News

Manchester, United Kingdom — 22-25 September 2009WYSE Archives

![]()

Student travel discount cards in the age of OTAs

“Don’t leave home without it” was once the tagline for American Express, offering, if not scaring, members to secure a safe alternative to cash prior to travelling: traveller’s cheques. The advice from American Express later became aspirational with the tagline “membership has its privileges”. Membership does usually come with privileges, which was the likely starting point in the 1950s for student unions to develop a special card for student travel discounts.

Originally developed by students for students, the International Student Identity Card (ISIC) is an affiliate programme that began in 1953 to facilitate mobility, cultural discovery and international exchange through more affordable travel opportunities for European students. The ISIC functioned as an internationally recognised proof of student status and at its core were discounted airfares, like the SATA ticket. Eventually offering more than travel-related discounts, today the ISIC is just one of several cards and many loyalty programmes offering special students discounts and preferential access to a wide range of lifestyle products and services.

Originally developed by students for students, the International Student Identity Card (ISIC) is an affiliate programme that began in 1953 to facilitate mobility, cultural discovery and international exchange through more affordable travel opportunities for European students. The ISIC functioned as an internationally recognised proof of student status and at its core were discounted airfares, like the SATA ticket. Eventually offering more than travel-related discounts, today the ISIC is just one of several cards and many loyalty programmes offering special students discounts and preferential access to a wide range of lifestyle products and services.In 2019, travel is relatively accessible and affordable, making it possible for people in general to travel more frequently and further- even on the conservative budgets that younger people have. Travel has become central to the lifestyle of many young people, including those able to combine travel with remote work or study for a ‘digital nomad’ lifestyle. It would seem as though a match had been made in heaven at the crossroads of international discount provider networks and the relative ease of global mobility for students, yet the picture seems to be quite the opposite.

Student discount cards have been followed by WYSE Travel Confederation’s global survey of youth travel, New Horizons, since 2002. A decline in importance of such discount cards became clear by 2012. How is it that discounts offered to students through such extensive and well entrenched networks are at an all-time low in terms of ownership and brand awareness?

The card made it possible: Yesterday’s indispensable student travel accessory

In 2002, the very first global survey of youth travel, New Horizons, asked young travellers about discounts they utilised for the last main international trip. At that time, nearly 60% of young travellers said they utilised some kind of student discount for their trip, namely for air travel. By 2007 that had gone down to 35% and by 2017 only 14% of young travellers reported that they had an ISIC card.

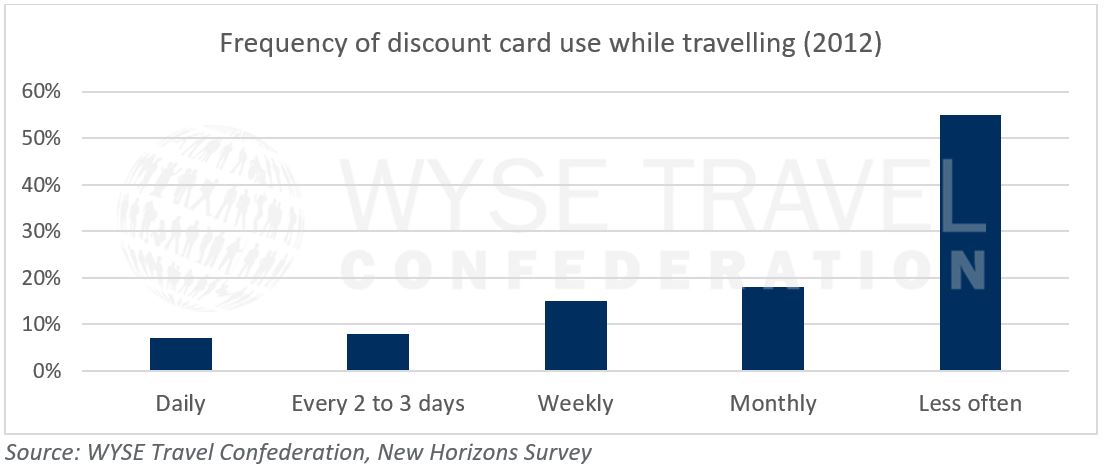

Despite a wider range of benefits beyond travel, a low frequency of use of suggests that discount cards were not of daily importance to travelling students by 2012 – slightly surprising given that some parts of the world were still emerging from the global financial crisis of 2008.

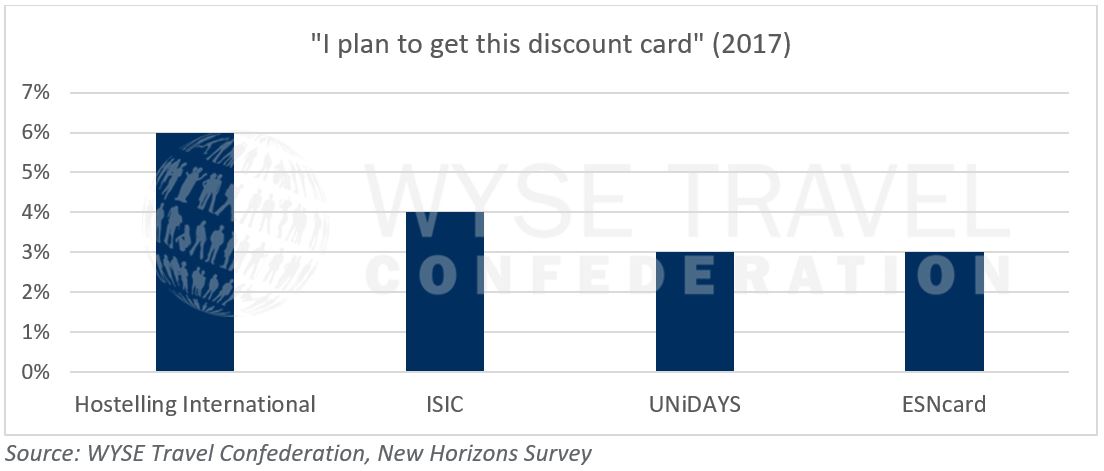

Fast forward to 2017 and the fourth edition of New Horizons, the global travel survey of the millennial and z generations, and the outlook is bleak with just 4% of our travel respondents saying they intend to buy an ISIC card.

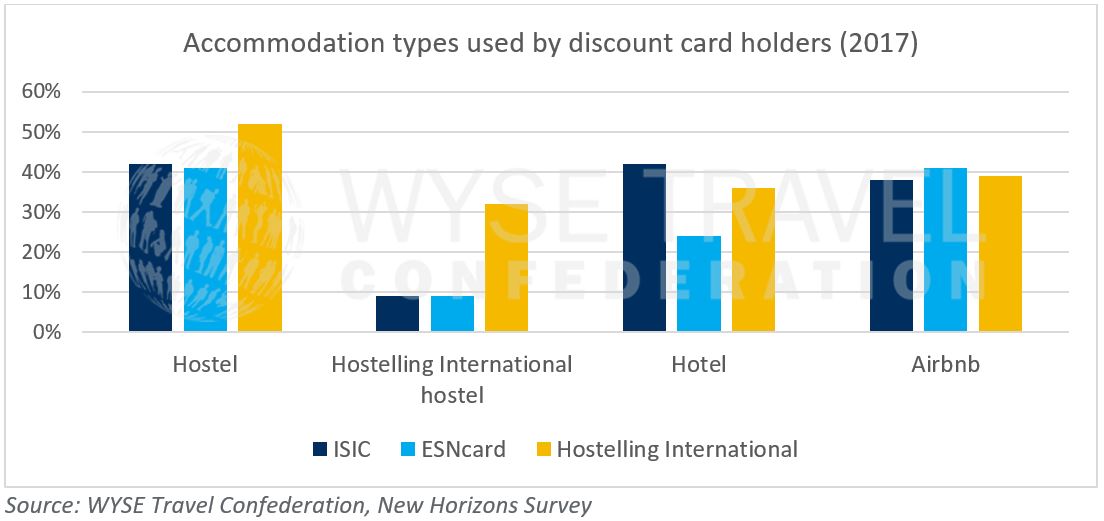

The slightly better-positioned Hostelling International card, intending to be purchased by 6% of young travellers in 2017, is somewhat logical given that hostels were the most popular type of travel accommodation used by discount card holders and travel accommodation has been one of the most sought-after types of discounts for students. Furthermore, self-identified backpackers (18%) and flashpackers (18%) are the two largest traveller types when it comes to discount card holders.

New Horizons data on travel splurging also suggest that young travellers prefer to splurge on unique experiences rather than traditional travel upgrades for accommodation or airfare.

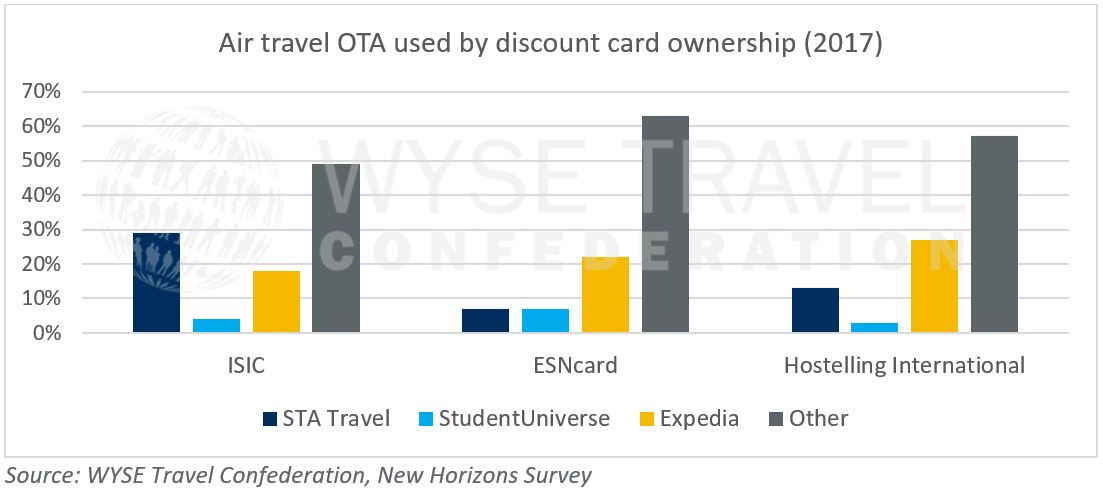

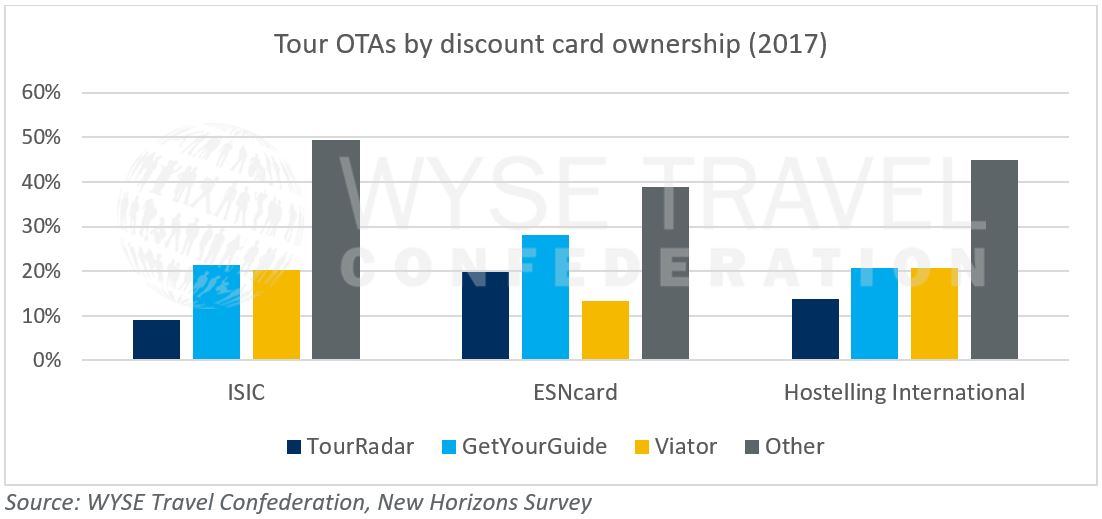

If the popularity of OTAs used to book flights is any indication, young travellers with discount cards are shopping around for flights, with nearly 60% of ESNcard holders having said they used an ‘other’ OTA than the options we provided.

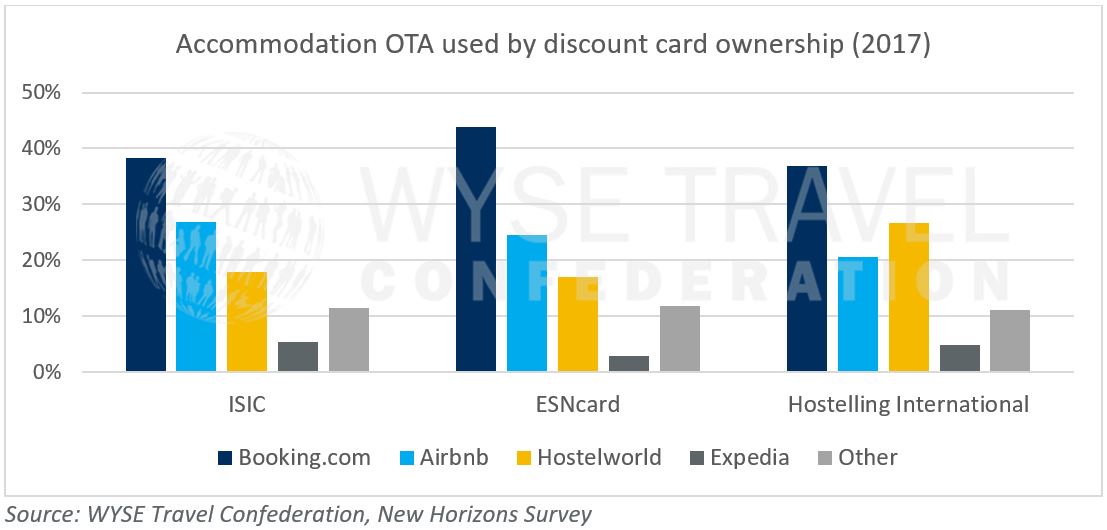

Interestingly, although Expedia seems to have the attention of some young travellers with discount cards when they are shopping around for flights, Expedia is losing this customer when it comes to booking travel accommodation.

Membership still has its privileges

Read more about trends and the future marketplace of youth and student travel in New Horizons IV: A global study of the youth and student traveller, a report that is one of the many privileges of membership with the largest global association of youth travel specialists, WYSE Travel Confederation.