Organisations dealing in educational and cultural exchange travel programmes for the student market have remained slightly more positive than the youth and student travel industry as a whole since the start of the pandemic and the COVID-19 Travel Business Impact Survey[1]. However, outlook might soon take a turn for the worse for cultural exchange specialists and those who partner with them—the sector was dealt a blow from the United States in the form of a presidential proclamation that halts certain visas used by cultural exchange programme visitors for the remainder of 2020. Businesses active in all sectors of the youth travel industry are looking to the first half of 2021 for recovery to begin, including educational and cultural exchange travel.

Outlook for educational and cultural exchange travel

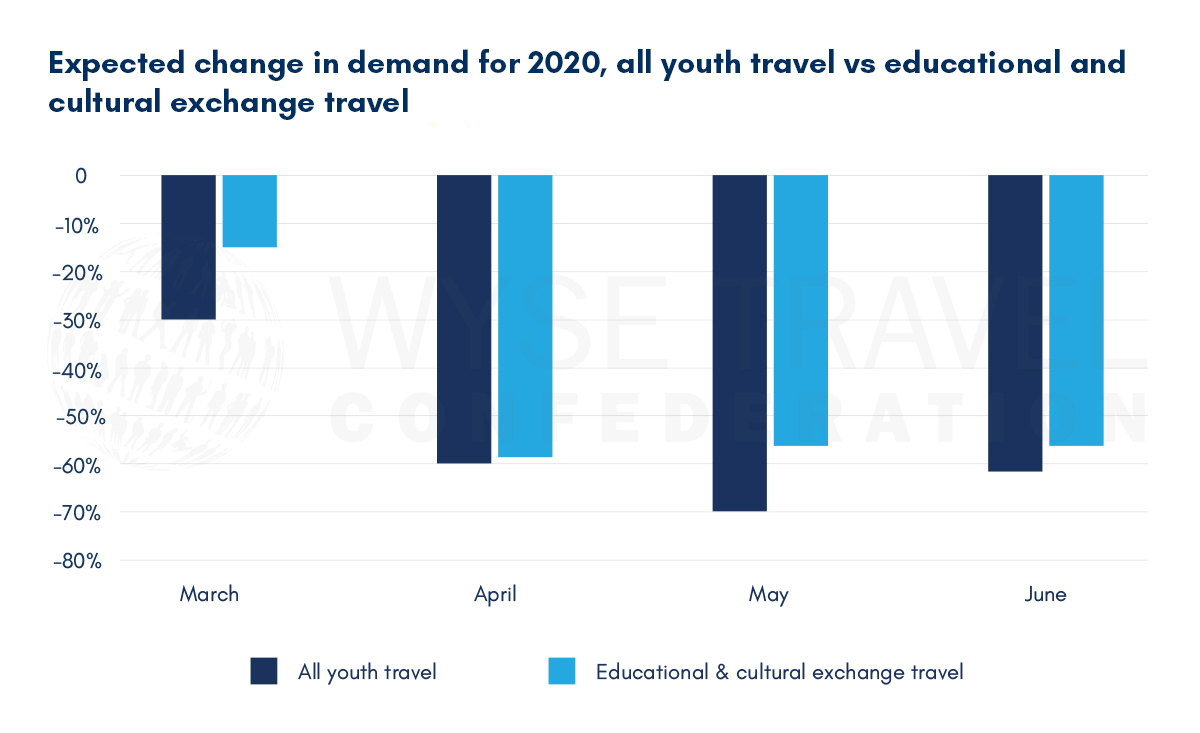

Across the whole of the global youth travel industry, the expected change in demand for 2020 compared to 2019 improved slightly in June (-62%) compared to May (-70%). However, within the educational and cultural exchange sectors expectations regarding demand have remained roughly the same since April, with specialists in these programme areas anticipating a 56% drop in demand year-on-year. Even so, educational and cultural exchange specialists have been slightly more optimistic than the youth travel industry as a whole over the course of the pandemic to date.

This slightly more optimistic though cautious outlook might soon change given the Proclamation Suspending Entry of Aliens Who Present a Risk to the US Labor Market Following the Coronavirus Outbreak issued in the United States on the 22 June by President Donald Trump. The Proclamation calls for the suspension of certain categories of visas that are required for some of the most popular cultural exchange programmes for youth visiting the USA— J visas “to the extent the alien is participating in an intern, trainee, teacher, camp counsellor, au pair, or summer work travel program”.[2]

It is prudent to note that findings in this article are based on data collected in early June, before the Proclamation. The suspension of visas for one of the most popular work experience and travel destinations for youth will not only have consequences for the global network of Agents and Sponsors specialised in this destination and programme, but also the suppliers of accommodation, activities, insurance and other travel products and services utilised by this youth travel market.[3] The business impact of the J visa suspension through 2020 will likely be reflected in the July edition of the COVID-19 Travel Business Impact Survey. The visa situation in the US will undoubtedly affect Sponsors based in the US, but also represents an opportunity for other destinations to gain awareness of similar cultural exchange programmes they facilitate for young travellers.

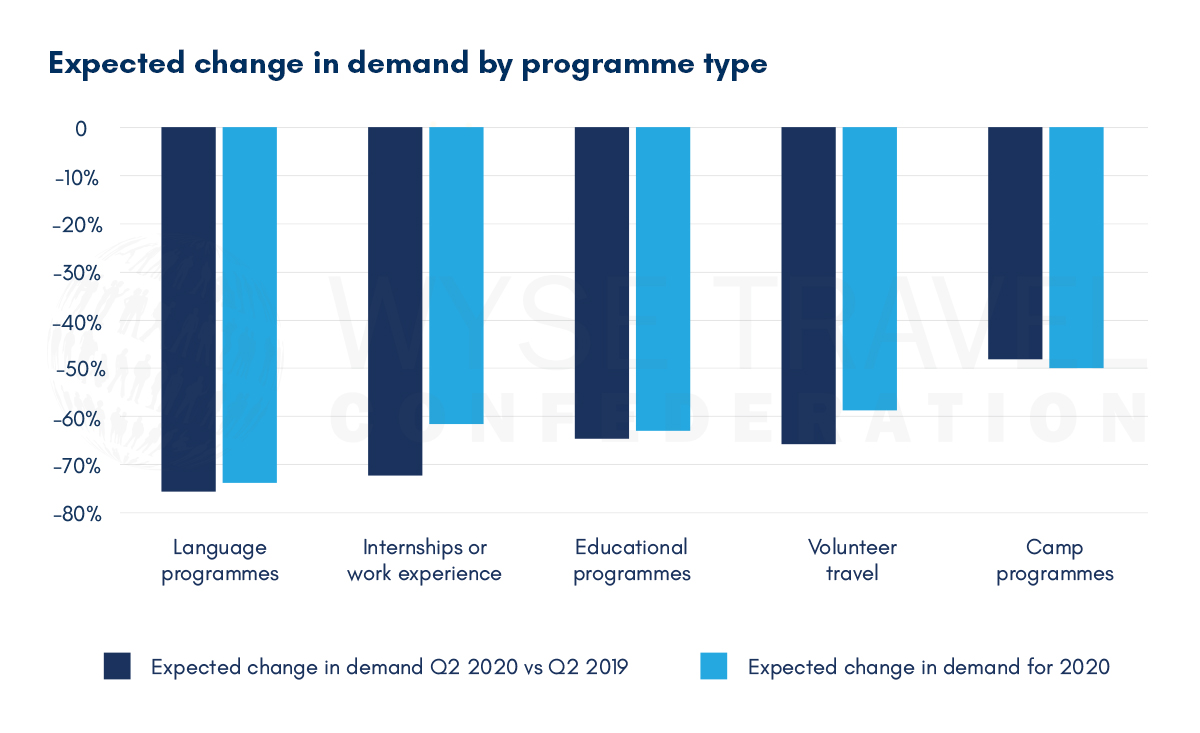

Camp programmes are among the survey respondents reporting the lowest expected drops in demand. Language travel appears to have been the hardest hit in the second quarter and is also expecting the worst annual results this year. For some programme types there is relatively little difference in the expected calendar year results relative to the present business quarter. In June, respondents dealing in internships and work experience programmes were more positive about their potential calendar year results than their current quarter, apparently expecting a turn-around later this year.

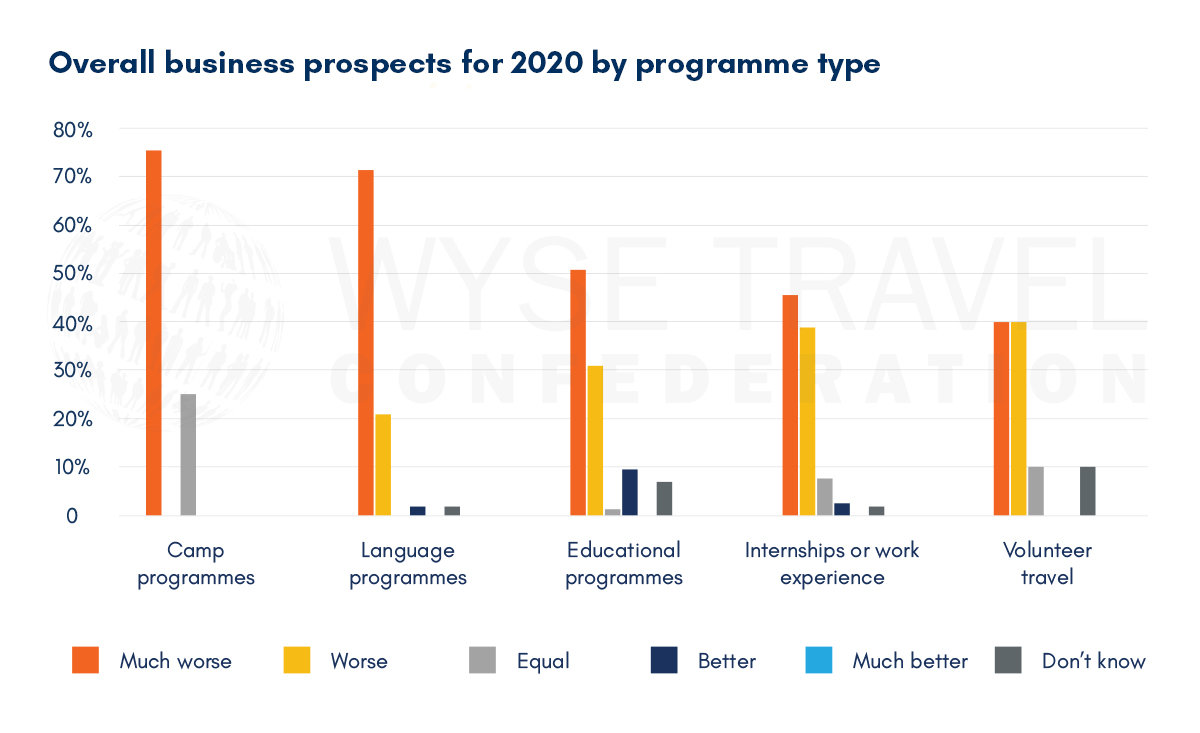

Camp programmes and language travel had the highest proportions of respondents expecting business to get much worse over the course of 2020. Ten percent of those dealing in volunteer travel are unsure of their prospects this year.

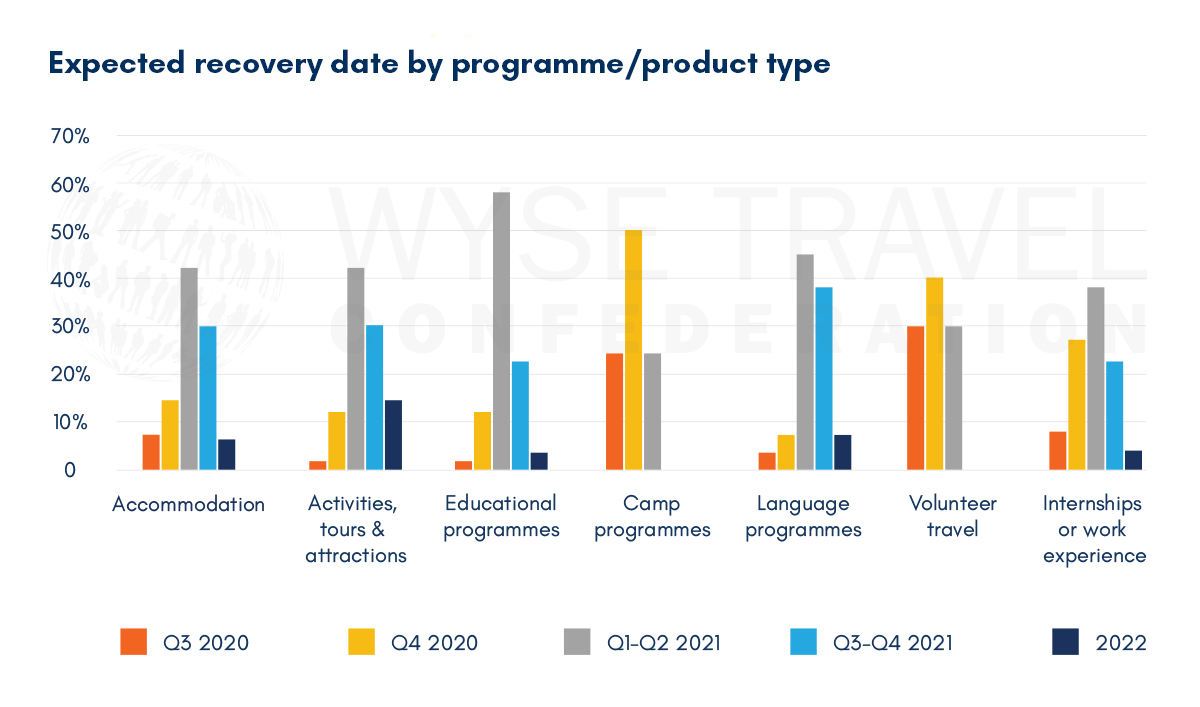

Expected recovery

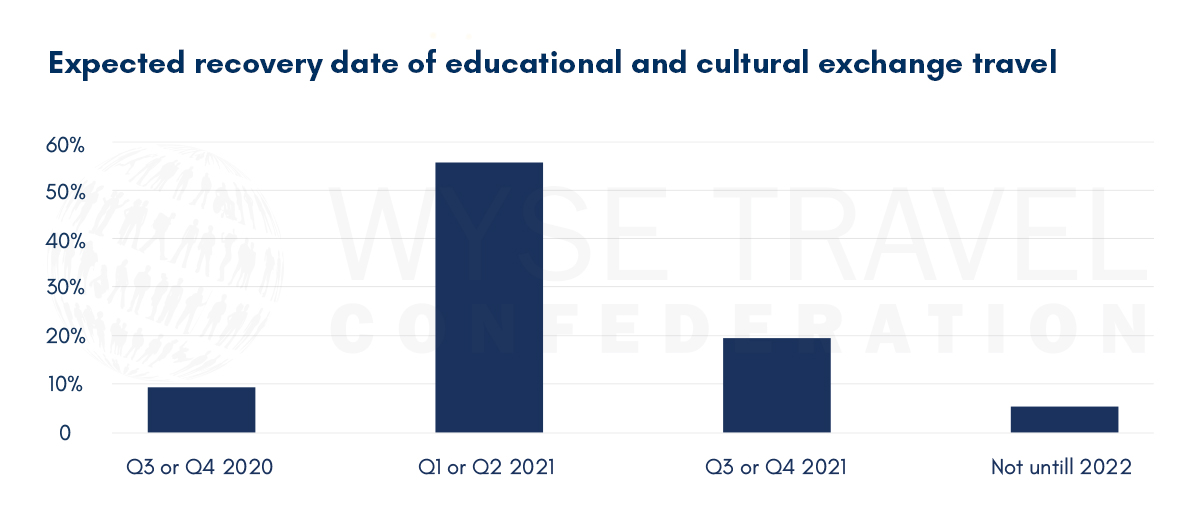

In the current climate of slow de-confinement and gradual lifting of travel restrictions, eyes are on signs of recovery. Even though some areas of business within the youth travel industry are starting to see interest and bookings, 44% of youth travel businesses do not expect a recovery to start until the first half of 2021. Twenty-eight percent believe recovery will not start until the second half of 2021.

For education and cultural exchange specialists, 56% have their eyes set on recovery in the first half 2021.

Actions taken

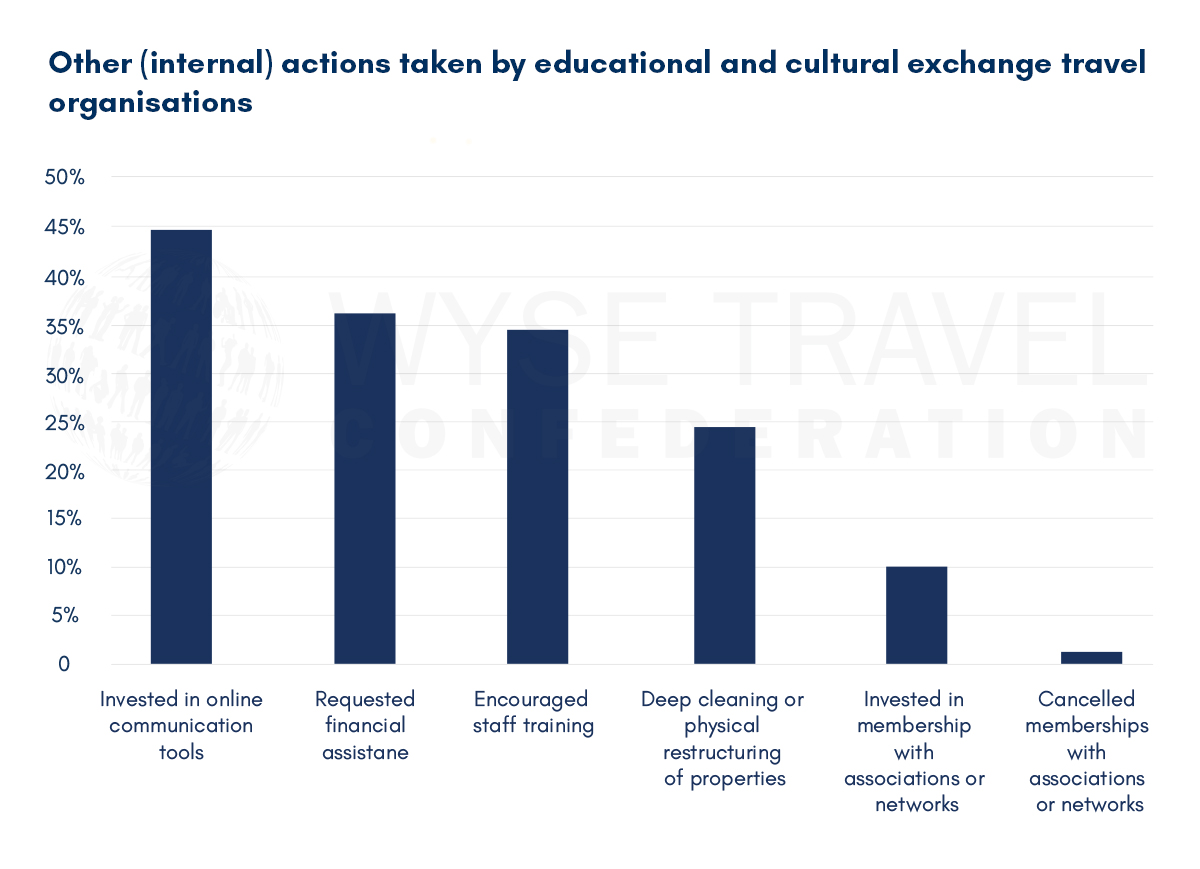

In June, educational and cultural exchange organisations, like the rest of the youth travel industry, continued to focus on the modification of policies and terms & conditions as one of the most important actions to improve business during the crisis. Diversifying products and services, as well as modifying target markets were also important actions for educational and cultural exchange organisations whereas others in the broader industry reduced capacity.

Forty-four percent of educational and cultural exchange organisations indicated that they had invested in online communication tools. This is perhaps not surprising given the move to offer a range of virtual experiences to clients while travel was not possible, including virtual classes and internships, as well as the need to facilitate communication and cooperation between staff and with business partners.

Marketing and communication

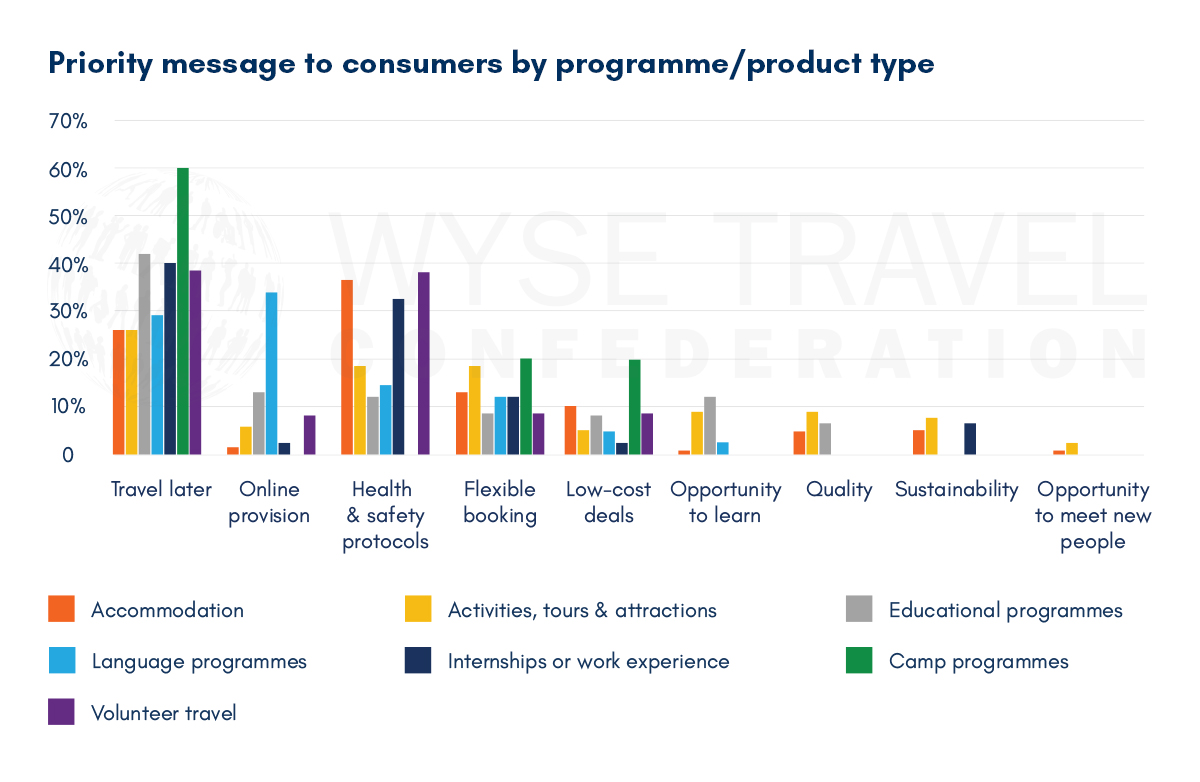

Given that travel restrictions in some areas of the world were set to be lifted in June and July, we asked respondents about their current marketing objectives and priority messaging to prospective customers. The most frequently mentioned messages being communicated to customers, across all areas of youth and student travel, were ‘travel later’ (31%) and that the organisation is implementing health and safety protocols (25%). Flexible booking was a message to consumers being used by 13% of respondents.

Currently the main marketing objective of educational and cultural exchange organisations is to maintain customer loyalty.

The message of marketing and communications varies significantly by youth travel sector, with camp programmes (60%) in particular suggesting to travel later. Language programme providers were most likely to highlight the online provision that they had developed. The opportunity to meet new people and was utilised by very few as a marketing message. Likewise, sustainability was a message utilised by few though some within the work experience travel and tours, activities & attractions sectors reported using this. Emphasising sustainability is perhaps a strategy for tour and activity providers, as well as attractions, being used to counter some of the ‘over-tourism’ sentiment that arose within various European cities in 2019.

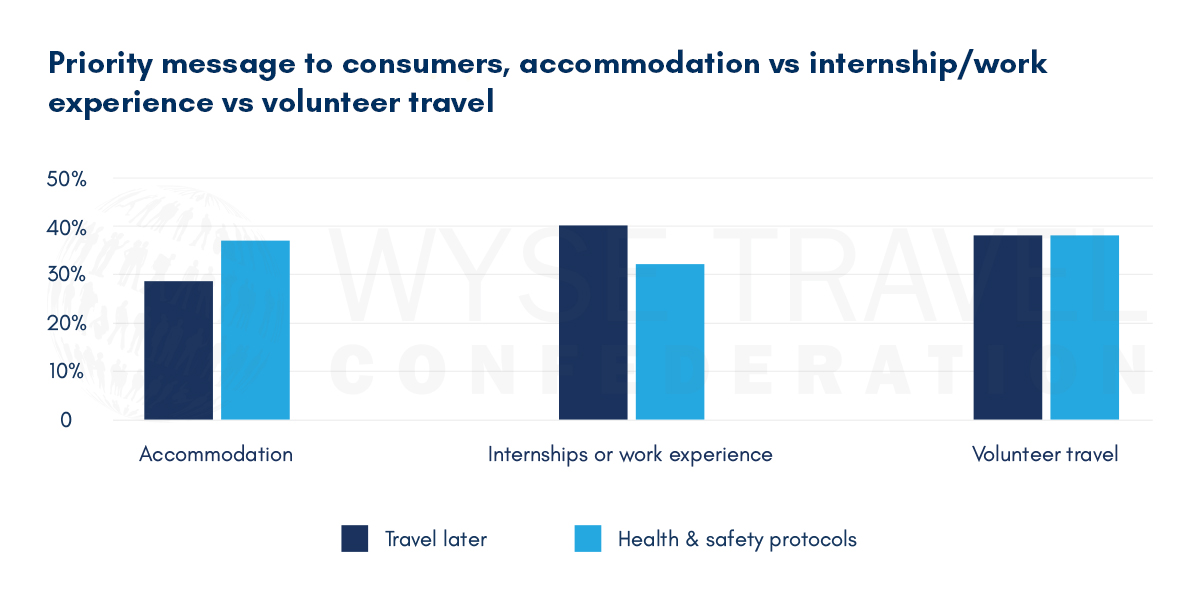

Messaging related to health and safety protocols was particularly prevalent in the accommodation and work experience sectors. Within the volunteer travel sector, the messages of ‘travel later’ and ‘health and safety protocols’ seem to be of equal importance at the moment.

For accommodation providers that have re-opened recently it’s not surprising health and safety protocols are the main message to consumers right now. However, it is interesting to note that for others across the industry, it is still more important to emphasise ‘travel later’ to consumers. This suggests a slight disconnect among potential partners within youth and student travel, however the message will likely start to shift as more borders are opened for international visitors and restrictions begin to ease.

WYSE Travel Confederation and the COVID-19 Travel Business Impact Survey

If your business would benefit from unique business insights on the youth travel market, industry representation for common business interests and new trading opportunities with international partners, we invite you to discover the resources of the global trade association for businesses serving young travellers, WYSE Travel Confederation.

Next survey in the series

WYSE Travel Confederation is repeating the COVD-19 Travel Business Impact Survey 3-13 July 2020. As with past travel business crises that we have monitored, it is important for the industry to come together and take its collective temperature. Given that youth aged 15 to 29 represent 23% of international arrivals, all travel businesses, regardless of their focus on youth-tailored travel products, are welcome to participate in the survey.

June 2020 Travel Business Impact Survey:

June a small turning point for the youth travel industry, but hopes are mostly set on 2021

May 2020 Travel Business Impact Survey:

Outlook worsens and financial aid is not the only investment governments should make to help travel and tourism

Increased focus on visa regulations and collaboration for youth travel to survive the COVID-19 crisis

Marketing youth travel in the shadow of global crisis

April 2020 Travel Business Impact Survey:

Q2 worse across the globe, but some source markets expecting better for the whole of 2020

Staff cuts, location closures and short survival periods

Satisfaction with COVID-19 cooperation, but placement availability concerns rise

March 2020 Travel Business Impact Survey:

Youth travel anticipating 30% decrease in business for 2020

Business outlook by youth travel sector

Looking back in order to see ahead

[1]Data for this report were collected between 5–15 June 2020 by WYSE Travel Confederation, the global association for youth, student and educational travel organisations, via web-based questionnaire in English. The survey was the fourth in a series titled COVID-19 Travel Business Impact Survey.

The fourth iteration of the survey attracted 373 responses from 82 countries. Three-hundred and forty-eight responses were retained for analysis. Respondents included organisations specialised in youth travel products as well as those representing mainstream travel products, members and non-members of the association. All respondents were asked about the impact that the COVID-19 (Coronavirus) pandemic has had on their business in travel. Questions related to change in demand, outlook for 2020, main concerns and actions taken in response to COVID-19 have been repeated across surveys. New questions related to marketing, messaging to consumers, and business participation at large-scale B2B events were added to the fourth iteration of the survey.

The profile of respondents to the fourth survey in June 2020 was similar to that of respondents of previous surveys. There were relatively fewer responses from language and educational travel providers and more responses from providers of accommodation and activities, tours & attractions. Youth travel specialists, defined as those organisations with over half their main business in the youth market, have consistently made up 60% or more of respondents over the course of the four monthly waves of the survey. The level of youth travel specialisation among respondents in June was similar to May, although slightly lower than in the first two months of the survey.

[2]The Exchange Visitor Program (EVP) of the United States provides opportunities for about 300,000 foreign visitors from 200 countries and territories each year to experience American society and culture and engage with US citizens. Eighty-five percent of EVP participants are age 30 or younger. The Exchange Visitor (J) non-immigrant visa category is for individuals approved to participate in work-and-study-based exchange visitor programmes. In 2018, the Summer Work Travel (SWT) Program, one of 15 EVP categories affected by the Proclamation signed on June 22, 2020, included just over 104,500 participants. [source: US Department of State]

[3]The US is the most popular work experience and travel destination for youth globally. Agents sending youth to the US to participate in SWT must work with government-designated Sponsors who are based in the US and responsible for participants during their stay. Agents and Sponsors sell a range of travel products and services to SWT participants, including flights, accommodation, activities, transportation, insurance, and preparatory courses. Youth travellers participating in such work experience programmes typically spend more in the destination than they earn during their stay, representing positive economic value to the destination. The main benefits of such programmes, as reported by participants, are improved language skills, more appreciation of other cultures and a desire to live abroad. [sources: WYSE Travel Confederation Summer Work Travel Survey, 2019 and New Horizons IV: Work Experience Travel, 2017]