Countries are making progress in vaccinating their residents against COVID-19, but travel restrictions remain for much of the world. The travel and tourism industry is eager to get back to business and service the pent-up consumer demand to travel again. When will the industry get back to meaningful levels of business?

More than half of respondents to WYSE Travel Confederation’s most recent COVID-19 Travel Business Impact Survey [1] reported that they expect economic recovery for their business in youth travel to begin in the second half of this year. A smaller, but still sizeable portion of respondents believe business recovery is further away.

This article looks at expected business recovery dates for organisations active in the youth, student and educational industry. It is based on data collected by WYSE Travel Confederation in February 2021.

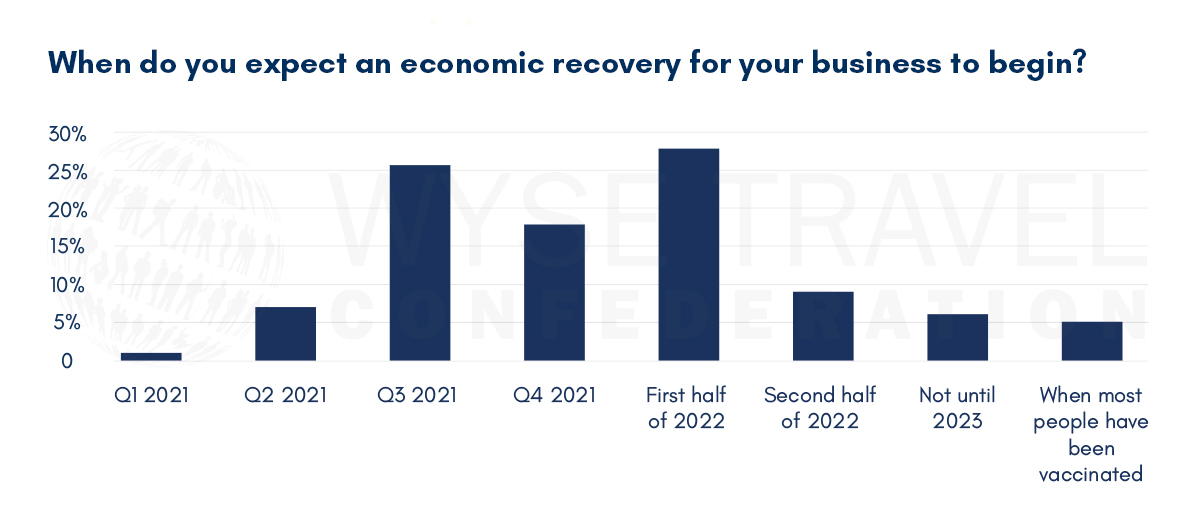

When will economic recovery begin?

More than half of respondents are hopeful that the road to recovery for their business will begin in 2021, albeit most likely not until the second half of the year. Some (28%) are focused on a point a little further down the road in early 2022.

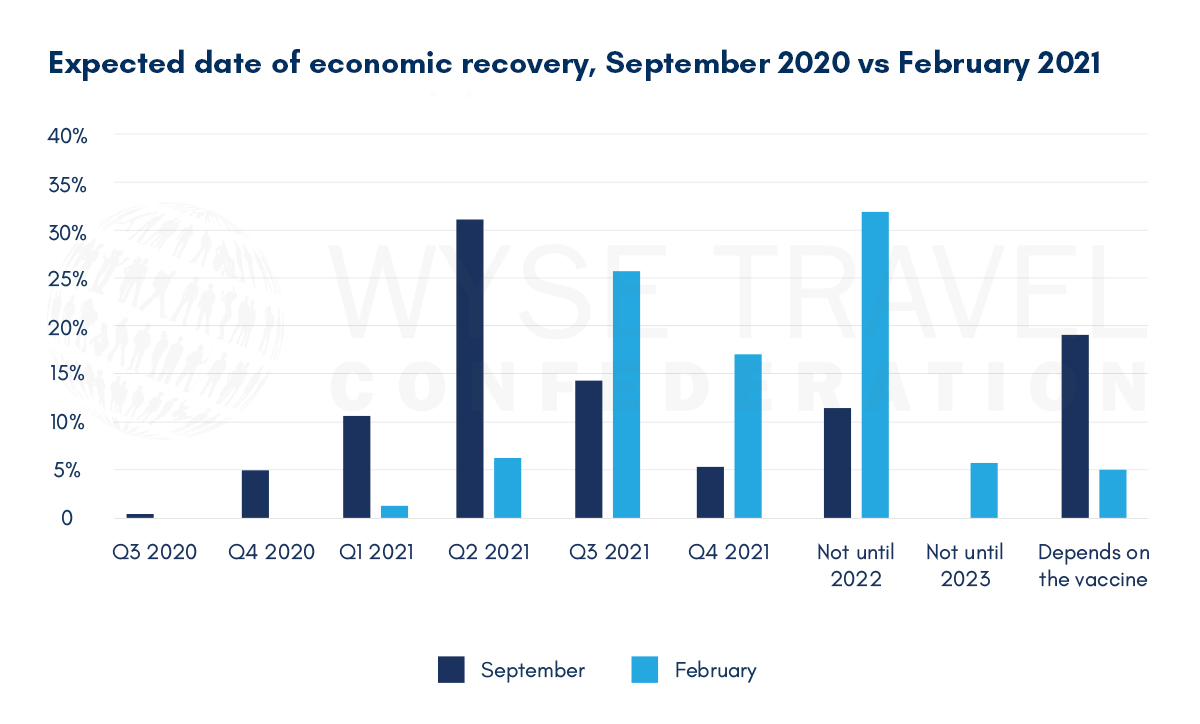

Shifting expectations

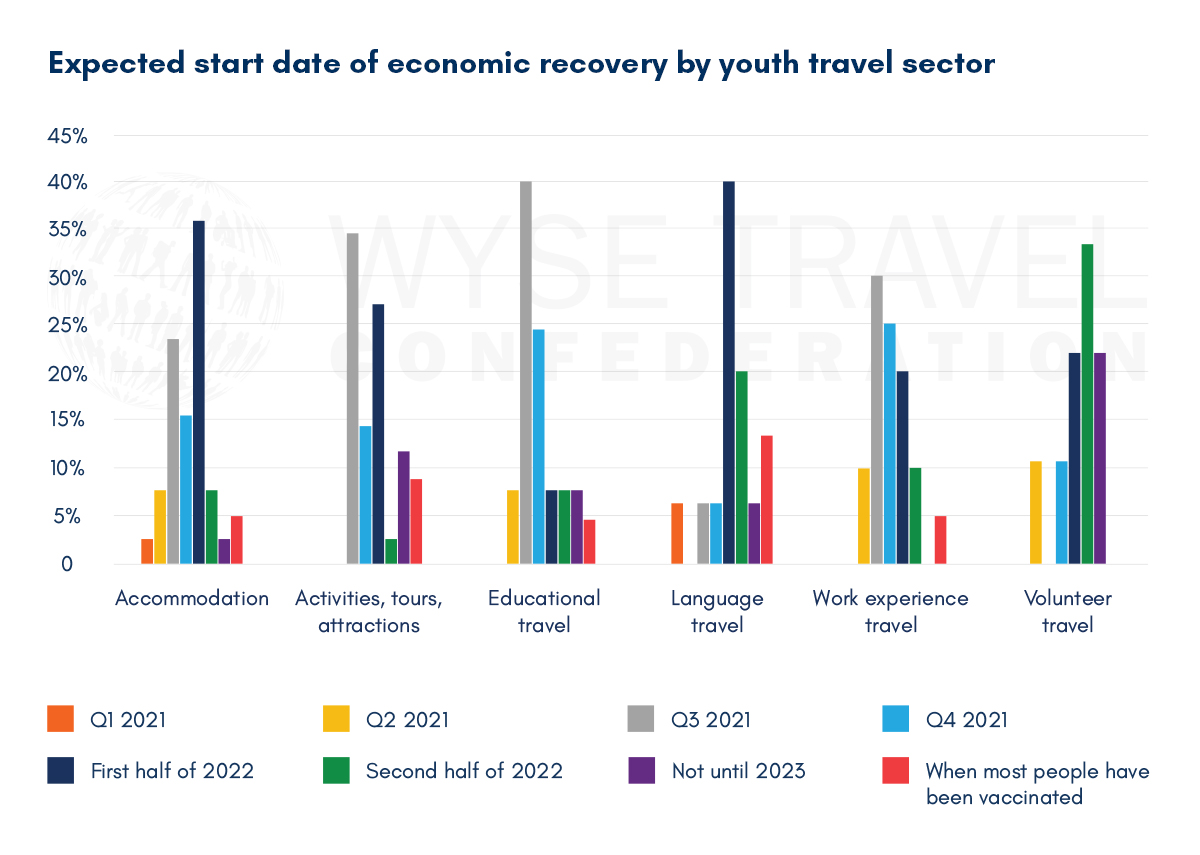

Projections for economic recovery in the youth, student and educational travel business have been shifting over the course of the pandemic. In September 2020, many respondents to the survey had their eyes set on recovering business during the summer 2021 season of the northern hemisphere, 32% believing that economic recovery would begin for their business in the second quarter of 2021. That timeframe now seems to have been reconsidered and extended.

Prior to the approval of the first vaccines in late 2021, a greater percentage of respondents saw economic recovery dependent on vaccination. In September 2020, 19% of respondents believed economic recovery would depend on the availability of a vaccine whereas in February 2021, only 5% said economic recovery would depend on most people being vaccinated.

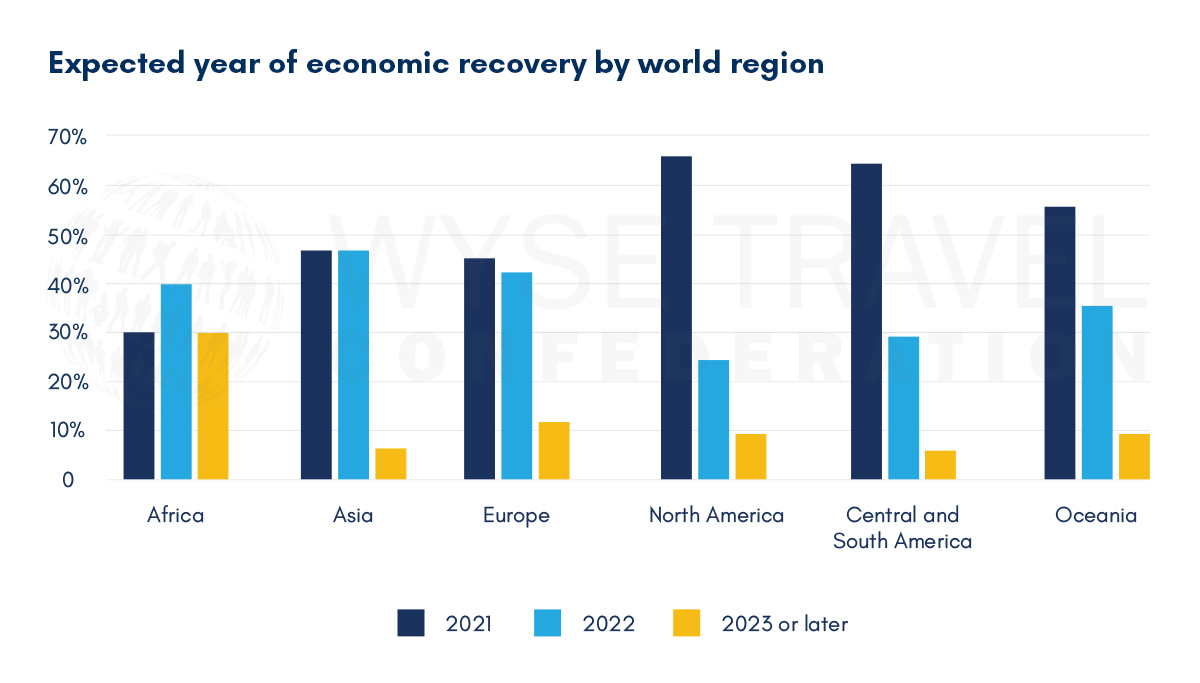

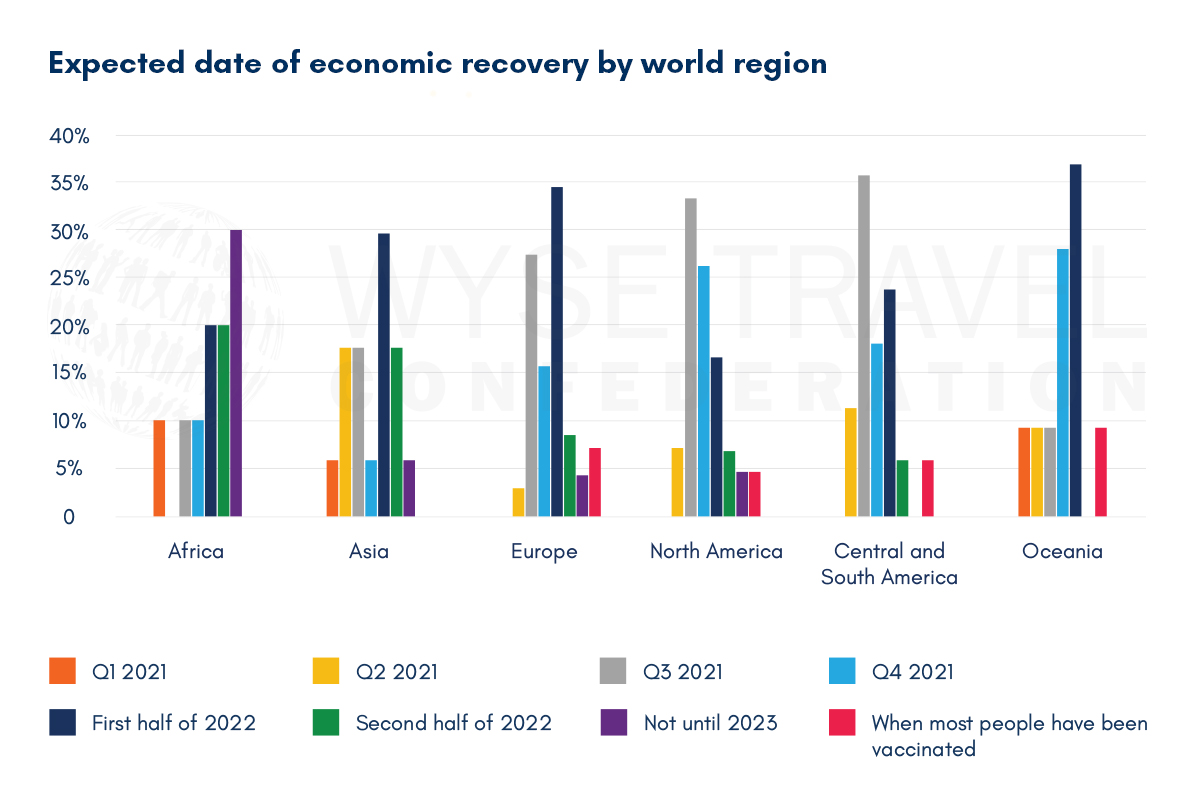

Expectations by world region

Expected dates for recovery vary by world region. Youth travel businesses in the Americas and Oceania are particularly optimistic about recovery beginning in 2021. Respondents in the Africa seem to be more conservative with their projections, with 30% expecting business to pick up in 2023 or later.

The bulk of respondents from Oceania and Europe are anticipating that the first half of 2022, if not the final quarters of 2021, will bring be the turning point for their businesses. Respondents in Oceania are most likely to view economic recovery as dependent on vaccination.

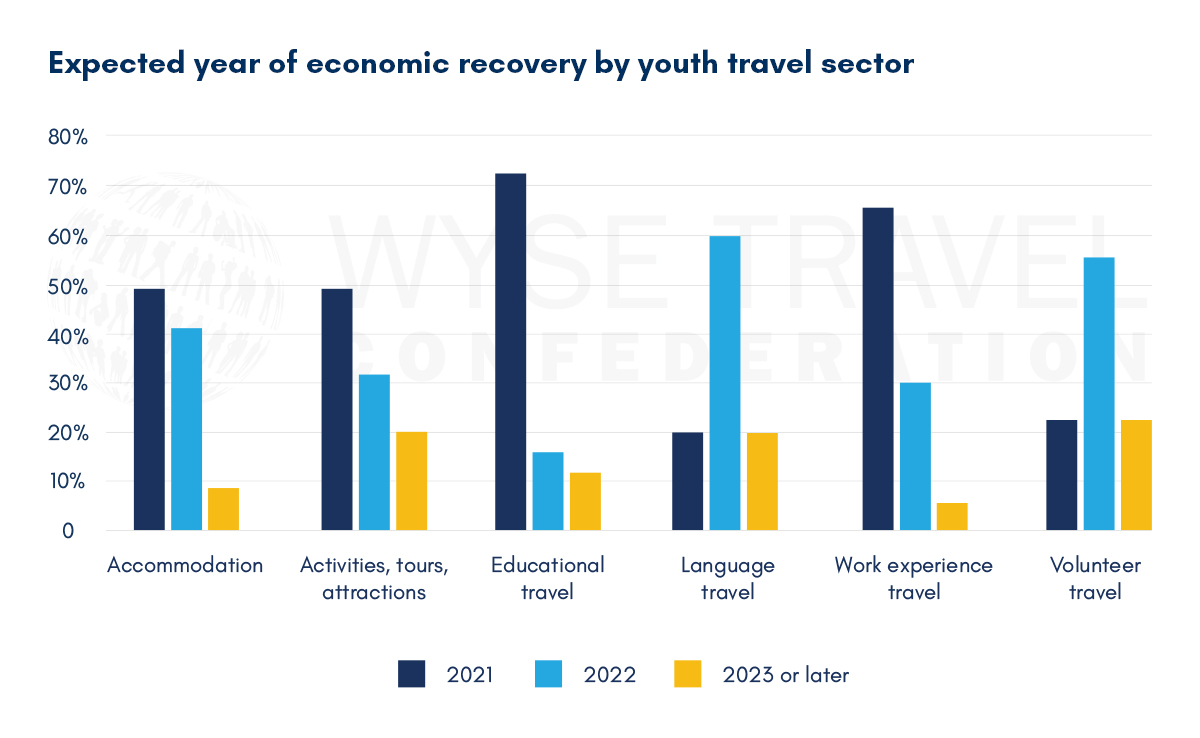

Expectations by youth travel sector

The educational and work experience travel sectors are most likely to view recovery as possible this year, in 2021. This optimistic outlook could be influenced by the fact that many educational institutions directed resources towards achieving a ‘digital shift’ in 2020 and are thus equipped to run hybrid programmes.

The language travel and international volunteer sectors are mostly projecting economic recovery for 2022. While both of these sectors have managed to accommodate the digital shift of their programmes, returning participants to traditional, immersive, in-destination programmes will depend on visa schemes that have been temporarily disrupted. Furthermore, traveller (and parental) perceptions that it is safe to participate in everyday life in the destination will be a factor.

Activities, tours and attractions seem hopeful that recovery will begin in late 2021 and in the first half of 2022. However, there does appear to be some concern in this sector that recovery will not start until 2023 or when most people have been vaccinated. Consideration for the roll out of vaccines in relation to economic recovery is present to some degree in most sectors, though the majority of respondents seem to view business recovery as possible before most people have been vaccinated.

Re-starting youth travel

Re-starting youth travel is dependent on travel in general resuming. Economic recovery for travel and tourism businesses will depend on a variety of factors.

Bi-lateral and regional agreements, pilot groups and digital health passes are some of the mechanisms being used to initiate the freer movement of people across and within borders after a year of pandemic-induced restrictions. Public health measures such as social distancing, face masks and hand sanitising will likely remain in practice and continue to have an impact on travel and tourism business capacity and operations. Consumer choices reflecting concerns for health risks in the destination will also affect the industry as it begins to serve international travellers again.

Young travellers aged 15 to 29 comprised 23% of international arrivals before the COVID-19 pandemic. More than half of the international trips made by the youth travel segment tend to be longer-stays in pursuit of educational and cultural goals within a destination. International youth visitors represent economic and cultural value for destinations that is different than that of a typical tourist on holiday. Youth tend to attract visiting friends and family to the destination during a long stay and are activity-intense beyond the main educational purpose of visit. International travel experiences tend to be the basis of life-long connections that young people develop with destinations.

International youth travel goals are often achieved with the cooperation of public and private institutions operating within formal frameworks established by governments. Typically, such frameworks involve visas and highly specialised sending and receiving organisations that ensure the preparation, safety and success of visiting youth.

Given the support structure that exists and the long, purposeful stays for these international travellers, youth should be among the first segments considered by destinations as they work towards re-opening for international visitors. Testing and quarantine entry requirements that will remain even as the world’s population is vaccinated against COVID-19 constitute small commitments of time for long-stay visitors such as international students and working holidaymakers. Social distance and hygiene practices for public health and safety will likely continue to be the norms of everyday life in most destinations, so for visitors with an educational or cultural purpose, these practices will be part of daily life in any destination rather than a hindrance to enjoying a vacation.

WYSE Travel Confederation

If your business would benefit from unique business insights on the youth travel market, industry representation for common interests and new trading opportunities with international partners, we invite you to discover the resources of the global trade association for organisations serving young travellers, WYSE Travel Confederation.

[1] Data for this report were collected between 2 and 14 February 2021 by WYSE Travel Confederation, the global association for youth, student and educational travel organisations, via web-based questionnaire in English. The February 2021 survey was the eighth in the series, attracting 379 responses from 61 countries. Three-hundred and forty-seven responses were retained for analysis. Respondents included organisations specialised in youth travel products as well as those representing mainstream travel products, members and non-members of the association.

All respondents were asked about the impact that the COVID-19 (Coronavirus) pandemic has had on their business in travel. Questions related to change in demand, business outlook, main concerns and actions taken in response to COVID-19 have been repeated across surveys.

Youth travel specialists, defined as those organisations with over half their main business in the youth market (ages 15 to 30), have consistently made up 60% or more of respondents over the course of the survey series.