KEY POINTS

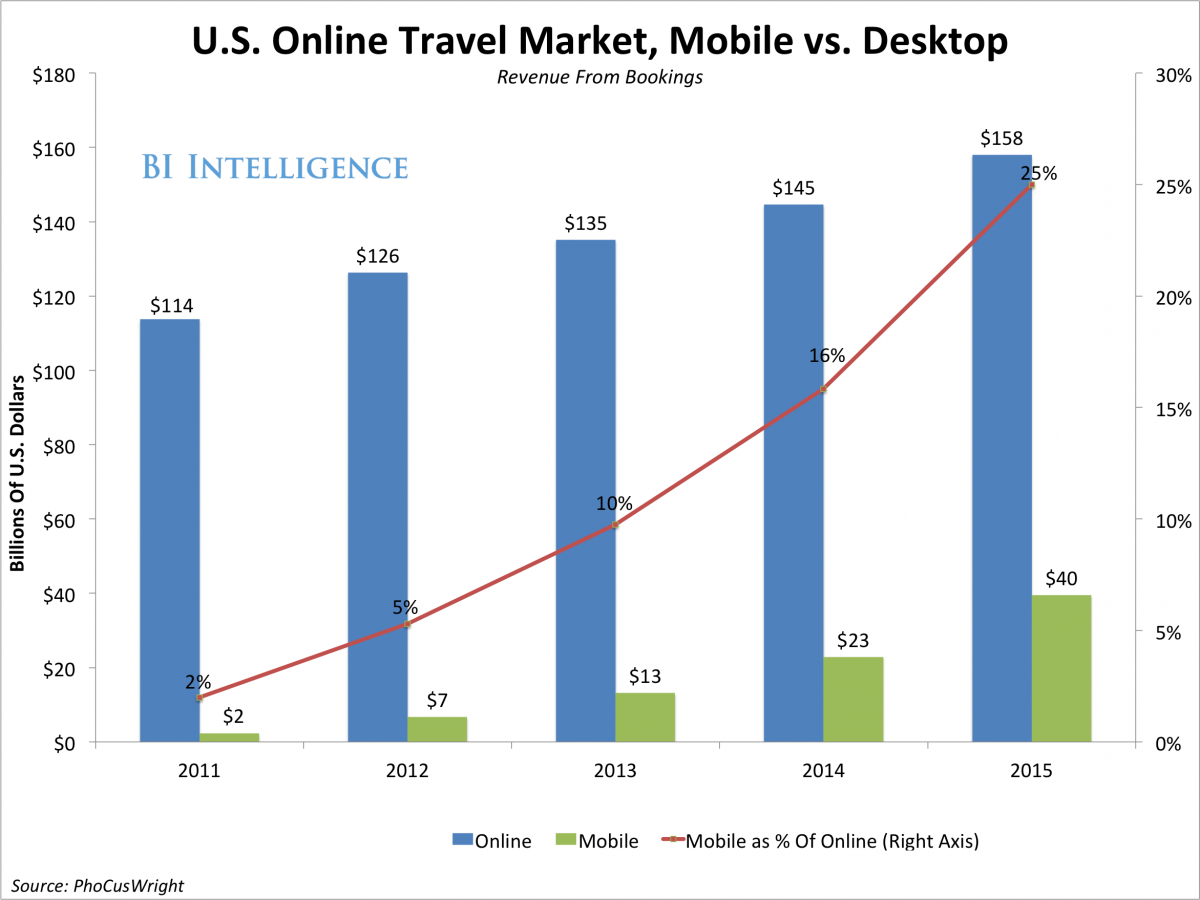

- Mobile devices are ideal companions for travellers, allowing them to access information, services and booking while en route. PhoCusWright estimates that by 2015, mobile will account for one-quarter of U.S. online travel sales, driving $US40 billion in revenue. In Europe mobile will account for one-fifth of bookings by 2015.

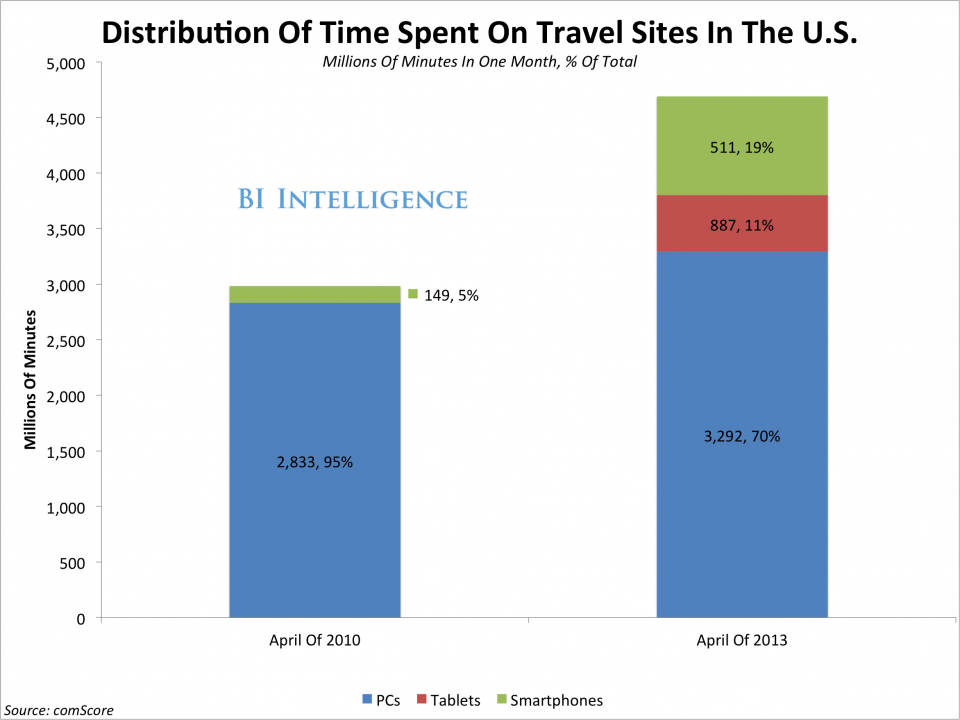

- Tablets are emerging as a power device for completing travel purchases. Tablets accounted for 7% of all online travel bookings globally in the third quarter of 2013, and 11% of all time-spend on travel sites in April 2013.

- Airlines, hotel chains, and online travel agencies like Expedia and Orbitz — as well as information providers like Yelp or TripAdvisor — need to stay ahead of the mobile computing curve. These are some of the hottest trends relevant to travel apps: cross-device services and marketing, algorithm-driven personalised local search results, innovative photo features, and the integration of travel information and data into augmented reality apps and wearables.

- Airbnb and other mobile-centric services provide bookings and travel information and recommendations. We look at Airbnb’s mobile-related strategies, including insta-booking and streamlined mobile payments.

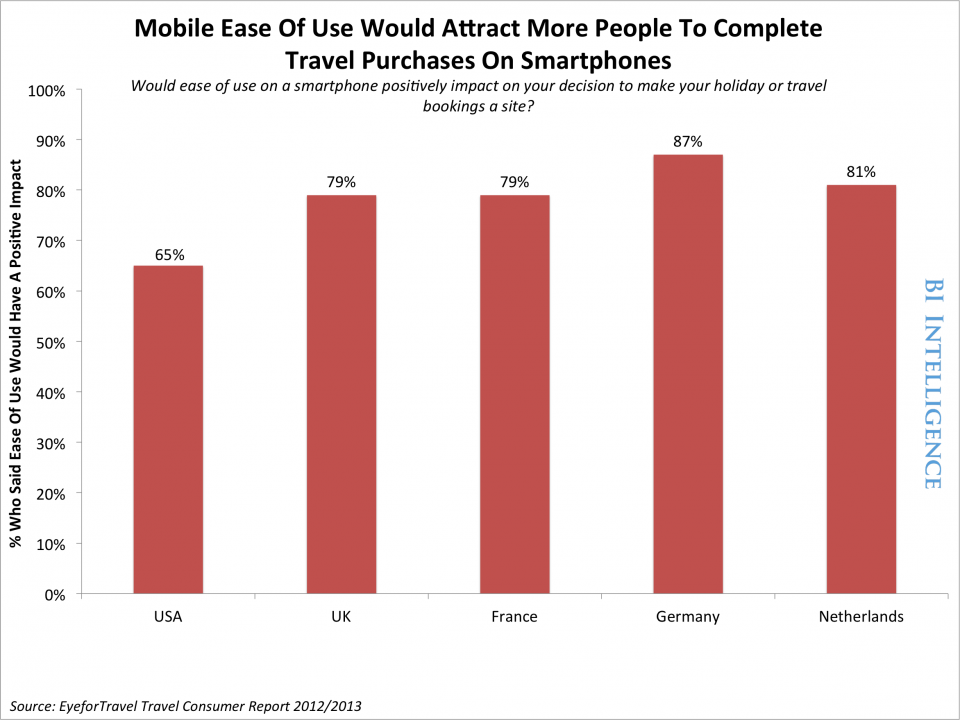

- But there are barriers to overcome before mobile can become a key channel for travel-related research and purchases (surveys show that on a global level relatively few travellers are using mobile to book travel): bad user experience design, friction that keeps users from completing transactions on mobile, and lack of Wi-Fi and 4G coverage.

- Wearables and the car dashboard represent the platforms where mobile travel will thrive next. Expect to see new travel-related apps and features for wearables debuting regularly. TripAdvisor has already begun working with in-car navigation systems.

INTRODUCTION

Travel is one of the world’s largest industries, and it continues to get bigger and bigger. Passenger miles have steadily risen, while the cost of providing these services, in real dollars, has declined significantly. Emerging economies around the world are seeing thriving middle classes take to the skies for the first time. The Federal Aviation Administration projects that U.S. passenger miles could more than double by 2032.

The Internet had a huge impact on the travel industry early on, as consumers swarmed to online travel agencies to find the best prices on flights and hotels, and took to online travel guides to plan their trips in advance.

In 2012, online U.S. travel sales surpassed $US100 billion, according to comScore. Air travel accounted for two-thirds of that spending.

Mobile is the latest sales channel upending travel, not least because travel pairs so well with mobile devices, allowing travellers to continue and amend their trip-planning once they’ve taken off.

Although the broader travel industry will grow at only a modest rate, mobile growth will significantly outpace both total and online growth to account for more than 25% of total U.S. online travel bookings by 2015, according to PhocusWright.

That translates to $US40 billion in travel-related commerce on mobile.

Thanks to rapid, worldwide adoption of smartphones, tablets, and other devices, the way we travel is changing dramatically — before, during, and after the trip.

So, it’s no surprise that players in the travel industry are emphasising mobile as a core component of their business strategies, and working to make their products and services mobile-friendly.

In this report, we look at how some of the latest entrants in the online travel space are transitioning to mobile, and what mobile-centric features are particularly well-suited to travel. We also underscore some of the pain points that are keeping mobile sales from catching up with mobile travel traffic. Then we take a look at what services could be next for mobile travel.

(This report updates our popular January 2013 report on mobile travel, “The Mobile Tourist: Smartphones Shake Up The Travel Market.”)

Mobile’s Piece Of The Travel Market

It’s difficult to size the global travel industry, because it is so far reaching. As we stated in our report last year, some figures peg the total direct and indirect economic impact of travel at north of $US6 trillion. Does this figure capture the value of the bus ticket I bought on a recent vacation from a street agent in a remote part of Vietnam?

It’s tough to know for certain.

But we can certainly deduce from the mountain of market research estimates that billions of dollars are at stake when it comes to mobile travel services and sales.

- In the U.S. alone, travel research firm PhoCusWright estimates the total travel market, including offline and online, stood at about $300 billion in 2012, with modest growth of about 5% annually expected in the next two years. The research firm sees growth for the online travel market of about 7% annually, which would slightly outpace growth in the broader travel market.

- Unsurprisingly, mobile stands as the major growth engine. In 2011, mobile travel bookings in the U.S. accounted for a little over $US2 billion, or 2% of all online bookings. Fast-forward two years, and that number has moved into the neighbourhood of $US13 billion, with that number expected to increase to nearly $US40 billion — or more than a quarter of online bookings — by 2015.

- In Europe, PhoCusWright projects that by 2015 mobile bookings will comprise 20% of online bookings, slightly behind the U.S. Last year, travel spending was believed to have reached a record $US343.5 billion (251.4 billion euros), after finally surpassing pre-recession spending levels in 2012. This record spending suggests that despite recent economic turmoil in many European countries the region may have turned a corner in terms of travel spend.

- Looking globally, online bookings reached $US54 billion in the third quarter of 2013, according to Adobe, representing a 10.7% increase over the same quarter in 2012. And the growth in mobile has been more impressive. Tablets alone have grown to account for more than 7% of total online booking revenues globally, nearly doubling their share in a year’s time.

Without a doubt, in the U.S. and abroad, mobile is commanding an increasingly large share of the online travel pie. And its impact goes beyond simply sales, as mobile drives an increasing share of overall online travel traffic, which is important to ad-driven travel businesses such as online travel guides and recommendation services.

How Mobile Is Impacting Travel

The travel market is comprised of two main categories:

- Suppliers: airlines, tour operators, rental car companies, hotels, and travel agencies, including online travel agencies (OTAs) like Priceline and Expedia.

- Information providers, such as TripAdvisor. Information providers are different from suppliers in that they often rely on advertising or subscription revenue rather than sales for their business models. They need to keep people engaged on their websites in order to make money. They should be encouraged by recent comScore data that shows that 30% of all time spent on travel-related websites in the U.S. is spent on phones and tablets.

- Some companies, like Airbnb, have tried to bridge the two categories and offer travel guide-type services as well as bookings.

Only a few decades ago, consumers most often booked either directly with suppliers or through bricks-and-mortar travel agencies. Then the Internet gave rise to the OTAs that have by now become household names — Orbitz, Expedia, Priceline, etc. But while these businesses were born on the desktop Internet, their mobile presence has become increasingly important to their revenue picture. In other industries such as retail, businesses that ignored mobile have lost their relevance to consumers. Online travel businesses face the same risk.

that have by now become household names — Orbitz, Expedia, Priceline, etc. But while these businesses were born on the desktop Internet, their mobile presence has become increasingly important to their revenue picture. In other industries such as retail, businesses that ignored mobile have lost their relevance to consumers. Online travel businesses face the same risk.

Google predicted that U.S.-based searches for hotel rooms on mobile would rise 68% in 2013, even as desktop searches declined. Searches on tablets, meanwhile, were expected to rise by 180%. Tablets appear to be particularly important to the search piece of the online travel industry. This squares with travellers being higher-income consumers more likely to own tablets, as well as tablets’ larger screens being more friendly to the intensive search sessions typical of online travel research.

“Mobile is an absolutely critical piece of our strategy. Long term, it’s the center of everything we’re doing,” says Joost Schreve, TripAdvisor’s vice president of mobile, in an exclusive interview with BI Intelligence.

But no matter how much suppliers and OTAs invest in mobile, a new sales channel always means plenty of market share comes up for grabs, and that provides a window of opportunity to some of the newest players in the travel space. Some of them, like HotelTonight, are mobile-only. Others, like Airbnb, straddle the mobile and desktop channels but were born in the mobile age, meaning mobile has always been integrated into their services.

Case Study: Airbnb

Airbnb, one of the big-name startups that have helped coin the idea of the “sharing economy,” pairs people who have rooms, apartments, and houses to rent, with travellers looking for a room at a discount to traditional hotel pricing and a more immersive experience in a new locale. The company, founded a year after the release of the first iPhone, is unusual among online travel businesses in that it has gone after all aspects of the travel industry, rather than remaining siloed as either only a supplier or an information and reviews forum.

Airbnb is a supplier in the sense that it provides rooms to customers. It is also a booking agent, earning a fee off of each of those transactions.

But it is also an information services company with neighbourhood guides that are content-rich. By encouraging users to vet travellers and hosts based on previous reviews, the company has cultivated an active community with a social dimension, and created an incentive for those who use Airbnb to keep giving feedback. In addition, its community guides encourage locals to share their tips and knowledge with Airbnb users.

The information sharing helps the Airbnb brand, further humanising the startup as something other than a bloodless booking and deals forum.

And mobile has been no small part of cultivating that community engagement — not to mention utility.

More than a year ago, the company revealed over a quarter of its traffic was mobile. That’s more than double the 12% it was at about a year earlier. Said co-founder Joe Gebbia in an interview with StrategyEye Digital Media: “The majority of our traffic will come through mobile. Definitely.”

Mobile isn’t just about offering the same services in the form of an app or a mobile website.

Here are some of the ways Airbnb is leveraging mobile:

- Near-Instant Communication: Both the desktop and mobile interface enable regular communications between guest and hosts, but the company claims that response times are three times faster via the mobile app. Outside of the app, users can also elect to receive messages and communicate via SMS. The goal is to expedite communication. This is important in helping guests and hosts coordinate meeting times, key exchanges, changed plans, etc.

- Low-Friction Payments: Airbnb partnered with payments company Braintree (now owned by PayPal) to enable customers to pay easily after filling in their payment details once. The intent here is to make the transaction process and authorization as painless as possible, whether on desktop or in the app.

- Continuous Improvements: Airbnb released a redesigned app in November 2013 that improved the experience for both host and guest. While the previous build was sufficiently capable, the new one provides prospective guests with larger photos to improve the discovery process, and gives hosts every tool they need to take a reservation on mobile. In this version, the mobile experience is meant to be every bit as good as the desktop counterpart.

While no single one of these mobile efforts is a game changer, they build on and reinforce each other to cultivate a rich mobile experience. They also help Airbnb maintain its credentials as a well-designed and tech-savvy service as its scales up.

CEO Brian Chesky told The Atlantic, “We’re really focused on mobile. Mobile, mobile, mobile.”

Removing friction is Airbnb’s most important principle, he added. In the interview, the CEO also touted the insta-book feature, which allows guests to instantly make a reservation without waiting for it to be approved by the host, as if it were a hotel (once a user reserves a room, that’s it — it’s held for them). At the time of the interview, in August 2013, around 2% of Airbnb properties had insta-book: “One thing that we’re doing is trying to shift every host to mobile. We’ll eventually get to a place where every booking is insta-book. The single most important thing we can do is to get every host on mobile.” Insta-book will be particularly well-suited to mobile because on-the-go travellers often need immediate confirmation.

Mobile-Only And Mobile-Centric Travel Features

Looking beyond travel-specific companies, there are a variety of online travel services and activities that are especially disposed to mobile usage.

These are important for travel companies to keep in mind as they move on to mobile and develop robust features meant to encourage usage.

- The Importance Of Cutting-Edge Location Technology: Location is the first mobile-centric feature that leaps to mind when you think about what a portable Internet-connected device can do. And for the travel industry, that’s even more true. comScore released data this past summer indicating that 82% of all mapping activity in the U.S. occurs on a tablet or smartphone. But location-based services or LBS, such as local in-app search, are changing. They’re becoming more personalised and algorithm-driven. Mobile travel companies should definitely try to stay ahead of the curve when it comes to LBS.

For example, TripAdvisor employs a multi-dimensional algorithm when users are in the mobile app’s “Near me now” mode, according to Schreve. When they’re on mobile, users tend to be much more sensitive to distance. As a result, TripAdvisor’s algorithm combines the user’s location with ratings and reviews from members of the user’s community to rank results. Let’s say a result is less than a mile away, gets great ratings, and has been positively reviewed by a member of the user’s network. That result would likely rank very high in search results.

- The Importance Of Integrating Photography Features: Photographs are hugely important on social media, and a favourite social-photo activity is sharing travel pictures. Mobile has made photo-sharing even easier, as people come to their destinations equipped with a high-quality lens embedded right in their smartphones.

With the natural partnerships between social, mobile, photos and travel in mind, Pinterest recently added a travel-focused, photo-sharing feature called “Place Pins.” The feature enables users to upload photos that can be tagged with geo-data and mapped. While the feature isn’t necessarily mobile-only, for a service that sees more than 75% of its traffic from mobile, this is clearly the focus. The service also integrates with Foursquare, furthering the location-enabled reach of these photos.

Pinterest has most often been associated with retail, but the move suggests the social network is also an important one for the travel industry to keep up with, alongside other social networks. Travel is exactly the kind of aspirational activity people love to talk about on social media, and mobile will continue boosting that activity.

- Augmented Reality Will Give Way To Wearables: A darling of technophiles, augmented reality or AR has captured imaginations as a way to view the world through a mobile device. Augmented reality refers to information or visualizations that are overlaid on real-world images when they’re viewed through your phone. For example, if you are just arriving at the Taj Mahal, you might hold up your phone, view the Taj Mahal on your screen and see explanations scroll by on the different architectural flourishes you’re seeing. Sounds great, if awkward. AR applications won’t take off until they are integrated into wearable devices, such as Google Glass.

So far, augmented reality hasn’t offered much more than a flashy way to enhance local searches. For example, Yelp offers “Monocle,” an AR feature on its mobile app that allows users to hold up their phone as they walk around their cities. Through the camera view, Monocle shows them semi-transparent labels that hover over the sidewalk indicating the name of nearby bars and restaurants, and the direction they should walk in if they want to get there.

But uptake of these flashy features has been limited.

TripAdvisor has a similar feature, but it has yet to see any widespread adoption, according to Schreve. So little in fact, that the feature has been deemphasized and does not appear readily available within the app. (Yelp’s Monocle feature is also tucked away, deep in the app menus.)

We believe that the future of augmented reality apps — for travel and other applications — rests with wearables.

BI Intelligence has estimated that the wearables category, including watches, glasswear and wristbands, could see as many as 90 million units sold annually by 2018. Just as mobile phones pair with travel, wearables also make sense as a go-to device for exploring travellers. And the expectation that wearables will play a role in the travel industry is borne out in the travel apps that are popping up for the devices. Travel+Leisure named some of their favourite wearables tech travel trends from the 2014 Consumer Electronics Show, citing features like ski goggles equipped with HD cameras so you can live-stream your run, and a smart bracelet that measures UV exposure at the beach.

Google Glass has seen several travel-relevant apps emerge, including a bike riding app that maps itineraries as you cycle. Another feature is its ability to simultaneously translate spoken bits of foreign languages. It’s easy to see how TripAdvisor and Yelp’s AR features might actually see usage if hands-free wearables take hold as a category.

Pain Points

Any sector migrating to mobile has experienced its share of pain points.

While global travellers are much more likely to own a smartphone than the broader population, adoption of new services is never instant and always comes with important caveats.

Some survey results show that on a global level, adoption of mobile travel services is still pretty limited. Among travellers globally, only 5% said they were using check-in and booking services on their phones, and 78% cited usability concerns and the limitations of the device as a reason they might not use mobile for travel, according to a 2013 SITA/Air Transport World Passenger IT Trends Survey.

But developed mobile markets like the U.S. and Europe may have already turned the corner in terms of fostering mobile travel adoption. Additionally, sites that provide information services may do a good job of attracting mobile audiences, even if getting people to actually make bookings remains a hurdle.

In any case, here are the “pain points,” or barriers to usage, that mobile travel services will need to overcome:

Cross-device seamlessness and marketing: Think about the last time you planned a trip. You likely spent more than one session thinking about, researching, and then booking travel. You probably did so on more than one device. In fact, Dara Khosrowshahi, President and CEO of Expedia, told the Jamaica Observer, “research has shown that 90% of online shoppers start their shopping with a handset or a PC and then go to a tablet, then they go to another device. So we have to make sure that the experience that these consumers have is consistent in an appropriate way across the devices.”

The focus here isn’t just on the user experience. It’s also about marketing. Expedia has begun tracking and retargeting users with ads, across devices. Expedia has teamed up with ad technology company Drawbridge and is able to anonymously track an individual’s browsing patterns on one device and be reasonably certain when that same individual has moved to another device. So, if someone has been on Expedia’s mobile site and abandoned the process of buying an air ticket to Jamaica, he or she can be located on their desktop PC and served personalised ads that nudge them to return to Expedia and finish the transaction, perhaps with a special offer to incentivise them.

The data showed that conversions for users that are retargeted in this way were as much as 336% higher than they were for a control group.

Frictionless transactions: Although travel is one of the better-faring industries in terms of mobile conversions compared to desktop conversion, the mobile channel still doesn’t achieve the conversion rate of desktop.

The difficult task of punching in credit card numbers on a small screen is one likely culprit for depressed conversion rates.

To combat this, companies are attempting to eliminate the input required and streamline the checkout process, with internal and third-party tools.

When Priceline prompts for payment information, users are given the option to pay with Google Wallet. Airbnb, as mentioned earlier, works with Braintree to enable streamlined payment completion.

Travel can also involve high-value purchases, and so security may be a concern for bookers.

Online travel agencies, airlines, and hotel chains will need to reassure travellers not only that completing transactions is easy, but that their information is stored securely, particularly in foreign countries.

Lack Of Data Coverage: Although international roaming rates have come down and T-Mobile rolled out an attractive international data plan, the fact remains that lack of mobile data coverage is still an issue for travellers. Travellers in foreign countries are often limited to using their mobile devices and travel-related apps and sites in hotel rooms and at cafes enabled with Wi-Fi. Sometimes, hotels gouge guests on Wi-Fi fees, further discouraging travel-related mobile usage. What’s needed is better collaboration among carriers so that easy global data usage becomes more the rule, and not the exception.

Meanwhile, many online travel companies have turned to developing offline services, apps that are useful even when the phone isn’t connected to Wi-Fi or a cell connection. TripAdvisor for instance has developed city guides for 82 cities that may be downloaded and used entirely offline.

The company has also developed intelligent caching, which enables the user to retrieve recently searched for information within the basic app, even when they’re offline.

Similarly, Google Maps also caches a user’s Wi-Fi enabled search and zoom on a map, allowing the map to use GPS to update in real time once the mobile user is en route.

What’s Next In Mobile Travel

The travel industry is too big and diverse for any one player to become a dominant force like Facebook has in social media. Moreover, the travel industry is big enough that  online and mobile travel does not have to be a zero-sum game. Many players will carve out niches in different categories like overnight accommodations, rental cars, and air travel.

online and mobile travel does not have to be a zero-sum game. Many players will carve out niches in different categories like overnight accommodations, rental cars, and air travel.

However, mobile is already a critical component, which will allow a company to distinguish itself from its peers and capture incremental market share. Making innovative mobile apps and mobile sites is key not just for increasing bookings or ad revenue, but also for providing superior customer service.

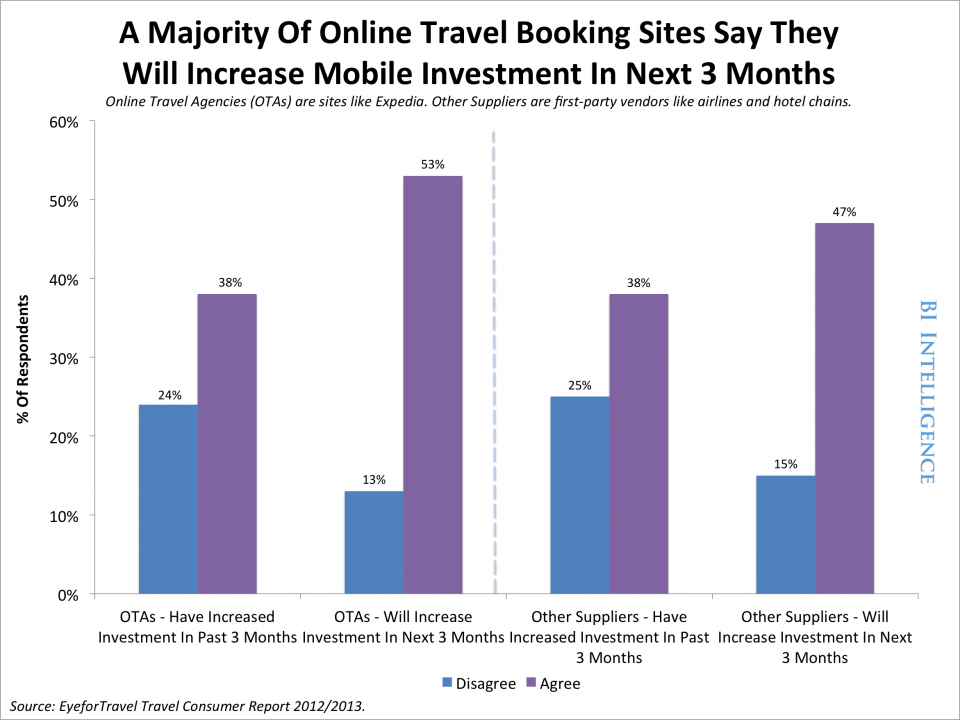

Survey data shows that 53% of online travel agencies and 47% of travel suppliers plan to increase investments in mobile in the next three months. (See chart above.)

Well-capitalised players will also likely look to acquire innovative mobile startups and early-stage travel companies as they scale on mobile.

TripAdvisor’s Schreve, for example, founded a GPS-enabled, trip-planning mobile company called EveryTrail, which was ultimately acquired by TripAdvisor.

He says, “acquisitions, particularly of mobile companies, are an area we expect to remain selectively active in.”

Wearables, as discussed earlier, as well as cars, are two logical next-phase mobile-travel markets.

TripAdvisor tells us that they have begun to experiment with smart watches and Google Glass, while also developing partnerships around in-car navigation.