There appears to be an improved business outlook amongst travel and tourism organisations, but let’s face it – 2020 was a pretty bad year.

If your business is still around after 18+ months of a global health crisis that has nearly halted international travel and declared uncertainty as the name of the game, things probably do look just a little bit better.

For one, vaccines are now available in some parts of the world. Testing has enabled more movement within and across societies. Also, countries and world regions have negotiated travel “bubbles” and reciprocity agreements related to arrivals and departures.

The mood is not upbeat, however. In fact, it’s worsened when it comes to several B words – Biden, Brexit and bans.

This article reports on the general business outlook for organisations working in the youth and student travel marketplace according to the ninth edition of WYSE Travel Confederation’s COVID-19 Travel Business Impact Survey.

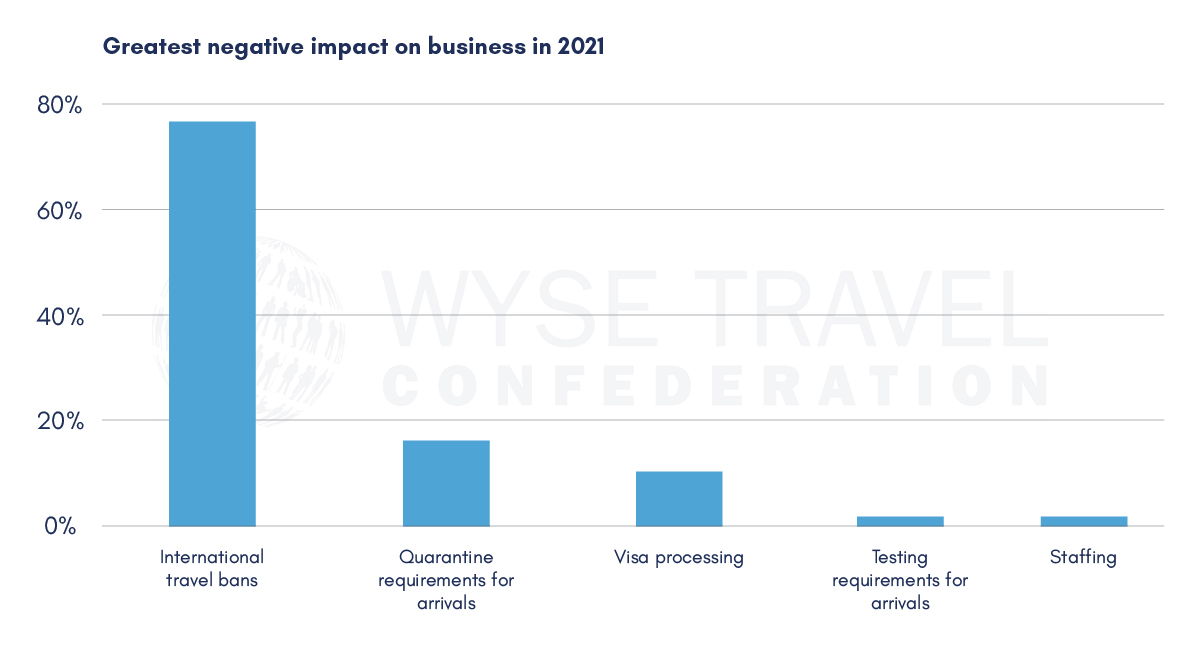

If you’re not banned, there’s a lot to plan

Unsurprisingly, most travel and tourism businesses responding to the September 2021 edition of the COVID-19 Travel Business Impact Survey reported that international travel bans have had the greatest negative impact on their business this year. Quarantine and testing requirements were considered negative factors for just 15% of respondents. Visa processing, integral to international study and popular visa-dependent cultural exchange programmes in the US and UK, represented the greatest negative impact for 10% of organisations reporting.

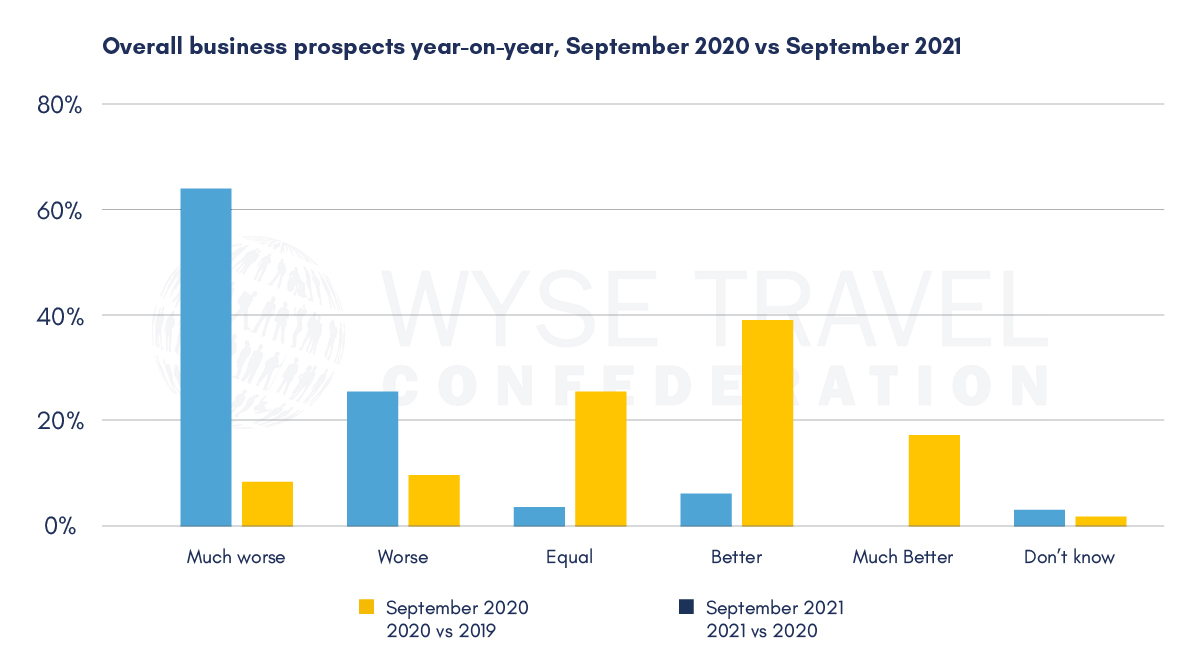

Looking better, but 2020 was really bad

The overall outlook for business is improving, though year-on-year comparisons during a period of such extremes (2019 to 2021) should be read with caution. On average, respondents reported the change in demand between Q2 2021 and Q2 2020 at +11%. However, one year ago, change in demand between Q2 2020 and Q2 2019 was -70% on average.

In September 2020 when comparing 2020 to 2019, most respondents said they had worse or much worse prospects for business. Comparing 2021 to 2020 one year on in September 2021, 52% said their year-on-year quarterly business prospects were better or much better, suggesting that 2020 might have been the low point of what is turning out to be a multi-year global health crisis.

As of September 2021, expectations for the change in business volume 2021 vs 2020 were +17% on average. One year ago in September 2020, the expected change in business volume 2020 vs 2019 was -70% on average.

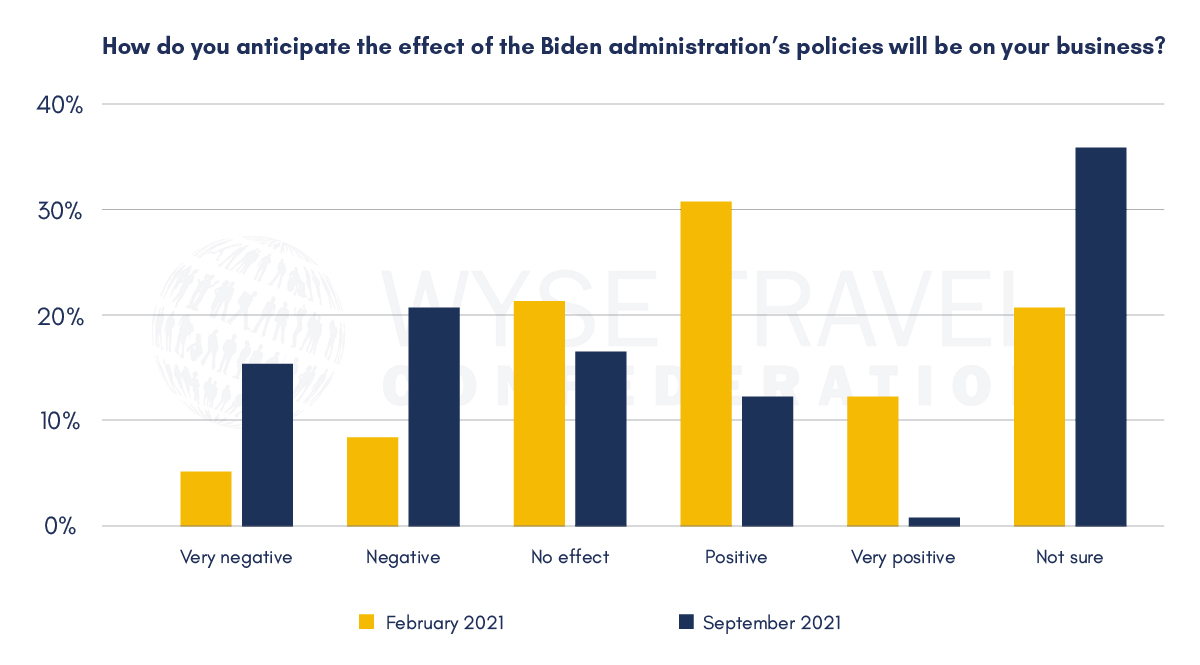

Biden loses his bounce

Although the business outlook is slowly improving in general, the sentiment towards US President Biden has changed for the worse over the course of this year.

In February 2021, 43% of respondents anticipated a positive or very positive effect on business due to the Biden administration. As of September 2021, the shift is towards uncertainty (35%) or negativity (36%) in relation to the Biden administration. This is not surprising given Biden’s insistence on maintaining travel bans for various regions and countries to enter the United States.

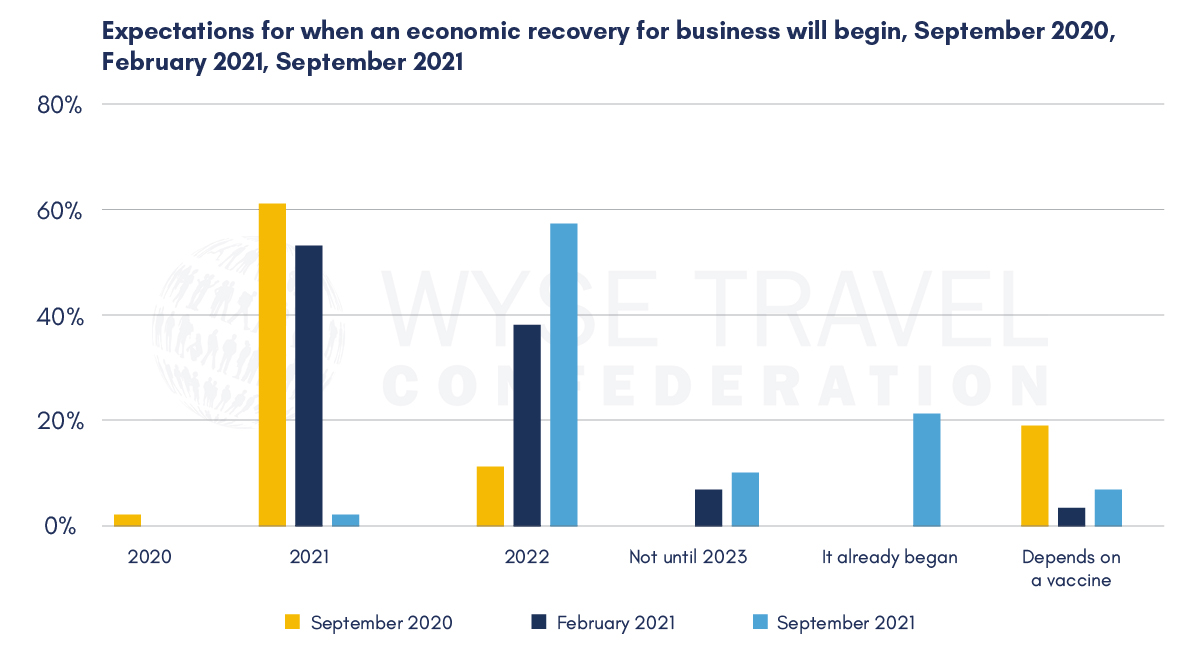

How long can we make it?

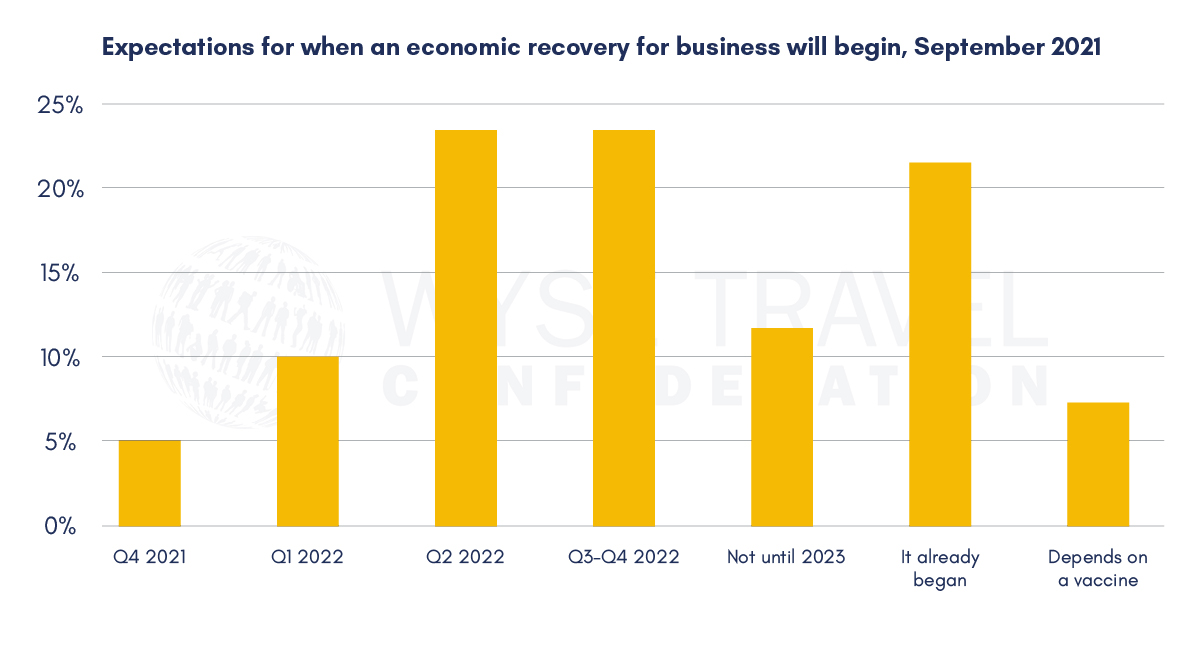

In general, the business recovery outlook has shifted over the course of the nine editions of the COVID-19 Travel Business Impact Survey. In September 2020, 63% of responding organisations believed that economic recovery was in sight for the following year, 2021. This assessment held strong early in 2021, however, more businesses are pushing better business prospects back to 2022.

As of September 2021, 46% of respondents expect economic recovery to begin for their business after the first quarter of next year. Looking further ahead, 11% do not see recovery beginning until 2023 and 7% believe that improved business prospects depend on vaccines. For 21% of organisations, a recovery has already begun.

Respondent profile

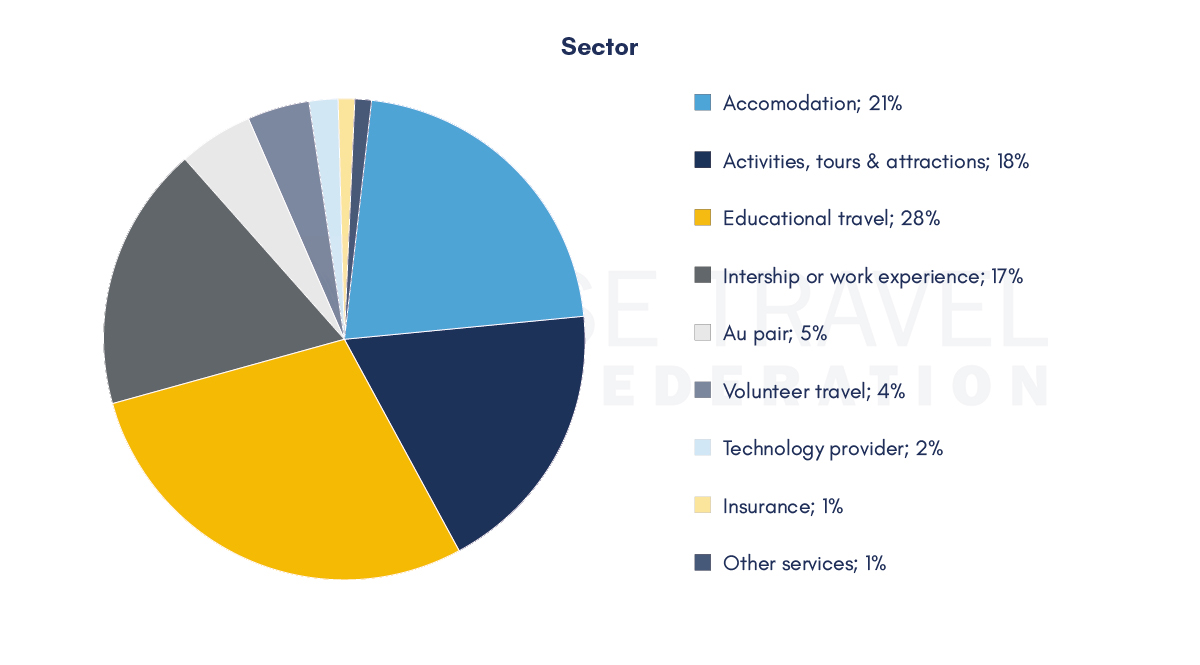

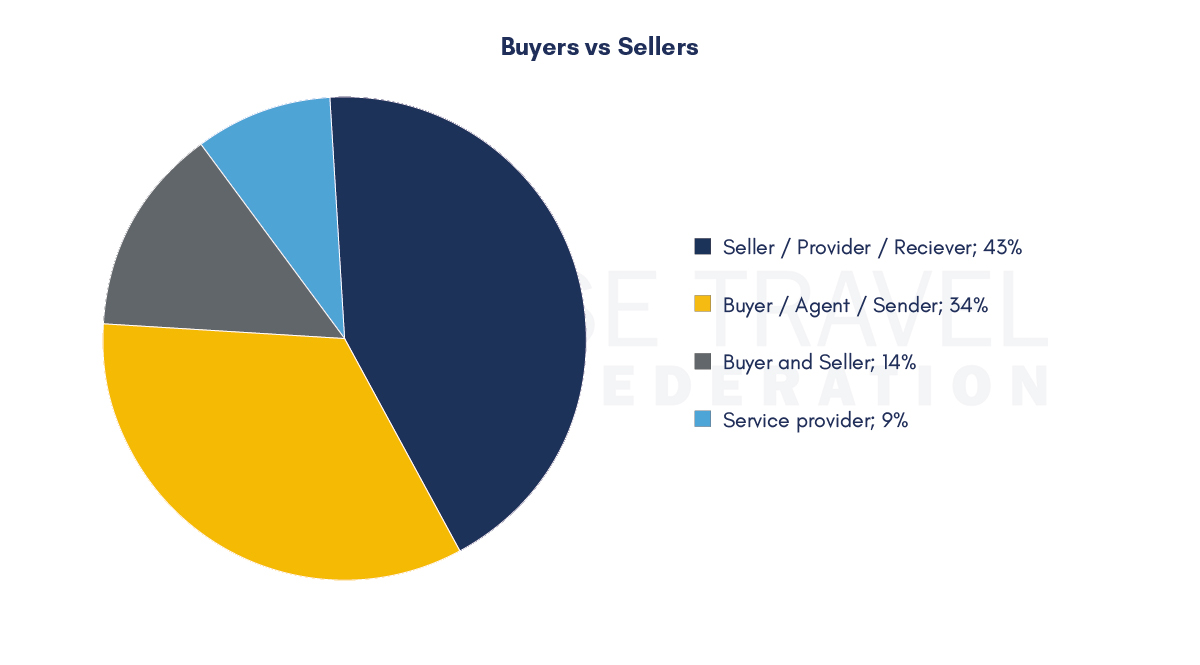

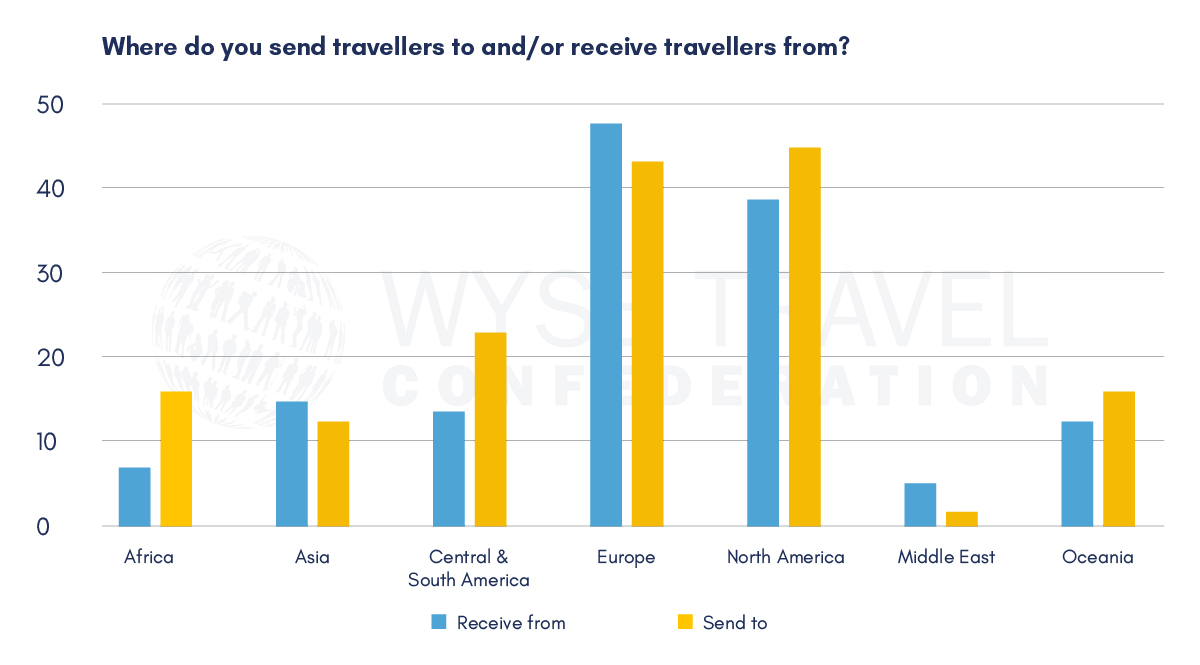

Data for this report were collected between 6 and 15 September 2021 by WYSE Travel Confederation, the global association for youth, student and educational travel organisations, via a web-based questionnaire in English.

The September 2021 survey was the ninth in the series, which began in March 2020. The ninth edition of the survey attracted 213 responses from 48 countries. Respondents included organisations specialised in youth travel products as well as those representing mainstream travel products. About seventy percent of respondents reported that 50% or more of their business in the youth and student travel marketplace. Respondents were both members and non-members of the association. The profile of respondents has remained similar over the course of the series, however, the number of responses has slowly decreased. In September 2020, the survey attracted 338 responses and 600 responses in March 2020.

WYSE Travel Confederation

If your business would benefit from unique business insights on the youth travel market, industry representation for common business interests and new trading opportunities with international partners, we invite you to discover the resources of the global trade association for businesses serving young travellers, WYSE Travel Confederation.