Investment in digital shift stymied drop in demand for youth travel programmes

Internships, language immersion courses, study abroad semesters and many other travel-based educational and cultural exchange programmes have adapted for virtual environments due to COVID-19. The August edition of WYSE Travel Confederation’s COVID-19 Travel Business Impact Survey[1] takes a look at the extent to which these sectors of the youth travel industry have gone digital this year and what the digital shift for youth travel programmes might look like for 2021.

Moving youth travel programmes online

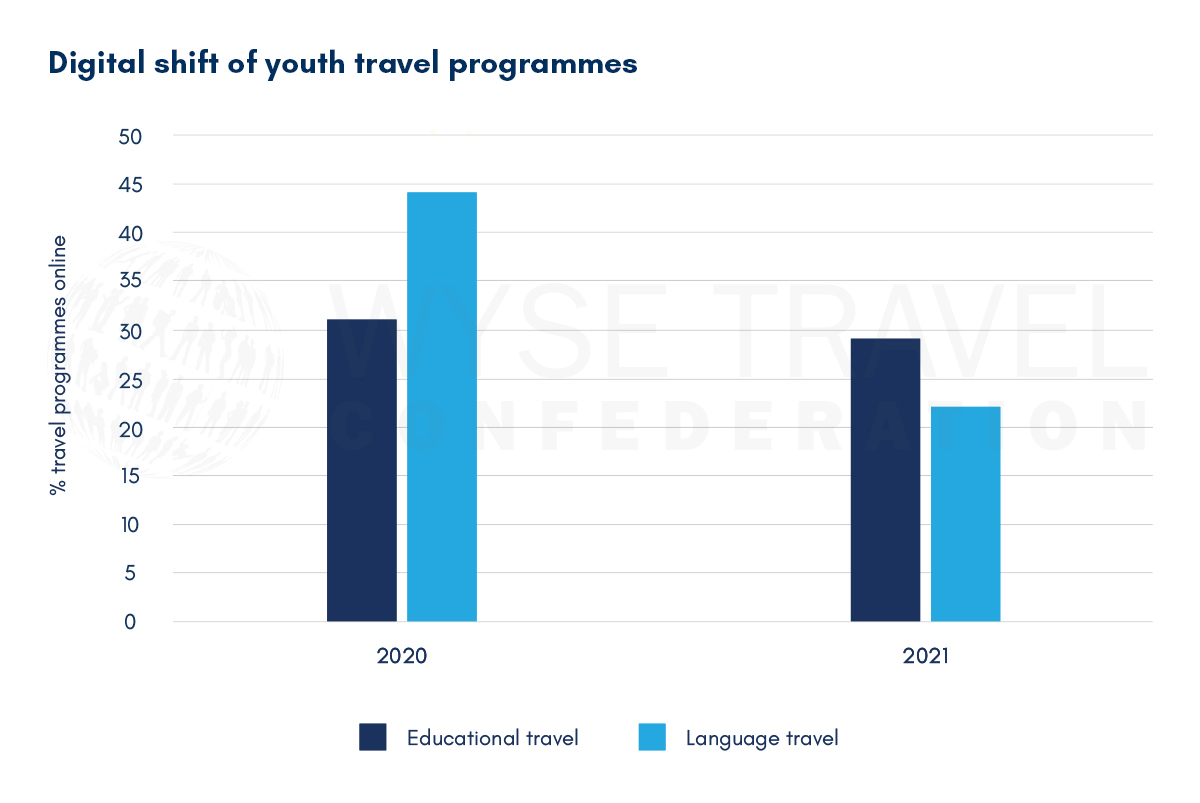

When asked what proportion of programmes that normally require travel have or would move online in 2020, responses indicate the average ‘digital shift’ for educational and cultural exchange travel programmes was almost 30%. For 2021, an average of 25% of youth travel programmes are slated to run online.

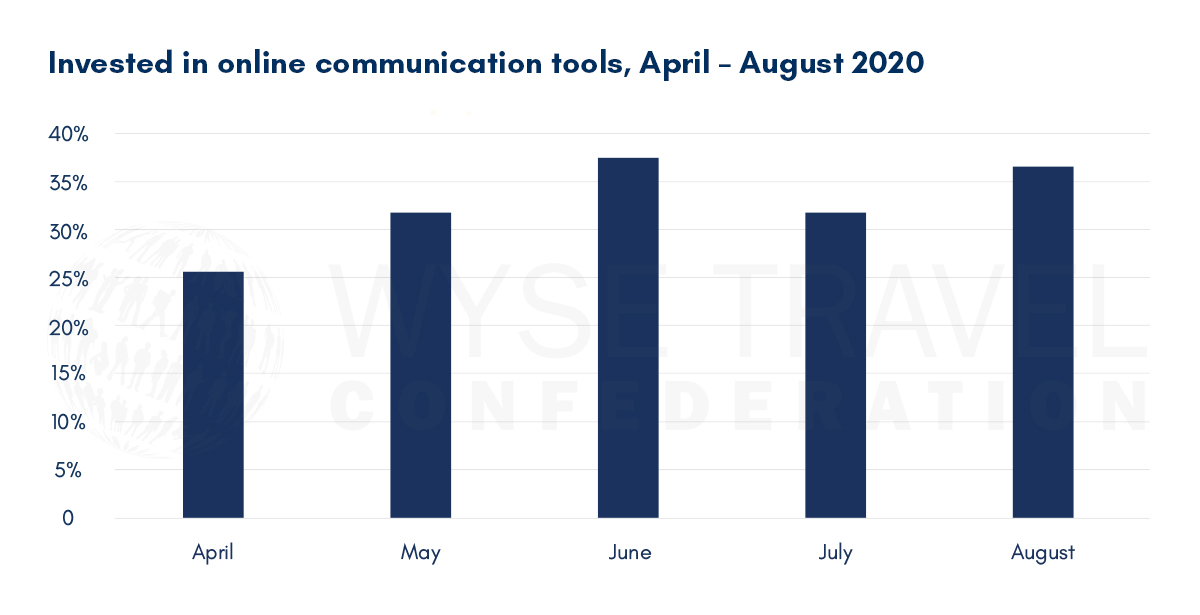

The digital shift has been supported by growing investment in online communication tools. In April around 25% of survey respondents indicated that they were investing in online communication in response to the pandemic, but by August this had increased to 37%.

Educational travel and language learning travel are the main sectors where the digital shift is occurring. In these sectors the development of online programmes is currently much more prevalent, with 44% of language travel programmes shifting online in 2020. Even so, language travel organisations anticipate that just 22% of language travel programmes will run online in 2021, suggesting an optimistic view that some travel-based programmes will be able to resume next year.

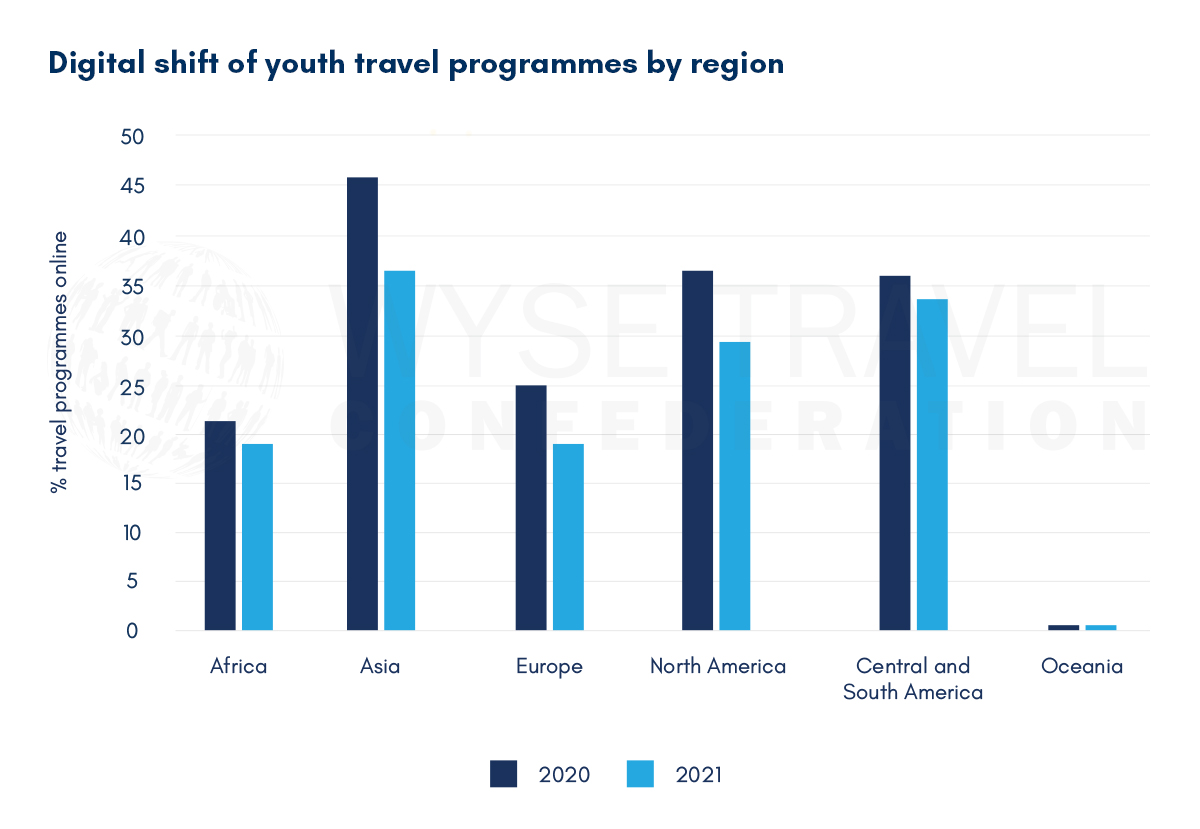

The digital shift of youth travel programmes, for 2020 and 2021, is greatest in Asia, followed by the Americas.

The investments in online communication tools that organisations have been making this year appear to be worthwhile, as these investments have supported a higher level of movement towards offering online youth travel programmes.

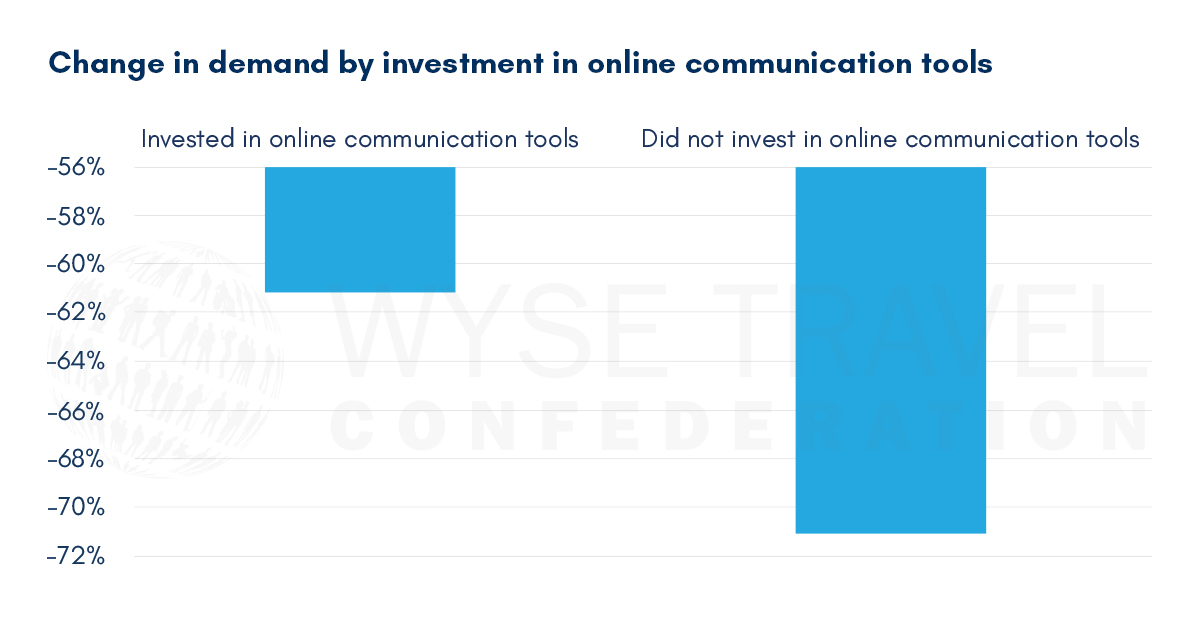

The shift to digital provision has also enabled suppliers to limit the downturn in demand. Compared with other suppliers, those who made digital communication investments over the past six months have reduced the fall in demand by about 10%.

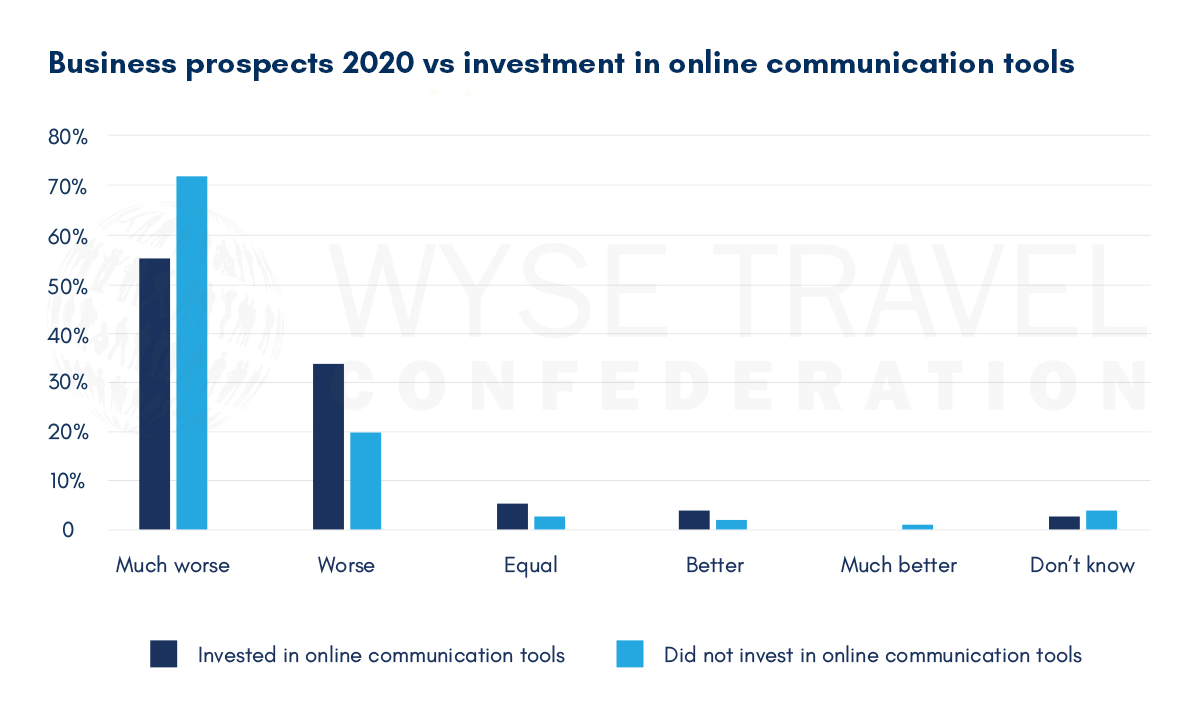

Those investing in online communication tools in the past six months were also significantly less pessimistic about their business prospects for 2020.

Even though investments in online communication tools that have enabled a greater shift to virtual replacements for some youth travel programmes, some organisations believe that travel is essential to the experience they offer and are playing the waiting game until travel can resume.

“Online learning programs has been available for many years. However, our main customers are the ones who prioritize travelling and also add learning or gaining experience. I would say 2021 will be a tough year and we do not know how COVID-19 will be creating challenges, shut-downs and economic crisis. 2021 depends on how borders and governments will be reacting and applying regulations.”

“Since we are a location based volunteer and experiential learning organisation, if there is no travel our business will struggle tremendously. Therefore, the main obstacles are:

1) Fear of contagion whilst traveling

2) Uncertainty regarding ‘openness’ of international borders

3) Uncertainty of Insurance cover

4) Increased costs due to new health & safety measures and reduced permissible occupancy levels

5) Lack of economic resources in our target audience”

Some have experimented with new digital programme offers but are not seeing that they will completely replace travel-based programmes or generate the same level of demand or income once travel resumes.

“We have created one virtual tour for people to purchase online, however it was a small project and has not drawn much income. Our income is from our volunteer program which cannot be done online. We hope to be open in 2021 but expect income loss because many volunteer spaces for 2021 will be taken by volunteers who were not able to come for their original booking in 2020. We will be honoring their original booking in 2021 at no extra charge.”

WYSE Travel Confederation and the COVID-19 Travel Business Impact Survey

If your business would benefit from unique business insights on the youth travel market, industry representation for common business interests and new trading opportunities with international partners, we invite you to discover the resources of the global trade association for businesses serving young travellers, WYSE Travel Confederation. Meet us at the World Youth and Student Travel Conference (WYSTC) Online 7 – 9 October 2020.

Next survey in the series

WYSE Travel Confederation will repeat the COVD-19 Travel Business Impact Survey in September 2020. As with past travel business crises that we have monitored, it is important for the industry to come together and take its collective temperature. Given that youth aged 15 to 29 represent 23% of international arrivals, all travel businesses, regardless of their focus on youth-tailored travel products, are welcome to participate in the survey.

To read the past months’ survey outputs, click here.

[1]Data for this report were collected between 3 and 10 August 2020 by WYSE Travel Confederation, the global association for youth, student and educational travel organisations, via web-based questionnaire in English. The August survey was the sixth in a series titled COVID-19 Travel Business Impact Survey.

The sixth iteration of the survey attracted 321 responses from 69 countries. Three-hundred and eight responses were retained for analysis. Respondents included organisations specialised in youth travel products as well as those representing mainstream travel products, members and non-members of the association. All respondents were asked about the impact that the COVID-19 (Coronavirus) pandemic has had on their business in travel. Questions related to change in demand, outlook for 2020, main concerns and actions taken in response to COVID-19 have been repeated across surveys.

The profile of respondents to the sixth survey in August 2020 was similar to that of respondents of previous surveys. Youth travel specialists, defined as those organisations with over half their main business in the youth market, have consistently made up 60% or more of respondents over the life of the survey series.