A slightly more optimistic view from travel and tourism companies operating in the youth market was detected in June after three months of increasingly negative outlooks. The fourth edition of the COVID-19 Travel Business Impact Survey conducted by WYSE Travel Confederation[1] revealed a small shift in business prospects for 2020, as well as a small improvement to the anticipated change in demand for the calendar year. Most businesses, however, do not see economic recovery beginning until 2021. This is supported by plans to participate in large-scale B2B events in person only as of 2021, suggesting that re-building the travel trade through these channels will rely on established networks and virtual events.

Demand and business prospects for 2020

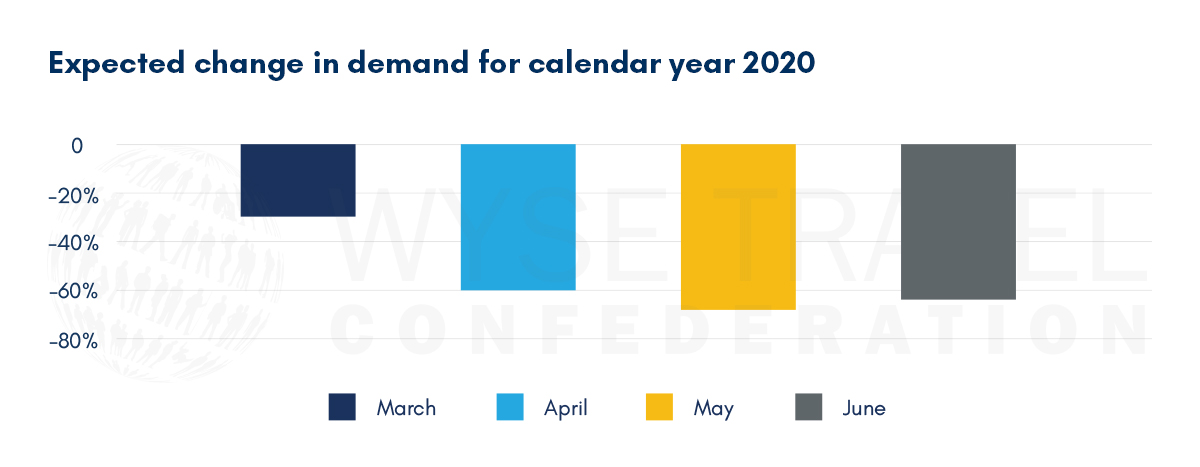

The average expected change in demand for the calendar year 2020 compared to 2019 was –62% in June. This is a slightly more optimistic view than in May when respondents were expecting a 70% drop in demand for the year.

With dates for some European countries to ‘re-open’ for the summer season, regional travel ‘bubbles’ and corridors being established and easing lockdown measures in some parts of the world, the quarterly outlook also improved slightly in June, with respondents expecting a 70% drop in demand for the second quarter of 2020 compared to the same period in 2019. In May, respondents had anticipated a 76% year-on-year drop in demand for 2020 vs 2019.

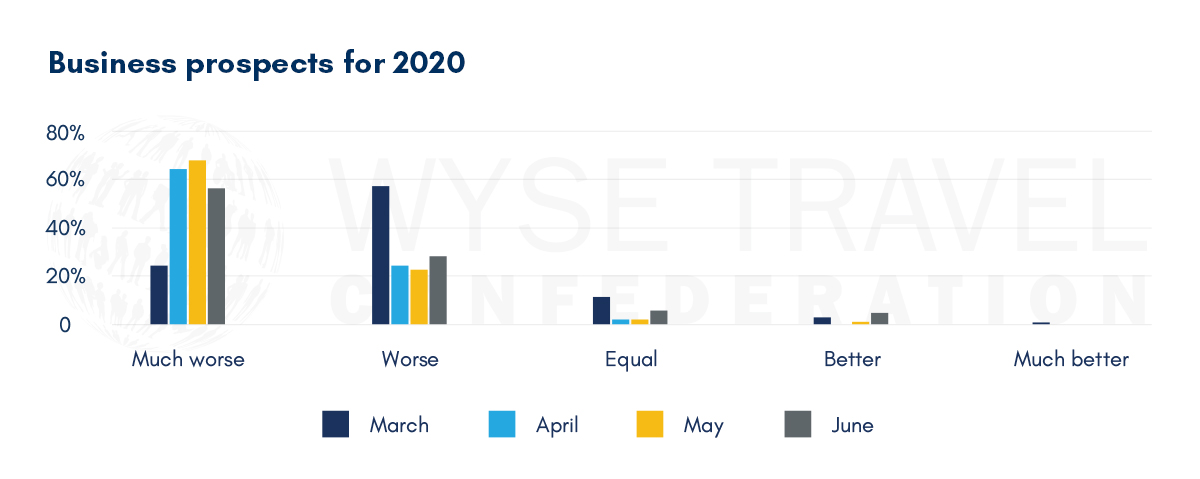

Overall business prospects were deemed to be slightly improved in June. The proportion of respondents expecting ‘much worse’ for their business in 2020 declined from 72% in May to 55% in June. Although there were hardly any indications that businesses anticipated ‘much better’ prospects, there were small increases in those seeing ‘better’ or ‘equal’ chances.

Recovery timeline

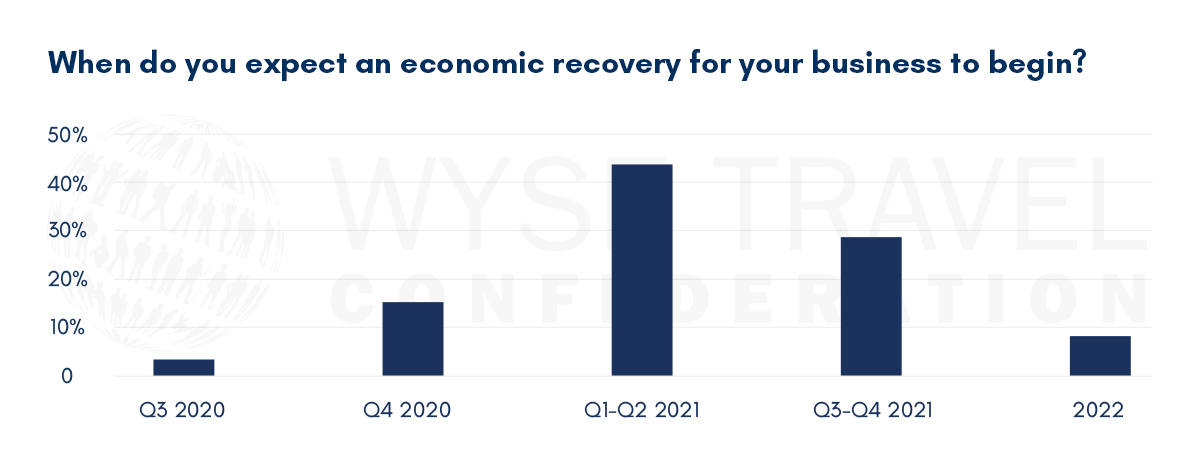

The changes in business outlook from month to month are slight. The medium-term outlook currently views the first half of 2021 as the turning point for recovery of travel and tourism businesses dealing in the youth market.

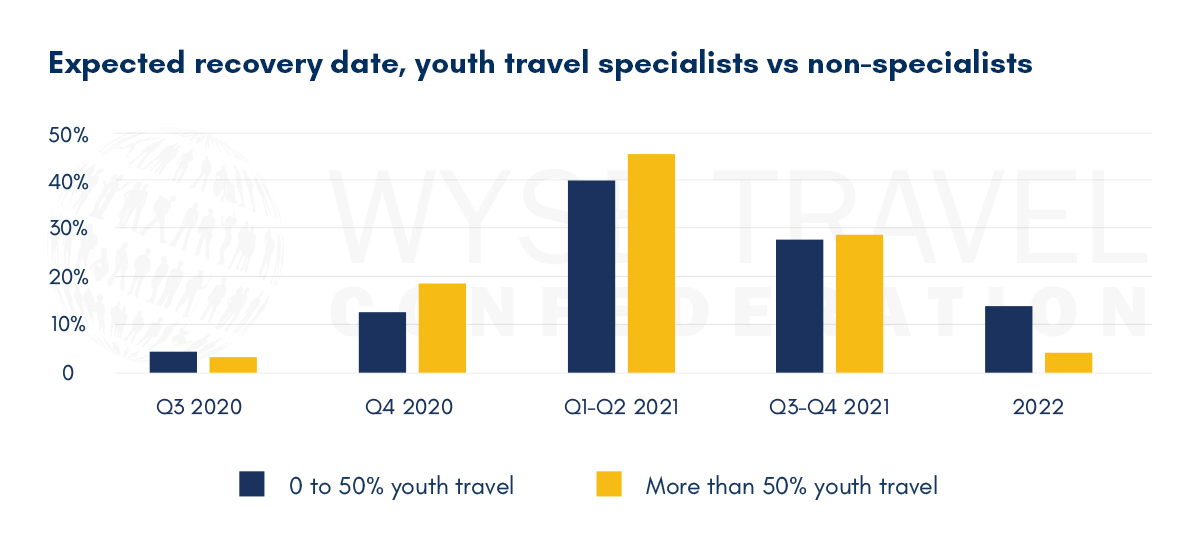

Youth travel specialists, defined as those organisations with over half their main business in the youth market, have consistently made up 60% or more of respondents over the course of the monthly COVID-19 Travel Business Impact Survey since March 2020. In June, youth travel specialists generally expected an earlier recovery date than non-specialists.

Business travel and B2B events

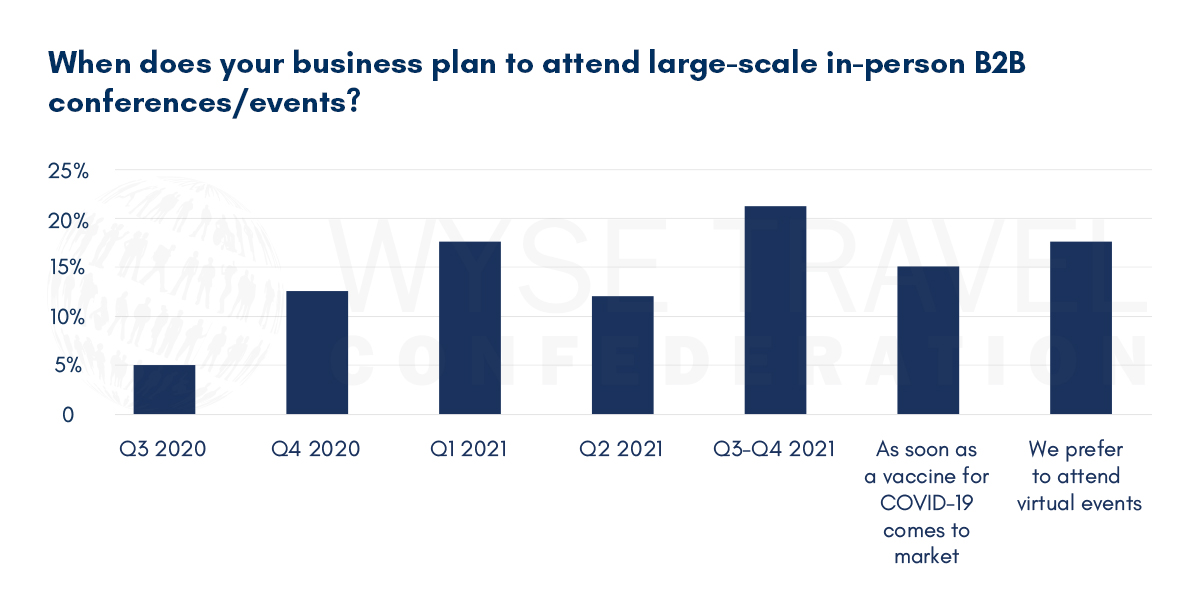

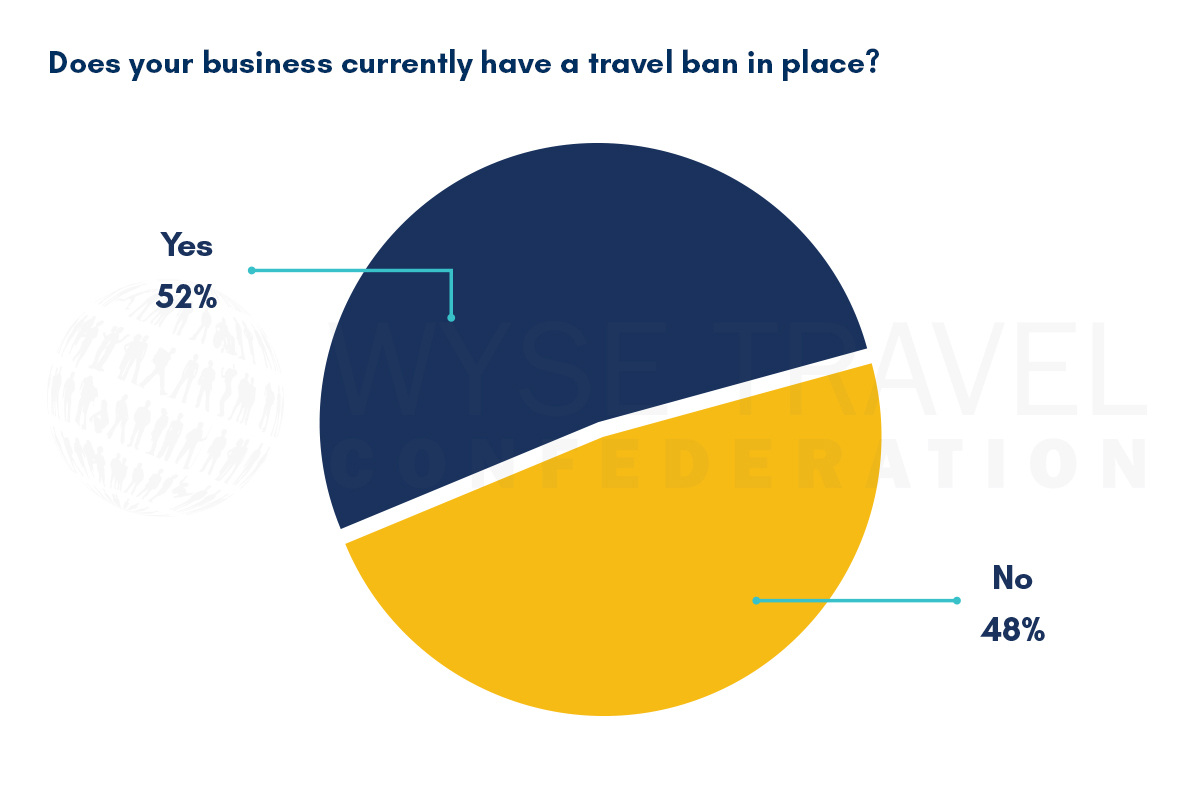

The timeline for economic recovery corroborates with plans to travel to large-scale B2B conferences and events being pushed back to 2021. Fifty-one percent of respondents indicated that they would not plan to attend such events until some point in 2021. This is not surprising given that 52% of respondents reported their business currently has a travel ban in place. Fifteen percent of respondents said they would travel to B2B events as soon as a vaccine comes to market and 18% prefer virtual events for their business. Accommodation providers were particularly likely to favour attending virtual events. The period at which organisations plan to start attending conferences and events was strongly related to their estimate of when recovery would begin for their business.

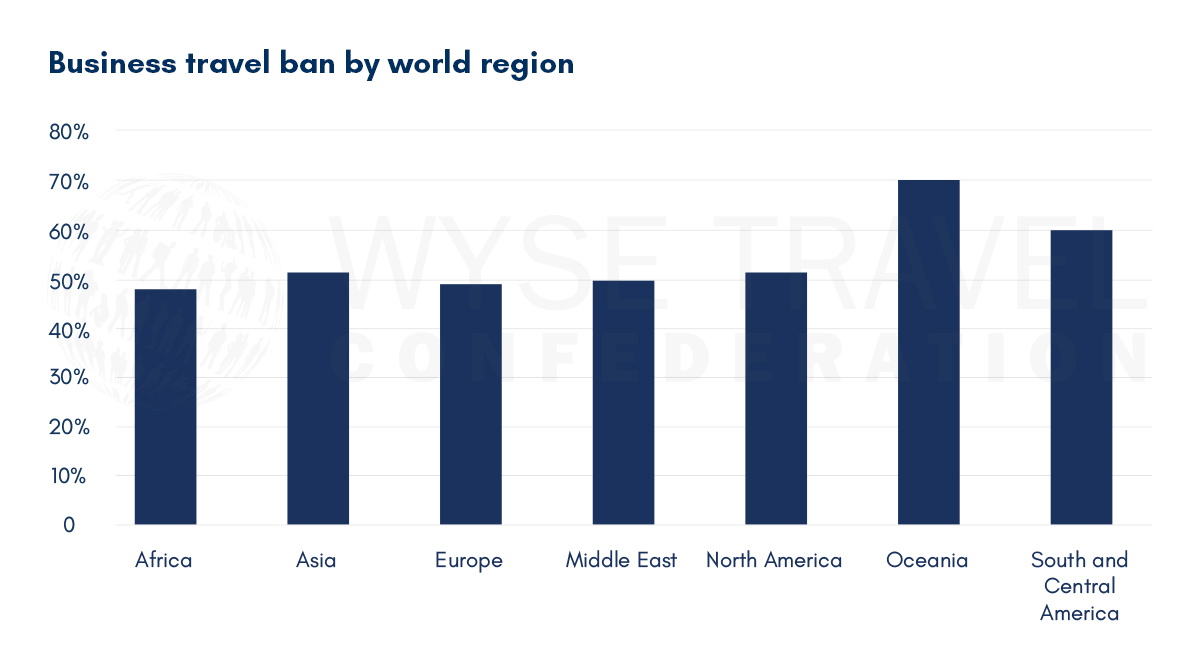

Corporate travel bans are currently fairly widespread by world region, although Oceania stands out as the region with highest proportion of bans on business travel at 70%.

WYSE Travel Confederation and the COVID-19 Travel Business Impact Survey

If your business would benefit from unique business insights on the youth travel market, industry representation for common business interests and new trading opportunities with international partners, we invite you to discover the resources of the global trade association for businesses serving young travellers, WYSE Travel Confederation.

Next survey in the series

WYSE Travel Confederation will repeat the COVD-19 Travel Business Impact Survey 3-13 July 2020. As with past travel business crises that we have monitored, it is important for the industry to come together and take its collective temperature. Given that youth aged 15 to 29 represent 23% of international arrivals, all travel businesses, regardless of their focus on youth-tailored travel products, are welcome to participate in the survey.

May 2020 Travel Business Impact Survey:

Outlook worsens and financial aid is not the only investment governments should make to help travel and tourism

Increased focus on visa regulations and collaboration for youth travel to survive the COVID-19 crisis

Marketing youth travel in the shadow of global crisis

April 2020 Travel Business Impact Survey:

Q2 worse across the globe, but some source markets expecting better for the whole of 2020

Staff cuts, location closures and short survival periods

Satisfaction with COVID-19 cooperation, but placement availability concerns rise

March 2020 Travel Business Impact Survey:

Youth travel anticipating 30% decrease in business for 2020

Business outlook by youth travel sector

Looking back in order to see ahead

[1]Data for this report were collected between 5–15 June 2020 by WYSE Travel Confederation, the global association for youth, student and educational travel organisations, via web-based questionnaire in English. The survey was the fourth in a series titled COVID-19 Travel Business Impact Survey.

The fourth iteration of the survey attracted 373 responses from 82 countries. Three-hundred and forty-eight responses were retained for analysis. Respondents included organisations specialised in youth travel products as well as those representing mainstream travel products, members and non-members of the association. All respondents were asked about the impact that the COVID-19 (Coronavirus) pandemic has had on their business in travel. Questions related to change in demand, outlook for 2020, main concerns and actions taken in response to COVID-19 have been repeated across surveys. New questions related to marketing, messaging to consumers, and business participation at large-scale B2B events were added to the fourth iteration of the survey.

The profile of respondents to the fourth survey in June 2020 was similar to that of respondents of previous surveys. There were relatively fewer responses from language and educational travel providers and more responses from providers of accommodation and activities, tours & attractions. Youth travel specialists, defined as those organisations with over half their main business in the youth market, have consistently made up 60% or more of respondents over the course of the four monthly waves of the survey. The level of youth travel specialisation among respondents in June was similar to May, although slightly lower than in the first two months of the survey.