Marketing has obviously been on the back burner for many travel and tourism businesses during the COVID-19 pandemic because travel has been widely restricted. The decision of businesses to de-prioritise or make significant cuts to marketing over the last three months has been picked up by WYSE Travel Confederation’s COVID-19 Travel Business Impact Survey. Such a decision during a period of crisis makes sense as a cash preservation strategy. This strategy was also seen during the global economic downturn of 2008-2010. Here we consider whether we can learn anything from the past about the point at which youth travel businesses should start investing in marketing amidst a crisis and what other actions make good business sense alongside marketing.

We take a look back at data collected by WYSE Travel Confederation on youth travel during the global financial crisis of 2008-2010 to review what we learned then and to consider what the trajectory of recovery could be for youth travel organisations as COVID-19 travel restrictions start to ease.

The growth of international tourism and youth travel International travel experienced ten consecutive years of growth following the global economic crisis of 2009, according to UNWTO. Up until 2020, international travel grew on average 5% per year in terms of number of arrivals and strong growth was also recorded in the youth travel segment, the global market of travellers aged 15 to 29. In 2015, UNWTO and WYSE Travel Confederation reviewed the youth travel segment as a proportion of the global travel marketplace and together concluded that the youth travel segment had grown from 20% to at least 23% of international arrivals.[1]

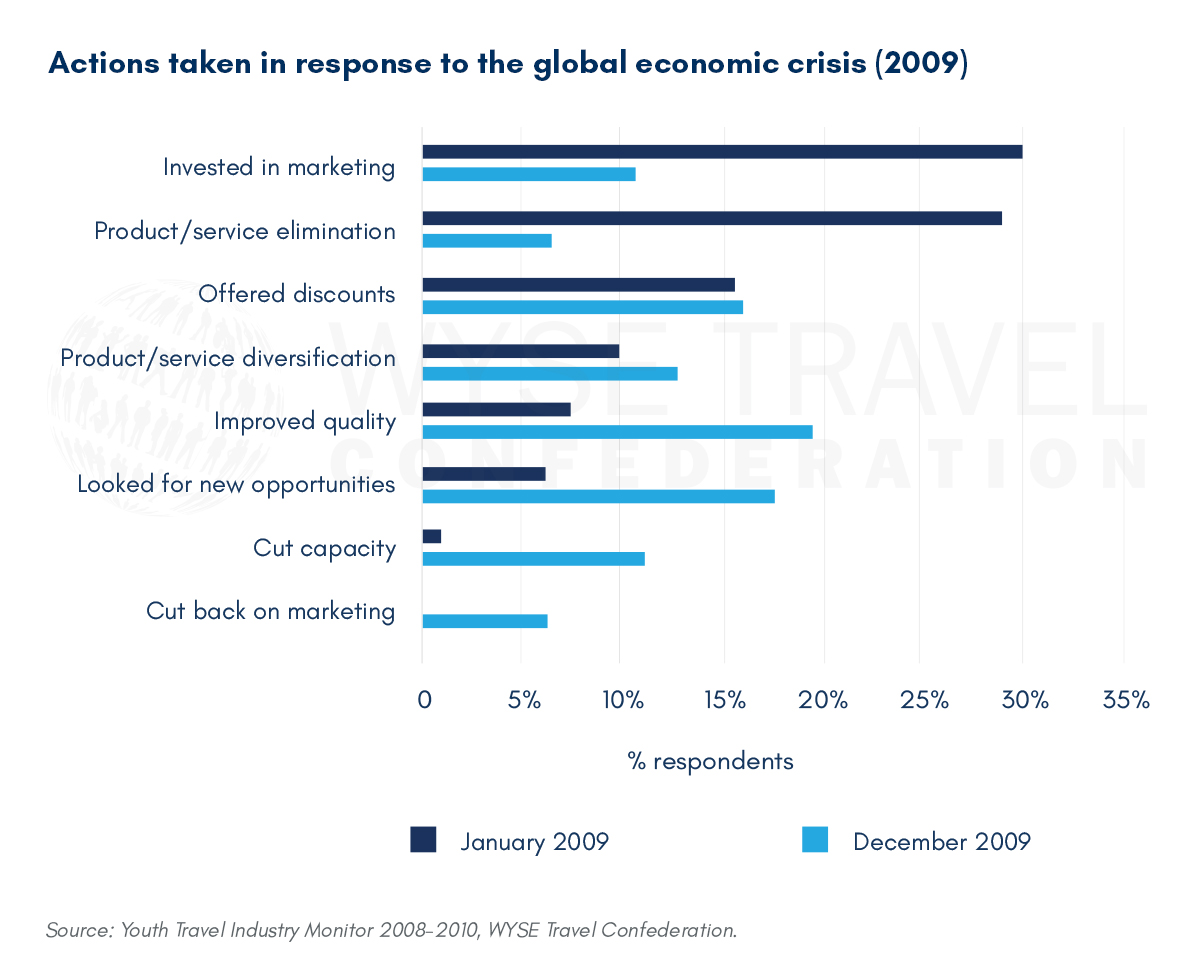

Marketing youth travel during a global economic crisis At the start of 2009 as the economic downturn set in globally, WYSE Travel Confederation’s Youth Travel Industry Monitor found that about 30% of youth travel businesses were still investing in marketing activities despite a streamlining of product (28%) taking place at the same time.[2] By the end of 2009, about 12% of youth travel businesses were investing in marketing but improving quality (18%) and finding new opportunities (17%) also entered the mix to build successful survival strategies to make it to the other side of the crisis.

During the 2008-2010 financial crisis, certain sectors of youth travel experienced greater drops in demand than others. However, overall, most of youth travel fared well over the duration of the financial crisis. For example, hostels and other forms of youth travel accommodation were hit hard early on, but over the course of the crisis hostel demand recovered more quickly than did demand for hotels, likely due to cost-conscious travellers. Work experience and internships suffered from a lack of placements and tightening of visa regulations, but by the end of 2009 this sector had experienced less than a 5% decrease in demand. Au pair, language travel programmes and insurance products all experienced growth in 2009. Over the course of 2009 costs rose by 3% on average for youth travel organisations.

The greatest negative influence on youth travel businesses during 2009 was considered to be consumer uncertainty. The perceived uncertainty of consumers may have led to increased marketing as 70% of organisations reported that they were planning to spend more on marketing in 2010. It could also have been that signs of general economic recovery were becoming clear and new investments in marketing made sense in order to take advantage of early growth in demand. These investments would reportedly be directed to website development and direct communications with consumers. At the time in 2009, online advertising and social media were certainly not the developed marketing and communication channels that they are today nor were they the main focus of marketing spend for youth travel businesses. Online Travel Agents (OTAs) and sites offering reviews and other user-generated content were also not as highly developed as marketing channels as they are today. There were clear indications in 2009 that digital media advertising had already surpassed print media advertising in importance for youth travel businesses and that it was also gaining ground on trade shows and industry events.

Partnerships, followed by marketing, were considered the biggest positive influences on youth travel business over the whole of 2009. This perhaps suggests why most youth travel organisations surveyed said they planned to attend trade shows and industry events and more than 50% of respondents indicated they would attend at least four such events in 2010. As mentioned earlier, by the end of 2009 youth travel businesses were utilising a mix of marketing (12%), new opportunities (17%), and quality improvement (18%) as a survival strategy. Improving quality was likely a pre-requisite for solid partnership development. New opportunities to bring product to market were likely identified through partnerships and participation in industry events.

Marketing youth travel in 2020 during COVID-19

It is understandable that marketing during the COVID-19 pandemic has taken on low importance to businesses because most consumers are simply not allowed to travel. In contrast to the global economic crisis in 2009, the lockdowns of the COVID-19 crisis of 2020 have offered ‘time to kill’, which seems to have pushed businesses to identify new partners and opportunities much earlier. Even so, the three-pronged partners-opportunities-marketing approach to survival might be similar for businesses as travel restrictions loosen in the coming months and companies begin to add marketing to their overall business development again.

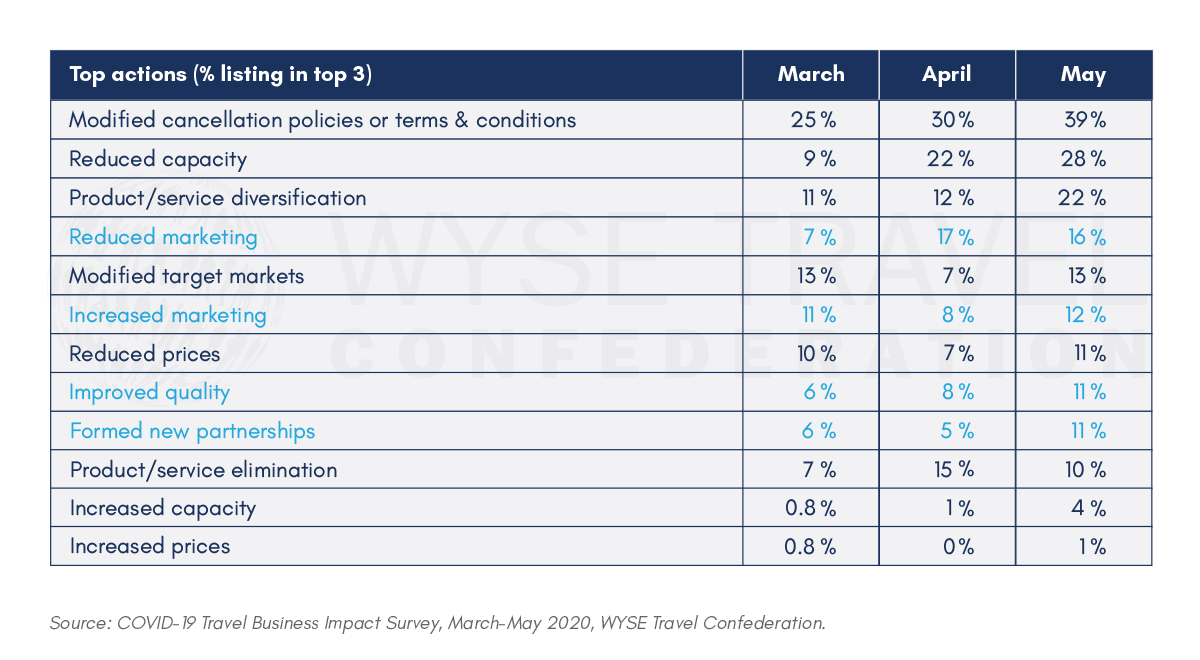

Since the start of the COVID-19 Travel Business Impact Survey in March, the most frequent action taken by travel companies has been to modify cancellation policies and terms & conditions. As of May there were more moves to cut capacity and diversify product offering. Very few respondents increased capacity or prices, but there are some signs that capacity is being added in anticipation of easing of travel restrictions. It also appears that the number of actions being taken overall is growing as the crisis deepens. More businesses are now forming new partnerships in attempts to weather the storm.

Economic uncertainty, travel restrictions, political uncertainty and employment topped the business concerns in May for both the short- and long-term. Short-term concerns about visa regulations rose notably in May. Marketing was the least important of short-term concerns for businesses in May.

What will be different for youth travel during COVID-19? For the short term, travel businesses perceive a consumer confidence problem that can be addressed through marketing. Many travel and tourism businesses are now developing messaging around health, safety and quality standards to communicate to consumers in order to re-build confidence in travel. Similar efforts to encourage booking with flexible change and cancellation policies have already been made by companies. Unlike in 2009, these efforts represent pre-requisite investments in marketing (time and cost) and the possibility for businesses to find new opportunities with partners. WYSE Travel Confederation’s COVID-19 Travel Business Impact Survey findings suggest that youth travel businesses have already acted quickly to identify new opportunities and partners that will complement their marketing initiatives once travel starts to resume.

However, COVID-19 is not a marketing problem. COVID-19 is a global health crisis. Not only has it triggered a global economic crisis, it is also becoming wrapped up in a crisis of civil rights as unrest increases in the USA and other countries around the world. The positive and negative effects of global and local mobility have been stark and painful during the pause caused by the pandemic. These effects have been environmental, health-related, social, cultural, economic and political and will likely continue to present challenges and opportunities for all travel and tourism businesses.

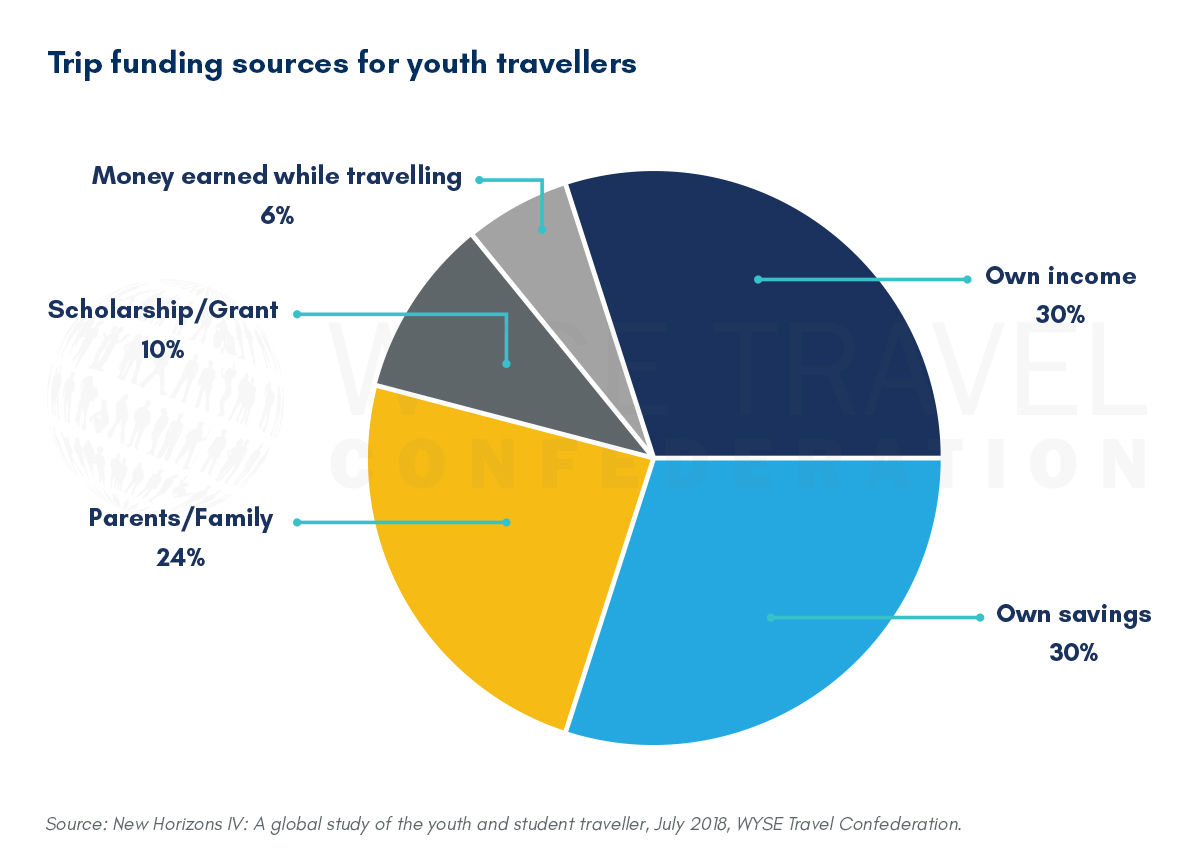

The economic crisis brought on by COVID-19 will have an impact on funds available to youth for the purpose of international travel and education. While there is no doubt there will be ‘pent up demand’ for exploration and discovery through travel, youth travel is funded by a mix of sources and those sources are at risk during an economic crisis.

On average, an international youth trip relies on parents/family to fund 24% of the total cost and the traveller her/himself generally covers 60% of the cost. The remaining 16% may come from sources such as scholarships, grants or money earned while travelling, such as through a working holiday or work & travel scheme. With entire industries at a stand-still and forced to lay off staff and unemployment at all-time highs, it is reasonable to expect that families will have less to contribute to leisure and educational travel for their children. With fewer jobs available, it is also reasonable to expect that young travellers will not have the same level of economic independence and therefore not be able to save as much of their own earned income for travel. Furthermore, opportunities that combine international cultural exchange and the possibility to earn a small amount of money while abroad may also become scarce as fewer placements for work experience, internships, or research become available within host companies and educational institutions. Visa regulations and funding for such programmes may also tighten.

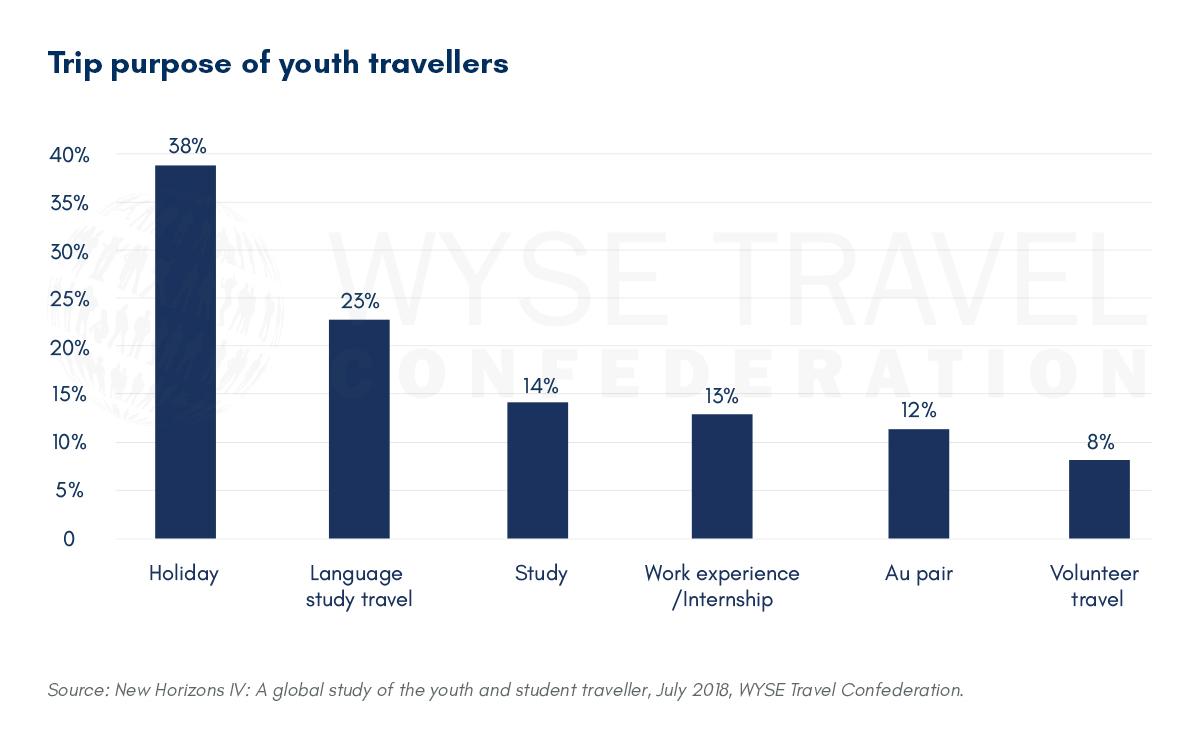

As the above scenario illustrates, youth travel is not just leisure travel.[3] Actually, less than 40% of international trips taken by travellers age 29 or younger are leisure trips. Most other international trips taken by youth are related to education and cultural exchange or a combination of the two with leisure. Lower levels of mobility for international educational travel and cultural exchange mean that destinations and their local economies will not benefit from the business generated by the secondary travel and tourism that long-stay youth travellers and the visiting family and friends of these travellers bring to host destinations. This will leave accommodation, hospitality, attractions, retail and many other services to rely on business from local and regional visitors.

Hostels and other types of youth travel accommodation that operate largely with shared, communal spaces face greater recovery challenges than hotels and other providers of private accommodation. As a result, hostels may be slower to recover than they did during the global financial crisis in 2009.

Online Travel Agents (OTAs) and Google will likely develop new services for suppliers and consumers in attempts to recover from mass cancellations brought on by COVID-19 and re-invigorate traveller confidence. These have so far come in the form of limited marketing credits and commission reductions for suppliers. However, Google is reportedly experimenting with a pay-per-stay product and a network of large travel brands have partnered with Booking.com and Trivago to form the COVID Travel Alliance to offer the COVID-19 Travel Database, “a free access database to support the travel industry through the reopening period, providing a single data source for travellers in a period of low travel confidence.”

Exhibitions, conferences and trade shows that connect international buyers and sellers of travel product have played an important role for the niche products and markets that form the youth travel industry. For the immediate future the events industry will be somewhat limited in its ability to offer the same experiences and opportunities for B2B trade as it did pre-COVID-19, which could affect the speed of recovery for some sectors. Trade associations and other industry networks have swiftly moved to adopt virtual events to fill the gap. However, with few possibilities for international arrivals while health risks continue to be managed within countries, trade opportunities will likely remain limited until global mobility resumes.

Youth travel recovery from the COVID-19 pandemic will be different from the economic downturn of 2008-2010 because the situation is much less predictable, and more adaptation is required. The physical restriction of mobility and the curtailing of leisure activities are radical ideas in advanced economies, the effects of which are still playing out. Once restrictions are lifted, travel and tourism businesses will hope for a fast rebound, but whether this is possible will depend on successfully managing public health risks and keeping the virus under control. This obviously requires large–scale collaboration, including from consumers, and is a question of social responsibility and not only personal preservation. More broadly, a rift may develop between travellers who would like to use their personal leisure time to simply have fun and travellers who will be more conscientious about the places they choose to visit and the purpose and impacts of their travel. The participation of youth in the large-scale public protests against police brutality and racism amidst a global public health crisis illustrates the risks that some young people are willing to take for the social good and their potential as a force for meaningful change as travellers.

WYSE Travel Confederation and the COVID-19 Travel Business Impact Survey

If your business would benefit from unique business insights on the youth travel market, industry representation for common business interests, and hopefully soon, new trading opportunities with international partners, we invite you to discover the resources of the global trade association for businesses serving young travellers, WYSE Travel Confederation.

Next survey in the series

WYSE Travel Confederation will repeat the COVD-19 Travel Business Impact Series 3-13 July 2020. As with past travel business crises that we have monitored, it is important for the industry to come together and take its collective temperature, so to speak. Given that youth aged 15 to 29 represent 23% of international arrivals, all travel businesses, regardless of their focus on youth-tailored travel products, are welcome to participate in the survey.

May 2020 Travel Business Impact Survey:

Outlook worsens and financial aid is not the only investment governments should make to help travel and tourism

Increased focus on visa regulations and collaboration for youth travel to survive the COVID-19 crisis

April 2020 Travel Business Impact Survey:

Q2 worse across the globe, but some source markets expecting better for the whole of 2020

Staff cuts, location closures and short survival periods

Satisfaction with COVID-19 cooperation, but placement availability concerns rise

March 2020 Travel Business Impact Survey:

Youth travel anticipating 30% decrease in business for 2020

Business outlook by youth travel sector

Looking back in order to see ahead

[2]WYSE Travel Confederation, the global trade association of youth, student and educational travel organisations, conducted the Youth Travel Industry Monitor from December 2008 to March 2010 in response to the then economic crisis. The survey periodically measured the impact of the economic crisis on international travel organisations serving the youth market, tracking the business response amidst conditions of financial crisis. The purpose of the Youth Travel Industry Monitor was to help members of WYSE Travel Confederation to better understand the impact of the crisis on international travel trade, make informed decisions and develop business survival strategies. The survey was launched in December 2008, conducted quarterly throughout 2009 and completed at the end of Q1 2010.