Fortunately for the travel industry, the newly released publication, New Horizons IV: A global study of the youth and student traveller, offers a comprehensive, global perspective on the under-30 travel market and its evolution since 2002. The report is based on the New Horizons Survey, which is conducted by WYSE Travel Confederation every five years.

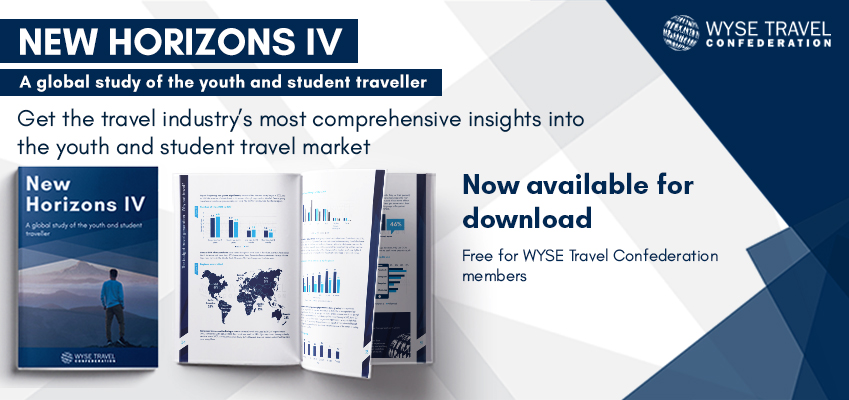

1. Travel splurging

When the New Horizons Survey asked millennial and gen Z travellers what they were willing to splurge on during their trips, they were clear on their preference for experiential purchases. Thirty-seven percent of respondents were willing to shell out extra cash for food and drink experiences. Traditional travel luxuries, such as airfare upgrades, were favoured least.

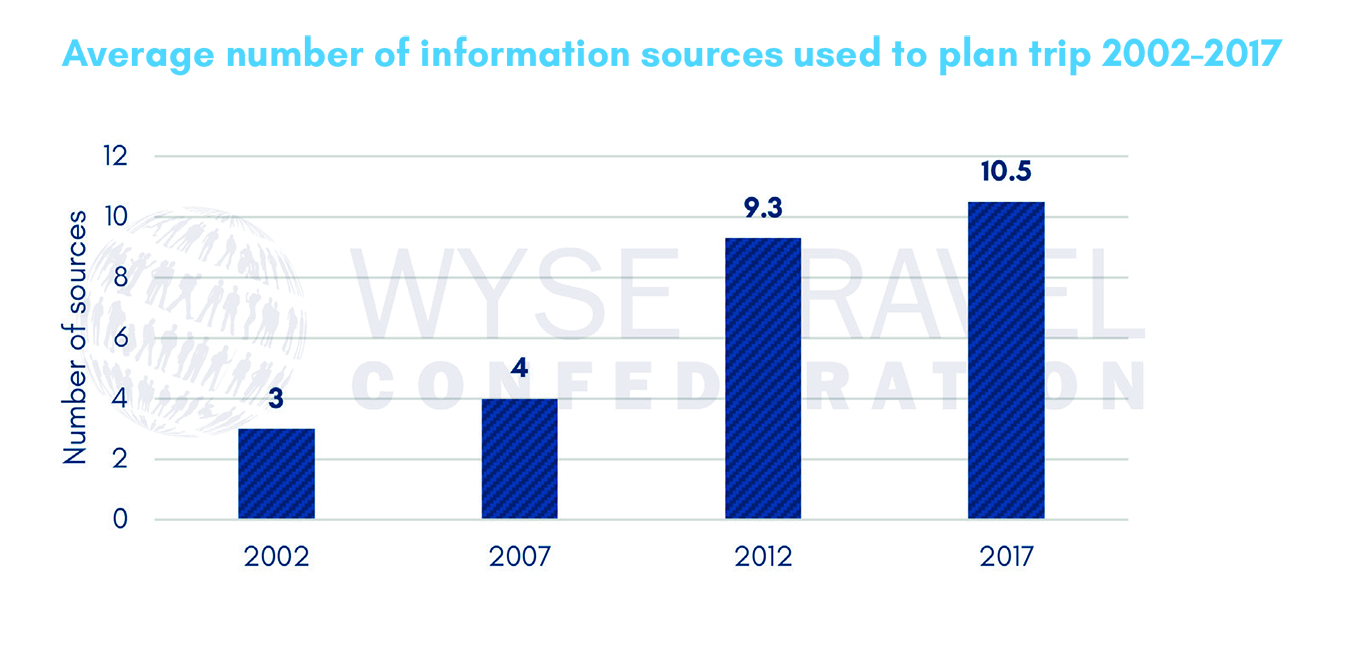

2. Growing information intensity and utilisation of Online Travel Agencies (OTAs)

The number of different information sources used to research the main trip has climbed steadily, from three in 2002 to over 10 in 2017. Friends and family were still the most used information sources in 2017, but the importance of social media and comparison or referral websites grew significantly from 2012.

Industry insight: New media and booking platforms will be crucial travel planning resources for the next generation of youth travellers, generation Z. These digital natives have grown up with smartphones and wifi and are significantly less likely to use tourist information offices and tour operator brochures. Nearly three-quarters of gen Z respondents made at least one booking via smartphone in 2017.

Although the top destinations remain largely the same as in 2012 and 2007, a few noteworthy shifts are revealed from the 2017 New Horizons Survey. While the USA remains the top destination for young travellers, it lost some of its share from 2012. Also, Australia came back into the top 10 for the first time in a decade.

Industry insight: Young people are still interested to visit the US, but are also deciding to explore other less-visited destinations. Given the slight decline in long trips of 120+ days and an increase in shorter trips, long-haul destinations will need to start rethinking how to attract young travellers undertaking longer stays for study, working holidays, au pairing, and other cultural exchanges.

The advantage of a global survey such as New Horizons is the ability to evaluate the current size of the still-emerging digital nomad population. In 2017, only 0.6% of millennial and gen Z travellers labelled their travel style as ‘digital nomad’ over more traditional labels such as ‘backpacker’ or ‘traveller’. However, 0.6% of all youth travel represents 1.8 million trips.

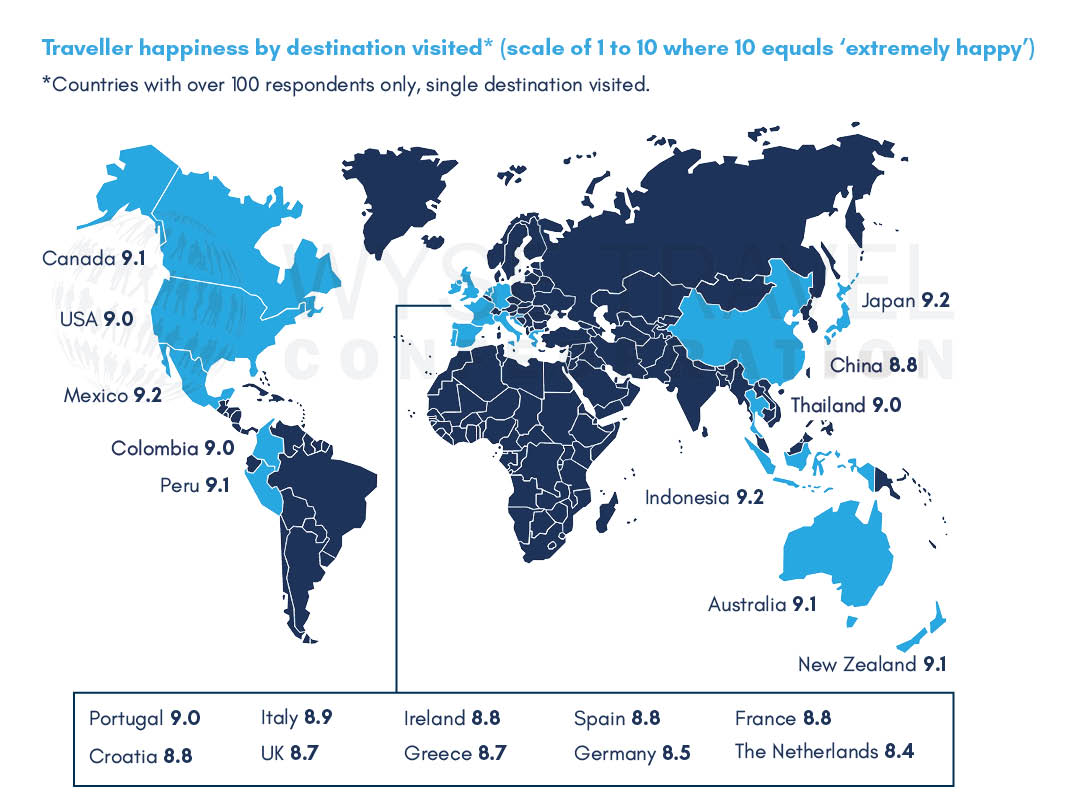

Millennial and gen Z travellers indicated three significant factors in their travel happiness: destination, trip length, and activities.

6. Generation Z is the future of youth travel

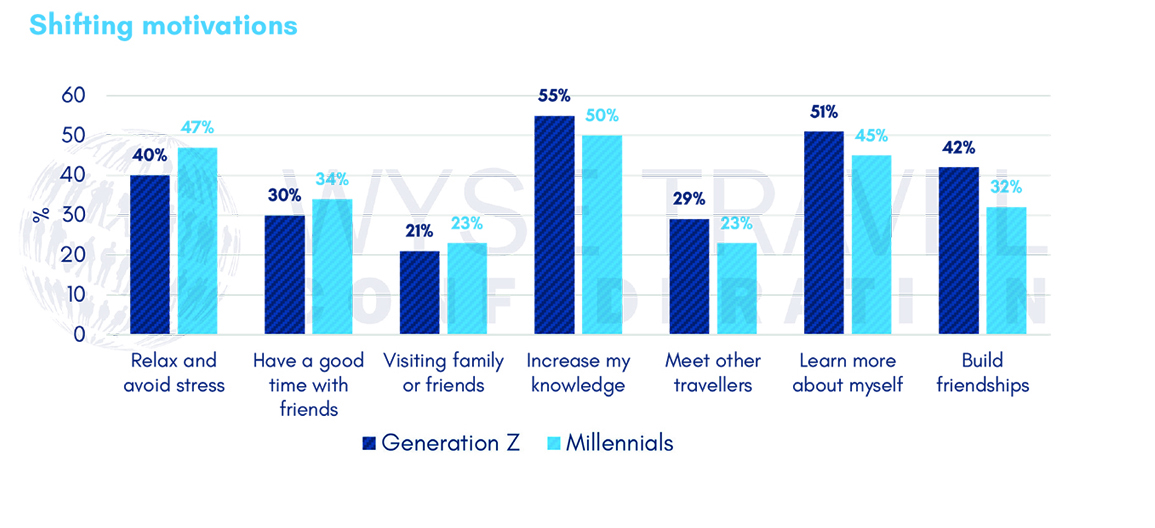

Gen Z is already on track to become the largest generation of consumers by the year 2020. These digital natives are bringing their own flavour to the youth travel market. For example, generation Z is just as likely as generation Y to make online bookings. However, they use OTAs and third-party websites less. Gen Z travellers are also more social than millennials and more likely to want to connect with locals.

Industry insights: Gen Z already seem to be more activity-focussed than millennials. The use of social media for information searching and booking is also likely to increase and morph as new channels emerge.

WYSE Travel Confederation research reports are free for members. To learn how to become a member and receive your free download and other benefits, contact us.