News

Manchester, United Kingdom — 22-25 September 2009WYSE Archives

![]()

STR: Mainland China performance update

Kelsey Fenerty, STR

9 December 2020

As the first market impacted by the COVID-19 pandemic, China was quick in both its pandemic mitigation as well as its hotel recovery. While STR does not report on hostel performance in China, lessons learned in the market’s hotel recovery can be applied to the hostel sector.

Budget accommodations bounce back first

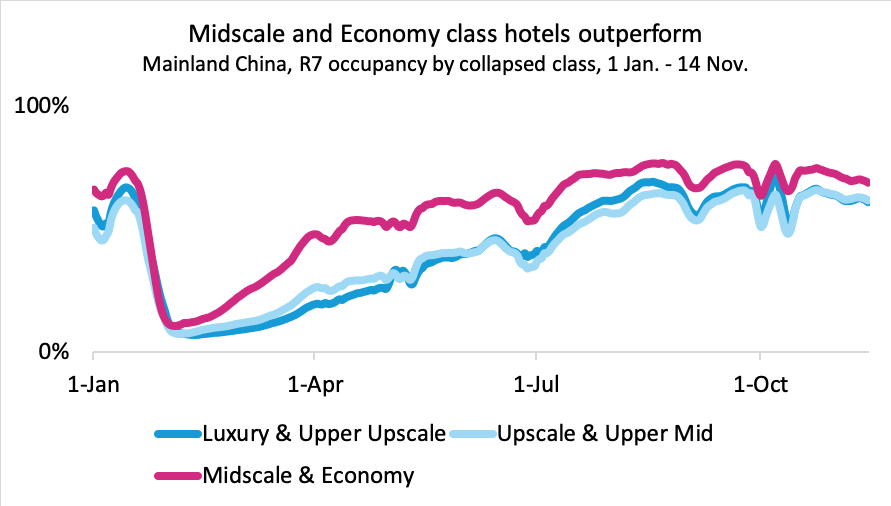

It’s no secret that Midscale and Economy class hotels – the segment of hotels most comparable to hostels – have had a relatively better time than other, more expensive hotel classes no matter the region. Mainland China is no exception to this rule: Rolling 7-day Midscale and Economy hotel occupancy fell less and recovered faster than occupancy in the other two collapsed classes.

Their lower price point likely contributed to lower-tier hotels’ strong occupancy this year, and until mid-September, Average Daily Rate (ADR) among Midscale and Economy class hotels fell more than rate in the other collapsed classes. Demand from healthcare personnel and other key workers, along with less historic reliance on group demand, also helped to foster quicker recovery among lower-tier hotels.

Hostel takeaway: With rates declines concentrated in lower-tier hotels and demand scarce for any accommodation type, hostels have never had more competitors. As the gap between hostel and hotel ADR narrows, overcoming guests’ concerns surrounding hygiene and social distancing is key to maintaining demand share.

Bringing back business (demand)

Early in the year, key workers contributed significantly to Mainland China demand. But even as lockdowns lifted, Tuesday and Wednesday occupancy kept pace with Friday and Saturday occupancy in Midscale and Economy hotels. This suggests lower-tier hotels are likely hosting midweek business travelers in addition to weekend leisure guests.

A lower price point has likely helped Midscale and Economy class hotels to capitalize on demand from both businesses and holidaymakers suffering from economic impacts of the pandemic.

Hostel takeaway: Many hostels have pivoted to target business travelers in recent years. And while business travel is absent in most parts of the world, the massive shift in travel patterns caused by the pandemic offers hostels a unique opportunity to reset guest strategy and capitalize on the economic recession to target business demand once it returns.

Secondary market renaissance

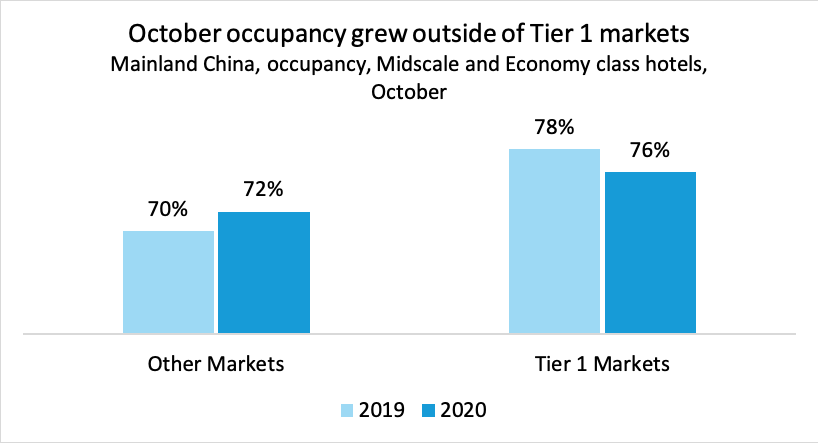

Beijing, Shanghai, Guangzhou, and Shenzhen, Mainland China’s traditional Tier 1 markets, are among the biggest and most popular Chinese markets. Midscale and Economy class occupancy in these four markets typically exceeds that in other Mainland China markets by over ten percentage points.

Tier 1 market occupancy in lower-tier classes exceeded other market occupancy in October 2020, in line with prior year trends but diverging from total hotel trends. For all hotels, other market occupancy outpaced Tier 1 market occupancy from February to July, and while Tier 1 market occupancy once again exceeded other market occupancy from August to October, summer travel and holiday impacts played a significant role in the reversal.

The variance in occupancy trends between budget hotels and all hotels suggests that Midscale and Economy hotels have recovered faster than other hotel classes.

Historic reliance on international demand has stymied Tier 1 market recovery, but secondary and tertiary markets with a focus on domestic travel have fared better. Occupancy in the Tier 2 market Jiangxi grew 4.8 percentage points from October 2019 while Tier 1 metropolis Guangzhou occupancy tumbled 5.6 percentage points from last year.

Hostel takeaway: Occupancy in Tier 1 markets overall may be down, but Shenzhen and Shanghai both grew occupancy in October 2019. Highlighting COVID safety procedures and property outdoor spaces or market outdoor attractions could help attract safety-conscious guests.

Conclusion

While European and Chinese response to the COVID-19 pandemic has differed, Mainland China hotel performance does offer hope and a reminder of good things to come once the crisis is under control. Price point, guest mix, and local attractions can help drive demand, and a second lockdown offers an opportunity to strategize and plan for travel’s eventual resurgence.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for global hospitality sectors. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, and an international headquarters in London, England. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.

Join WYSE Travel Confederation

If you’d like to join WYSE Travel Confederation and benefit from new connections, free access to industry research, informative webinar sessions, discounts on industry events and brand exposure within the youth and student travel industry, click below to view our membership options and find out more.