News

Manchester, United Kingdom — 22-25 September 2009WYSE Archives

![]()

COVID-19 impacts on hostel performance

By Kelsey Fenerty, STR

COVID-19 has wreaked havoc upon the travel industry, and the hostel sector is no exception. Hostels enjoyed a relatively “normal” February, but with March came the WHO pandemic classification, the abrupt halt of travel, and in many markets lockdown orders that temporarily closed hostel doors.

Below we check in with STR’s four hostel markets – Amsterdam, Berlin, Edinburgh and London – to study the impacts of COVID-19 on hostels across the continent.

Occupancy plummets as social distancing gains traction

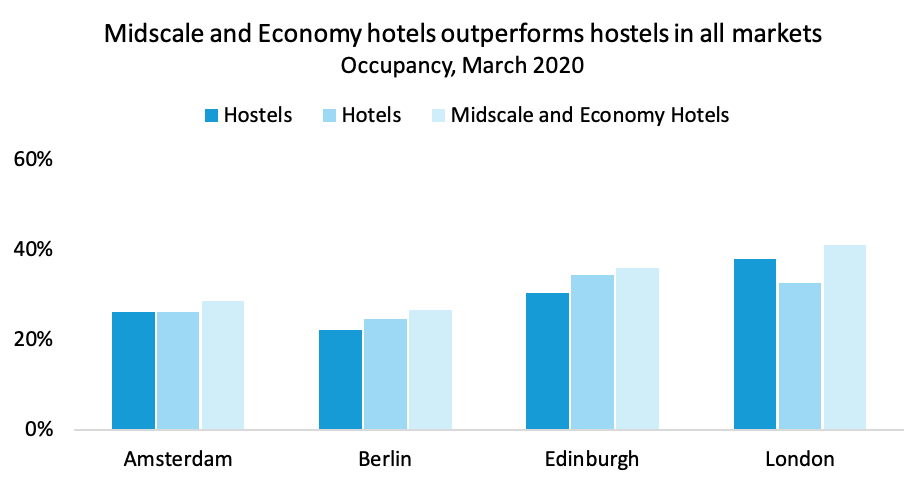

March hostel occupancy dipped below 40% in all four markets, a year-over-year decline of more than 50% in each. Compared to hotels, only Amsterdam and London hostels filled more spaces than did hotels. This is surprising, because Midscale and Economy class hotels – those properties with the lowest Average Daily Rates (ADRs) – have consistently outperformed all hotels globally, largely due to their affordability.

Although hostel rates are typically lower than Midscale and Economy class hotel rates, these lower-tier hotels outperformed hostels across all four markets. One possible explanation for this lies in the unique social environment offered by hostels, which left the sector vulnerable not just to COVID-19 but also to the measures necessary to prevent the virus’s spread.

Many hostels shut down common areas or reduced dormitory bed capacity, while others closed ahead of government mandates in order to protect staff and guests.

Cancellation fees, no-shows impact revenue

STR tracked five European conferences and events originally scheduled for February postponed or cancelled by COVID-19 concerns. For events slated for March, that number climbed to 76. Early in March, companies worldwide restricted or banned business travel and schools began to close, leading to a swift, sharp decline in group travel. Both factors contributed to a rise in cancellation fees and no-shows, which buoyed hostel revenue even as demand fell and led to an unlikely increase in Average Daily Rate (ADR).

For a clearer picture of true rate performance, hostel ADR is contrasted with hotel ADR, which does not include cancellation fees but does include no-show revenue. Hotel ADR declined in three of four markets, and apart from Edinburgh, Midscale and Economy class ADR outperformed all hotel ADR, again likely due to the relatively higher demand for these affordable properties.

Fortunately for future demand, many hostels are working directly with guests and groups to re-book their stays for a later date, and this could impact cancellation fee revenue moving forward.

Ancillary revenue still a boon for hostels

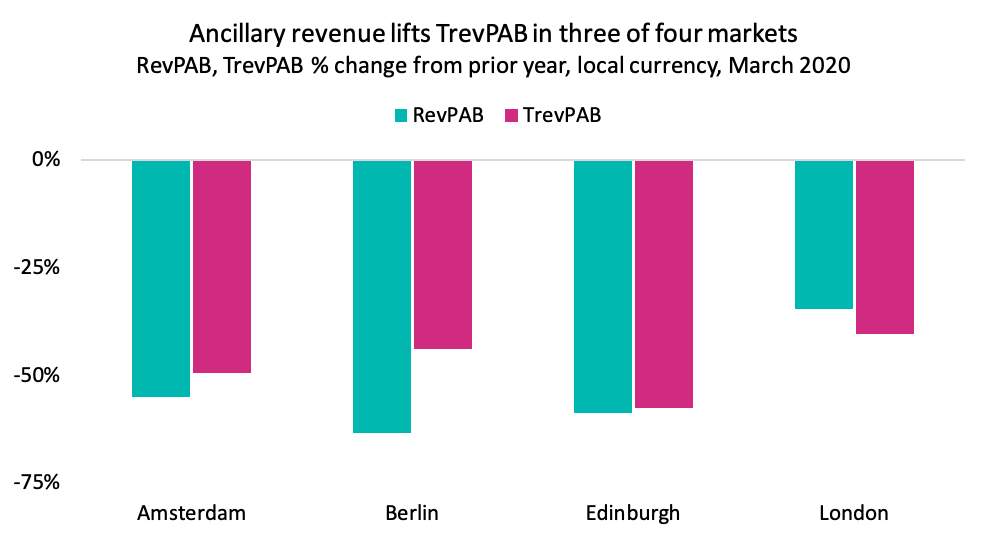

Hostel Revenue per Available Bed (RevPAB) and Total Revenue per Available Bed (TrevPAB) experienced unprecedented declines year-over-year. RevPAB in hardest-hit market Berlin was only €5.57 in March, a loss of 63.3% from 2019.

In all markets but London, other revenue declined less than beds revenue. This trend is consistent with pre-COVID performance, as other revenue often appears more resilient than bed revenue.

Looking to the future

Hotel occupancy in Amsterdam, Berlin and Edinburgh remained below 10% for the week ending April 20. London hotels maintained “good” occupancy at just under 20% for the same week. Even as occupancies are bottoming out, hotels are still closing.

STR doesn’t track hostel data on a weekly basis but has been watching hostel closures. The UK’s lockdown effectively closed Edinburgh and London hostels for the entirety of April. While the lockdown does not (yet) extend past May 7, many hostels are pre-emptively extending closures into summer.

The situation is slightly different in The Netherlands and Germany and while some hostels voluntarily closed, the sector was not required to shut down. As many European countries look to start easing lockdown measures over the coming weeks, STR will continue using data to understand the path out for all accommodation types.

Interested in more?

STR presented insights on the impact of COVID-19 on the European accommodation market in a recent WYSE webinar. If you are interested in viewing this webinar, please click here to request a recording.

STR has additional resources regarding hotel performance COVID-19. For more information regarding the STR and hostel performance, please contact Patrick Mayock.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for global hospitality sectors. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, and an international headquarters in London, England. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com

Join WYSE Travel Confederation

If you’d like to join WYSE Travel Confederation and benefit from new connections, free access to industry research, informative webinar sessions, discounts on industry events and brand exposure within the youth and student travel industry, click below to view our membership options and find out more.