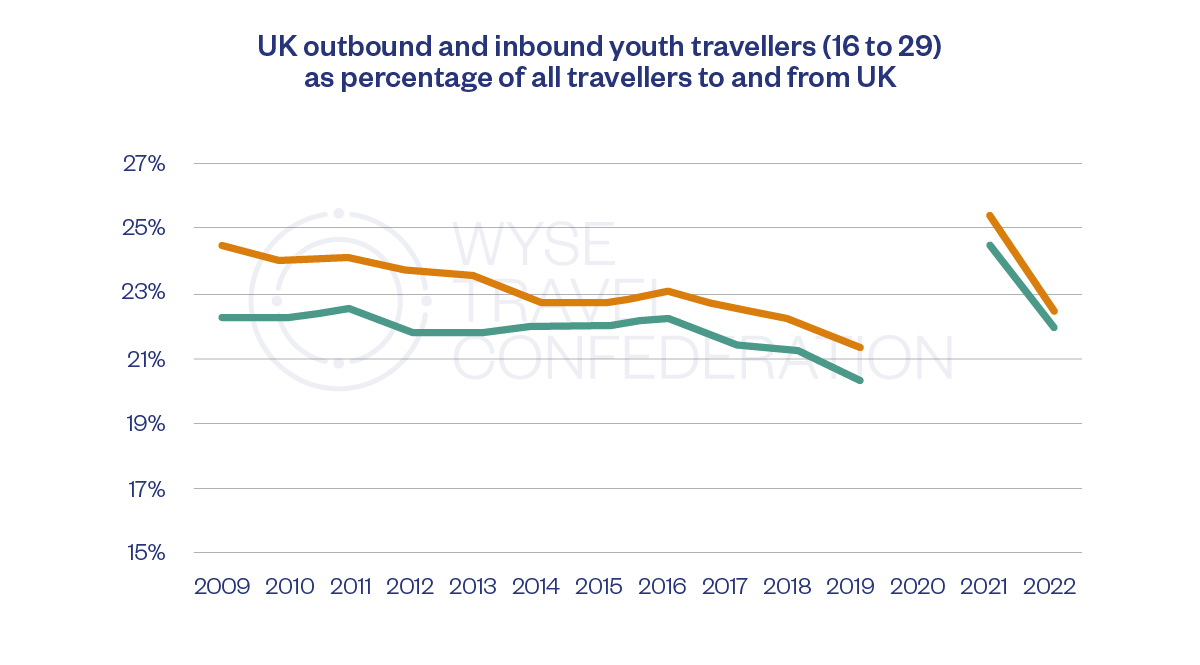

The resilience of youth travel is underlined by looking at the percentage of youth travellers in the overall market. There was a marked rise on the proportion of youth travellers during the pandemic, when those aged 16-29 made up almost a quarter of all trips. Over the longer term, however, the IPS figures show a slow decline in both inbound and outbound youth travel, which seems to be continuing in the post pandemic period.

Source: UK International Passenger Survey

Study travel to the UK

One niche which has seen particularly significant changes as a result of Brexit is study travel. The UK has historically had a very strong position in international education and educational exchange, because of the global importance of the English language. Of the 4.39 million internationally mobile students in OECD countries, 957,000 are studying in the United States, followed by the UK with 551,000 international students. The United Kingdom has a 9% of the global international education market.

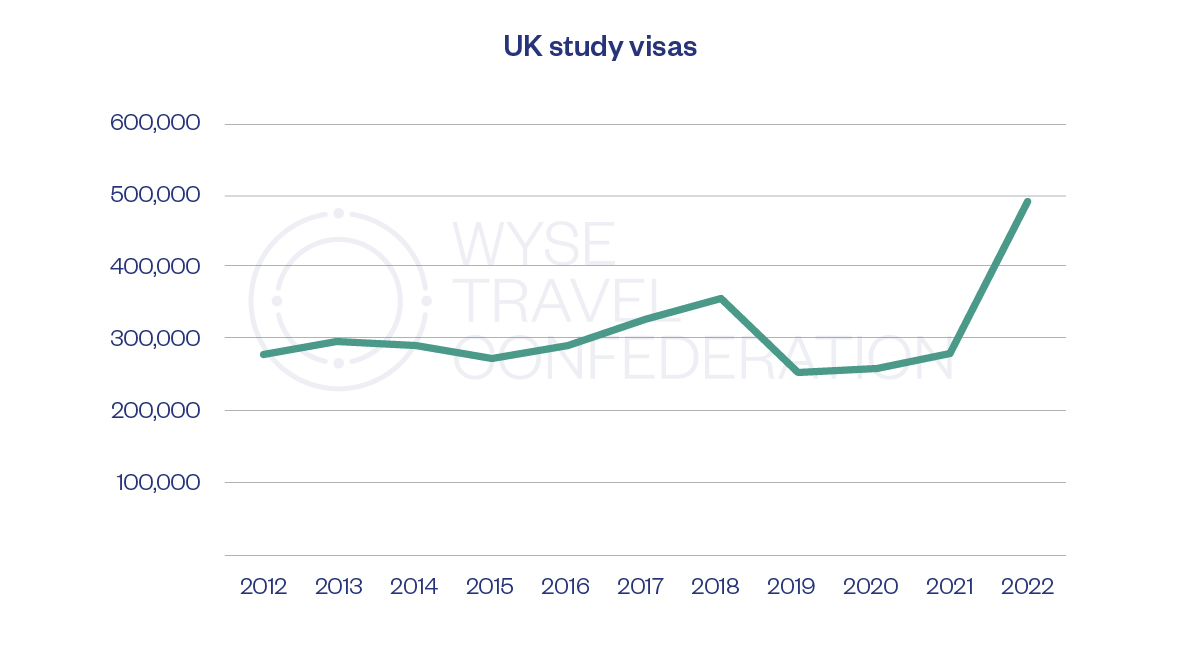

The overall study travel market seems to have suffered little as a result of Brexit, with a record of almost half a million study visas issued in the year to June 2022. Continued study travel growth is probably thanks to a major effort by higher education suppliers to find new source markets after Brexit. The visa figures show that the UK study travel market fell by 29% in 2019, just before the pandemic. This drop can largely be attributed to a fall in the number of EU/EEA students following Brexit.

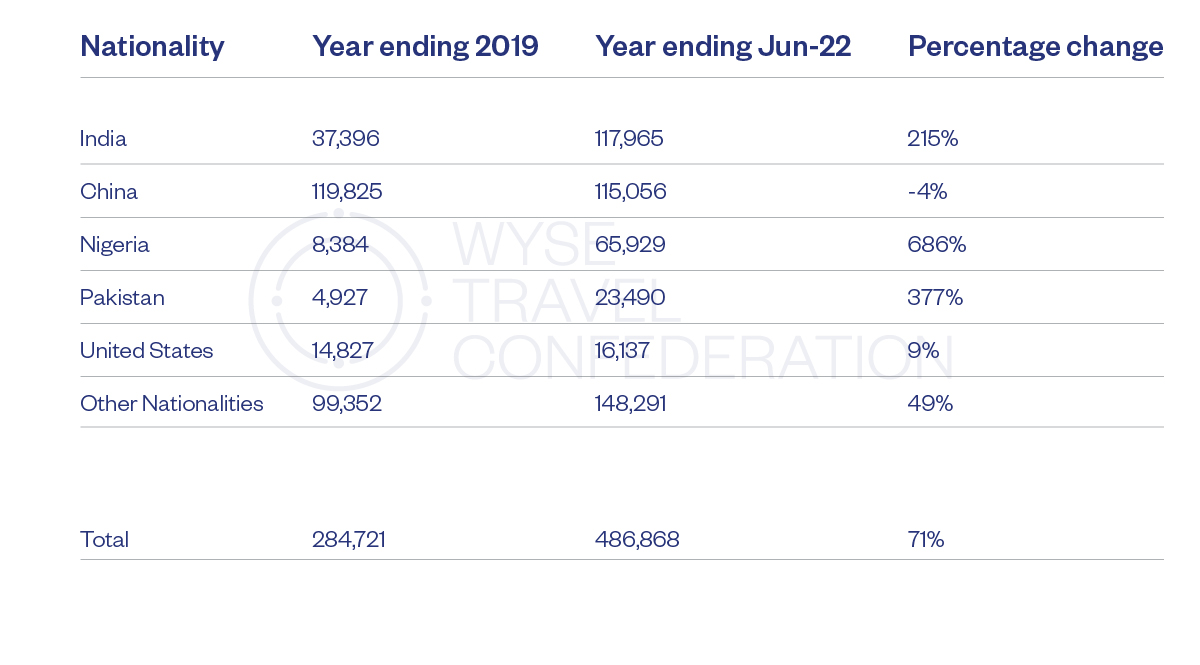

The fall in European students has been more than offset by the significant increase in the number of students entering the UK to study from China and India. In 2021 Chinese and Indian students accounted for 56% of all study visas, and 48% in 2022. This compares with a total of 24,098 Sponsored study visa grants to EEA and Swiss students, 5% of the total number of overseas student visas issued in this period. EU and EEA students now pay overseas fees following Brexit, meaning that costs rose considerably. In 2021/22, annual tuition fees for international undergraduate students in the UK started at £11,400 (US $14,100), rising to as much as £32,081 (US $39,670). The Russel Group of leading UK universities warned that many universities will attempt to offset falling government funding for education by targeting more lucrative international students. This means that the number of international students may keep rising in the UK, but the composition of the international student body may well shift further away from European markets where there are cheaper alternatives available in the EU.

Top 5 nationalities granted sponsored study visas, 2019 compared to year ending June 2022

Why do people come to the UK? To study – GOV.UK

One area of study travel that has been particularly hard hit by Brexit is school tripsEU citizens now need a passport to enter the UK, instead of using their ID cards. However, less than 40% of German citizens hold a valid passport, and less than half of the French. This presents a big barrier to school trips from many EU countries, particularly as schools will find it difficult to organise visits when even a small proportion of children lack a passport. A recent article (Guardian, 2023) indicated that bookings from French and German school groups were at 50% of pre-pandemic levels.

Conclusions

Although it is almost eight years since the UK Brexit vote the effects of that decision are still being felt in many sectors of economic and social life. Our analysis of international tourism flows shows that the UK has lagged behind in terms of tourism growth for much of the post-Brexit period. In the decade to 2019, UK international arrivals grew by 31%, compared with a global arrivals increase of 65% over the same period. Youth tourism seemed to be particularly hard hit, as both inbound and outbound youth travel fell as a proportion of total trips after the Brexit vote in 2016. The post-Brexit decline was, however, halted during and after the Covid pandemic. Young travellers proved themselves to be particularly resistant to the effects of Covid, and youth tourism was at the forefront of a strong recovery from 2021 onwards. However, inbound demand to the UK continues to be softer than outbound youth travel. The main exception to this is the university education sector, where universities have been successful in replacing European students with those from long-haul markets, particularly China and India. As universities seek to cover government funding losses, this trend is likely to continue in future.

Reference

Guardian (2023) French and German tourists turn their back on Brexit Britain.

www.theguardian.com/politics/2023/apr/08/french-and-german-tourists-turn-their-back-on-brexit-britain

|

Author Prof. Greg Richards, Professor of Placemaking and Events Breda University of Applied Sciences |